Search Market Research Report

Marine Insurance Market Size, Share Global Analysis Report, 2022 – 2028

Marine Insurance Market Size, Share, Growth Analysis Report By Type (Cargo Insurance, Hull & Machinery Insurance, Marine Liability Insurance and Offshore/Energy Insurance), By Distribution Channel (Wholesalers, Retail Brokers and Others), By End User (Ship Owners, Traders and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

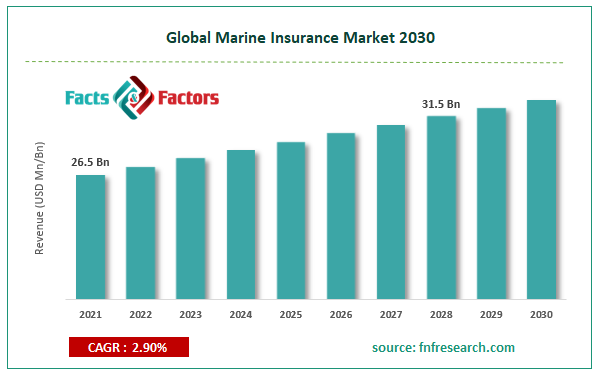

[221+ Pages Report] According to Facts and Factors, the global marine insurance market size was worth around USD 26.5 billion in 2021 and is estimated to grow to about USD 31.5 billion by 2028, with a compound annual growth rate (CAGR) of approximately 2.90% over the forecast period. The report analyzes the marine insurance market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the marine insurance market.

Market Overview

Market Overview

In the event of unfortunate events like damage to property and the environment, accidents, and fatalities, marine insurance coverage aids in risk management. It is made to lessen a policyholder's financial loss in the event of an accident, natural disaster, or another calamity. Ship owners, cargo owners, and charterers typically use marine insurance policies. Generally speaking, it is necessary to adhere to tight regulatory compliance of various countries during import and export trade operations. These programs can be altered to meet the unique business needs of customers. In addition, they also provide coverage for losses brought on by fire, explosion, hijacking, mishaps, crashes, and overturning.

The number of export activities worldwide is significantly increasing due to government agencies launching measures to support domestic industry and global trade in many nations. Marine insurance is also a requirement for boats used for commercial transportation. This is one of the leading causes of the demand for maritime insurance, which protects commodities or cargo from unforeseeable events while in transit. E-commerce businesses embrace sea shipping to simplify cross-border product transit and reach a more extensive clientele. This accelerates the market's expansion with the new trend of online buying brought on by quick urbanization, rising income levels, and the expanding impact of social media.

COVID-19 Impact:

COVID-19 Impact:

COVID-19 negatively impacted the marine insurance market's expansion. During the COVID-19 pandemic, business travel insurance experienced a drop. Lockdowns and travel ban across several nations because of the COVID epidemic. Countries closing their borders to visitors caused a halt in the flow of people across borders. Following the COVID-19 outbreak, an increase in aircraft cancellations and insurance claims had a detrimental effect on the market expansion.

Key Insights

Key Insights

- As Per the analysis shared by our research analyst, the global marine insurance market value will grow at a CAGR of 2.90% over the forecast period.

- The global marine insurance market was valued at around USD 26.5 billion in 2021 and is projected to reach USD 31.5 billion by 2028.

- The number of export activities worldwide is significantly increasing due to government agencies launching measures to support domestic industry and global trade, driving market growth.

- By type, the cargo insurance segment dominated the market in 2021.

- By end user, the ship owners segment dominated the market in 2021.

- Europe dominated the global marine insurance market in 2021.

Growth Drivers

Growth Drivers

- Incidences of losses are likely to pave the way for global market growth.

The market's growth is accelerated by the increase in international trade and the development of e-commerce. Ships carrying tonnes of cargo have over 85% of all global business, significantly boosting the world economy. The market is also affected by the rise in losses, such as harm done to cargo ships, ships, and terminals due to extensive marine commercial operations. The management of these risks and losses in the marine industry is greatly aided by maritime insurance. Rapid urbanization, lifestyle changes, a boom in investment, and rising consumer spending all favor the marine insurance market.

Restraints

Restraints

- Low profitability may hamper the global market growth.

Strong demand potential in emerging countries has drawn domestic and foreign suppliers, increasing market competition. Regions like the Asia Pacific have high total written premiums, yet suppliers' profitability is low. This can be attributable to the tips dropping to support the market's rising competition. Such anti-competition actions are expected to impact the market's expansion eventually.

Opportunities

Opportunities

- The incorporation of the IoT system brings up several growth opportunities.

The forecast period will see profitable prospects for market participants due to the internet of things (IoT) system's integration into the current marine insurance product lines for risk monitoring, claims to process simplification and other purposes. The market will also need maritime insurance due to increased cargo concentrations in ports, during transit, and in warehouses.

Challenges

Challenges

- Various rules and regulations may hamper the global market growth

The maritime insurance industry may be hampered by many laws, rules, and regulations relating to insurance services, data privacy, and cyber-security that call for additional certification, digital security, license, and technical assistance.

Segmentation Analysis

Segmentation Analysis

The global marine insurance market is segregated based on type, distribution channel, end-user, and region.

By type, the market is divided into cargo, hull &machinery, marine liability, and offshore/energy insurance. Among these, the cargo insurance segment dominated the market in 2021. Due to the expansion of free trade agreements, the cargo insurance market is anticipated to dominate. Over the projection period, it is expected that the global supply and demand for sea transportation would drive the need for cargo insurance.

The distribution channel divides the market into wholesalers, retail brokers and others. Among these, the retail brokers' segment dominated the market in 2021. The increased number of marine insurance brokers and agents is a crucial driver driving the market forward. Maritime insurance brokers work for organizations that offer marine insurance.

The end user divides the market into ship owners, traders and others. Over the forecast period, the ship owners segment is expected to develop fastest in 2021. Large-scale marine commercial operations result in significant losses for ship owners, including damage to ships, cargo vessels, and ports. As a result, managing these risks and losses in the marine industry becomes very difficult, and maritime insurance is crucial in preventing such losses. Massive losses and increased cargo concentrations in warehouses, ports, and transit drive up international demand for naval insurance.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 26.5 Billion |

Projected Market Size in 2028 |

USD 31.5 Billion |

CAGR Growth Rate |

2.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Allianz, AXA, Chubb, American International Group Inc., Arthur J. Gallagher & Co., Aon plc, Lloyd's, Lockton Companies, Marsh LLC, Zurich, and Others |

Key Segment |

By Type, Distribution Channel, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In April 2020 - To protect the oceans, Allianz SE announced a partnership with sea shepherd global. The cooperation initially lasted two years and covered Italy's Mediterranean coastlines.

Regional Landscape

Regional Landscape

Increasing imports and exports among significant companies will likely help Europe dominate the global market.

Europe dominated the marine insurance market in 2021due to the region's expanding commercial potential over the anticipated period. The market in this region is anticipated to grow due to the favorable effects of maritime transportation on the European market. Europe is surrounded by sea, encouraging marine trade and fuel market growth. The expansion of trade agreements worldwide and the activities of import and export give significant companies in the marine insurance sector chances. The marine insurance market in the region is expected to increase over the coming years. Growth in the need for waterborne transportation and an uptick in import and export activities have led to an increase in the number of ship owners, which in turn is boosting the region's marine insurance market.

Competitive Landscape

Competitive Landscape

Key players within the global marine insurance market include

- Allianz

- AXA

- Chubb

- American International Group Inc.

- Arthur J. Gallagher & Co.

- Aon plc

- Lloyd's

- Lockton Companies

- Marsh LLC

- Zurich

Global marine InsuranceMarketis segmented as follows:

By Type

By Type

- Cargo Insurance

- Hull & Machinery Insurance

- Marine Liability Insurance

- Offshore/Energy Insurance

By Distribution Channel

By Distribution Channel

- Wholesalers

- Retail Brokers

- Others

By End User

By End User

- Ship Owners

- Traders

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Allianz

- AXA

- Chubb

- American International Group Inc.

- Arthur J. Gallagher & Co.

- Aon plc

- Lloyd's

- Lockton Companies

- Marsh LLC

- Zurich

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors