Search Market Research Report

Insect Pest Control Products Market Size, Share Global Analysis Report, 2021 – 2026

Insect Pest Control Products Market By Insect Type (Mosquitoes, Termites, Cockroaches, Bedbugs, Rodents, & Others), By Application (Commercial & Industrial, Residential, Livestock Farms, &Others), By Control Measure (Chemical, Physical, Biology, &Others), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

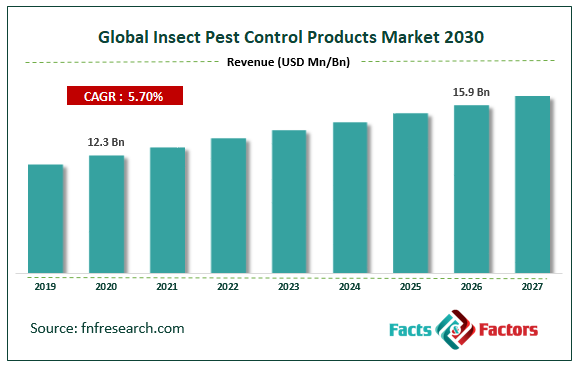

[185+ Pages Report] We at facts and factors have recently published a report titled “Global Insect Pest Control Products Market” that encompasses the spectacle of the market in an analytical and comprehensive manner. This report exhibits the global insect pest control products market to value approximately USD 15.9 Billion in the year 2026 from an initial value of USD 12.3 Billion in the year 2020 with growth at a CAGR value of 5.7%.

Market Overview

Market Overview

Insect pest control products are harmful and poisonous products that are often employed for killing insects by means of chemical measures. They are usually associated with preserving crop production and further preservation of trees, woods, and citizens from exposure to potentially harmful products. They are often used for the purpose of mitigation of pests but are usually accompanied by a lot of damages they bring on.

Industry Growth Factors

Industry Growth Factors

The primary market drivers for the global insect pest control products market include the rising demand from sectors pertaining to residential buildings, commercial & non-commercial institutions, livestock, and industrial coupled with rising impacts of climate change in terms of insect proliferation. Additionally, increased adoption of IoT-based automation tools and AI-based software solutions is expected to increase the footprint of the global insect pest control products market during the forecast period. Moreover, the adoption of integrated pest management technology coupled with cost-effective solutions is expected to boost the growth of the global insect pest control products market during the forecast period.

The global insect pest control products market is also driven by factors pertaining to advancements in technology coupled with rising concerns of environmental and ecological effects to name a few leading to a rising trend of organic-based pesticides to name a few. Factors credited with immense growth potential can be marked by constant product development coupled with mergers and acquisitions amongst the market participants is expected to boost the growth of the global insect pest control products market during the forecast period. However, a larger amount of approval time can decrease the market value for the global insect pest control products market during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global insect pest control products market is segmented into insect type, application, control measure, and region.

The global insect pest control products market is divided into mosquitoes, termites, cockroaches, bedbugs, rodents, and others on the basis of insect type. The segment pertaining to rodents is expected to witness the largest market share during the advent of the forecast owing to huge crop production losses coupled with rising demand from residential and commercial usage to name a few. Based on application, the global insect pest control products market is categorized into commercial & industrial, residential, livestock farms, and others. The commercial and industrial segment is expected to occupy the largest market share during the advent of the forecast owing to necessary functionality for providing aiding employees and customers a professional setting coupled with increased infestation cases arising from the latter to name a few. The global insect pest control products market is fragmented into chemical, physical, biology, and others on the basis of the control measures. The segment pertaining to chemicals is expected to witness the largest market share during the advent of the forecast owing to extremely superior results when compared to its counterparts coupled with cost-effective business measures to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 12.3 Billion |

Projected Market Size in 2026 |

USD 15.9 Billion |

CAGR Growth Rate |

5.7% Growth |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Bayer, BASF, Sumitomo, Korea Henkel Home Care, FMC Corporation, Syngenta, ADAMA, Rentokil Initial Group, Terminix, Rollins, Inc., Bell Laboratories, Inc., Arrow Exterminators, Ecolab, Inc., Rentokil Initial PLC, ANTICIMEX, Cleankill Pest Control, ECO Environmental Services Ltd., and Lindsey Pest Services, Inc., among others |

Key Segments |

Insect Types, Applications, Control Measures, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

North America is expected to witness the largest market share during the advent of the forecast owing to the increasing prevalence of insect-borne diseases coupled with rising demand for effective insect control measures to name a few. Asia-Pacific is expected to witness the fastest growing CAGR during the advent of the forecast owing to the region is the home to emerging economies such as China and India coupled with highly cultivable amounts of land to name a few. Additionally, increasing population subverting to modern and elevated based lifestyle coupled with rising prevalence of pest-related disorders is expected to increase the footprint of the insect pest control products market during the forecast period.

Competitive Players

Competitive Players

The key market participants for the global insect pest control products market are:

- Bayer

- BASF

- Sumitomo

- Korea Henkel Home Care

- FMC Corporation

- Syngenta

- ADAMA

- Rentokil Initial Group

- Terminix

- Rollins Inc.

- Bell Laboratories Inc.

- Arrow Exterminators

- Ecolab Inc.

- Rentokil Initial PLC

- ANTICIMEX

- Cleankill Pest Control

- ECO Environmental Services Ltd.

- Lindsey Pest Services Inc.

By Insect Type Segment Analysis

By Insect Type Segment Analysis

- Mosquitoes

- Termites

- Cockroaches

- Bedbugs

- Rodents

- Others

By Application Segment Analysis

By Application Segment Analysis

- Commercial & Industrial

- Residential

- Livestock Farms

- Others

By Control Measure Segment Analysis

By Control Measure Segment Analysis

- Chemical

- Physical

- Biology

- Others

Industry Major Market Players

- Bayer

- BASF

- Sumitomo

- Korea Henkel Home Care

- FMC Corporation

- Syngenta

- ADAMA

- Rentokil Initial Group

- Terminix

- Rollins Inc.

- Bell Laboratories Inc.

- Arrow Exterminators

- Ecolab Inc.

- Rentokil Initial PLC

- ANTICIMEX

- Cleankill Pest Control

- ECO Environmental Services Ltd.

- Lindsey Pest Services Inc.

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors