Search Market Research Report

Fiberglass Market Size, Share Global Analysis Report, 2022 – 2028

Fiberglass Market Size, Share, Growth Analysis Report By Glass Type (E-Glass, ECR-Glass, S-Glass, AR-Glass, H-Glass, Others), By Resin Type (Thermoset Resins, Thermoplastic Resins), By Product Type (Glass Wool, Direct, Assembled Roving, Yarn, Chopped Strand, Others), By Application (Composites, Insulation), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

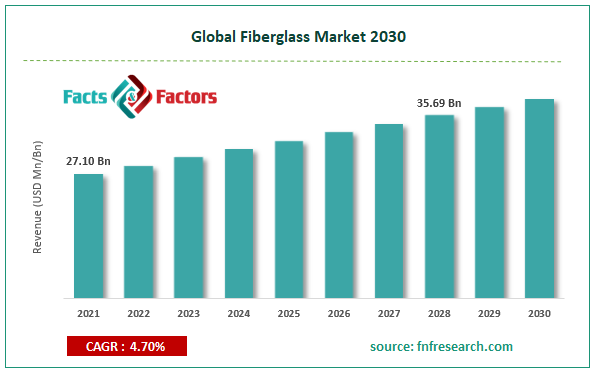

[233+ Pages Report] According to the report published by Facts Factors, the global fiberglass market size was worth USD 27.10 billion in 2021 and is estimated to grow to USD 35.69 billion by 2028, with a compound annual growth rate (CAGR) of approximately 4.70% over the forecast period. The report analyzes the fiberglass market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the fiberglass market.

Market Overview

Market Overview

Fiberglass is a reinforced plastic material from glass fibers embedded in a resin matrix. It is widely supplied in the form of glass wool, straight and assembled yarn, yarn, cut yarn, flat sheets, etc. Fiberglass is light in weight, economical, corrosion resistant, durable, and highly electrically insulating. It is widely used compared to conventional materials, such as aluminum and steel, due to improved energy efficiency and environmental sustainability. As a result, fiberglass is widely applied in various industries, such as construction, automotive, aerospace & defense, electronics, etc. The construction sector's expansion is the main driver of the global fiberglass market's expansion. The market is growing due to a notable rise in attention paid to infrastructure and road quality. The expansion of the worldwide fiberglass market is predicted to be fueled by an increase in demand for lightweight vehicles and aircraft.

COVID-19 Impact:

COVID-19 Impact:

COVID-19 is not just a harmful virus. It turned out to be a very dangerous virus. Governments worldwide have seen it and decided to stop it by imposing temporary quarantine and lockdown measures. Many markets and industries have been affected. The fiberglass market is one. Due to the global shutdown, many fiberglass manufacturers have been forced to close or significantly slow down production. Fiberglass became scarce, causing its price to skyrocket. Industries that use fiberglass in manufacturing find that their production costs increase significantly. They have no choice but to charge higher prices to the end consumer to compensate for the sudden and dramatic increase in production costs.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global fiberglass market value is expected to grow at a CAGR of 4.70% over the forecast period.

- In terms of revenue, the global fiberglass market size was valued at around USD 27.10 billion in 2021 and is projected to reach USD 35.69 billion by 2028.

- The construction sector's expansion is the main driver of the fiberglass market's expansion. The market is growing due to a notable rise in attention paid to infrastructure and road quality.

- By glass type, the S-glass category dominated the market in 2021.

- By resin type, the thermoset resin category dominated the market in 2021.

- The Asia Pacific dominated the global fiberglass market in 2021.

Growth Drivers

Growth Drivers

- Increased use of fiberglass in the automotive industry to drive market growth

A higher strength-to-weight ratio is an important factor in automobile manufacturing; fiberglass products are widely used in various applications. During the manufacturing process, materials with high strength and low weight help provide high mileage and better fuel efficiency for the vehicle. Many countries are focusing on producing light vehicles to meet CAFE (Corporate Medium Fuel Economy), which is driving the use of fiberglass composites in the automotive industry. Hence, the growing trend toward lightweight and fuel-efficient vehicles is considered one of the key drivers contributing to the growth of the global fiberglass market.

Restraints

Restraints

- The lack of appropriate disposable methods for fiberglass may hamper the market growth

The lack of appropriate disposable methods for recycling glass wool is a barrier for this sector. Fiberglass recycling problems impede the market's expansion. Environmental and health-related issues and fluctuating raw material prices are expected to limit market expansion.

Opportunity

Opportunity

- An increasing number of wind energy capacity installations presents market opportunities

Fiberglass composites are widely used in wind energy because they provide a good strength-to-weight ratio. Many countries, such as China, Germany, and Spain, are working to restructure their energy systems in favor of renewable sources. According to the Global Wind Energy Council (GWEC), by 2035, the renewable energy industry is expected to generate more than 25% of the world's electricity, a quarter of which is expected to come from the wind, which also contributes to a reduction in carbon emissions. Wind power is a viable option for electricity generation as it is a cost-effective alternative while adding new generating capacity to the grid.

Segmentation Analysis

Segmentation Analysis

The global fiberglass market has been segmented into glass type, resin type, product type, application, and region.

Based on glass type, the E-glass, ECR-glass, S-glass, AR-glass, H-glass, and others. The S-glass segment dominated the glass type segment in 2021 as it has better tensile strength and modulus than E glass. ECR glass is e-fiberglass. It has a good waterproof rate, high mechanical strength, and acid and alkali galvanic corrosion resistance. E-Glass contains boron aluminum silicate glass fibers containing alkaline components such as aluminum oxide. This is the most widely used fiberglass formulation in the world.

Based on resin type, the market is classified into thermoset resins and thermoplastic resins. The thermostat resin segment dominated the market in 2021. Thermostat resin is a polymer that is cured irreversibly by curing a viscous liquid or soft solid preliminary resin. Thermoplastics are materials that soften to a liquid at high temperatures, then harden when cooled. Thus, the thermostat resin type dominates the resin type segment in the global fiberglass market.

Based on product type, the global fiberglass market is segmented into glass wool, direct & assembled roving, yarn, chopped strand, and others. The yarn segment dominated the product type segment in 2021 and is expected to continue its dominance in the global fiberglass market due to the high use of yarn-type products in various industries.

Recent Developments

Recent Developments

- February 2021: Aptera Motors has announced that it will launch the world's first mass-produced solar-powered car. Aptera is designed for efficiency and is made of ultra-lightweight fiberglass and composite materials.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 27.10 Billion |

Projected Market Size in 2028 |

USD 35.69 Billion |

CAGR Growth Rate |

4.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

China Jushi Co. Ltd., Owens Corning, Nippon Electric Glass Co. Ltd., Taishan Fiberglass Inc., Chongqing Polycomp International Corp., Johns Manville Corp., Binani 3B-the Fibreglass Company, Taiwan Glass Ind. Corp., PFG Fiber Glass Co. Ltd., Asahi Fiberglass Co. Ltd., Knauf Insulation, Saint-Gobain Vetrotex, CertainTeed Corporation, Saint-Gobain ADFORS, AGY Holding Corp., and others. |

Key Segment |

By Glass Type, Resin Type, Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the fiberglass market in 2021

Asia-Pacific dominated the global fiberglass market in 2021. Increasing attention to emission control policies and growing demand for environmentally friendly products have led to technological advancements in composites. The replacement of traditional materials, such as steel and aluminum, with fiberglass, contributes to the growth of the fiberglass market in the Asia Pacific. In addition, the growing demand for fiberglass from various industries, such as construction, transportation, automotive, and electronics, is expected to grow the fiberglass market in the Asia-Pacific region.

Competitive Landscape

Competitive Landscape

- China Jushi Co. Ltd.

- Owens Corning

- Nippon Electric Glass Co. Ltd.

- Taishan Fiberglass Inc.

- Chongqing Polycomp International Corp.

- Johns Manville Corp.

- Binani 3B-the Fibreglass Company

- Taiwan Glass Ind. Corp.

- PFG Fiber Glass Co. Ltd.

- Asahi Fiberglass Co. Ltd.

- Knauf Insulation

- Saint-Gobain Vetrotex

- CertainTeed Corporation

- Saint-Gobain ADFORS

- AGY Holding Corp.

Global Fiberglass Market is segmented as follows:

By Glass Type

By Glass Type

- E-Glass

- ECR-Glass

- S-Glass

- AR-Glass

- H-Glass

- Others

By Resin Type

By Resin Type

- Thermoset Resins

- Thermoplastic Resins

By Product Type

By Product Type

- Glass Wool

- Direct and Assembled Roving

- Yarn

- Chopped Strand

- Others

By Application

By Application

- Composites

- Insulation

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- China Jushi Co. Ltd.

- Owens Corning

- Nippon Electric Glass Co. Ltd.

- Taishan Fiberglass Inc.

- Chongqing Polycomp International Corp.

- Johns Manville Corp.

- Binani 3B-the Fibreglass Company

- Taiwan Glass Ind. Corp.

- PFG Fiber Glass Co. Ltd.

- Asahi Fiberglass Co. Ltd.

- Knauf Insulation

- Saint-Gobain Vetrotex

- CertainTeed Corporation

- Saint-Gobain ADFORS

- AGY Holding Corp.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors