Search Market Research Report

Carbon Thermoplastics in the Automotive Market Size, Share Global Analysis Report, 2022 – 2028

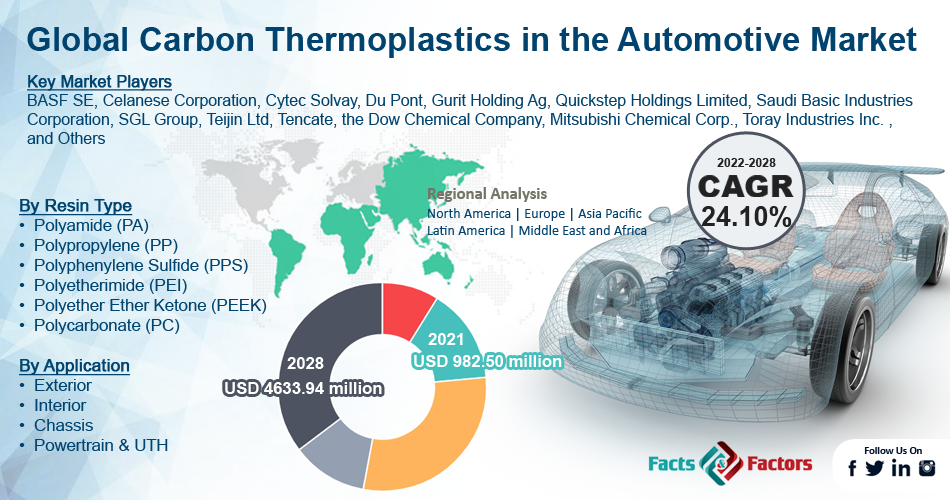

Carbon Thermoplastics in the Automotive Market Size, Share, Growth Analysis Report By Resin Type (Polyamide (PA), Polypropylene (PP), Polyphenylene Sulfide (PPS), Polyetherimide (PEI), Polyether Ether Ketone (PEEK), Polycarbonate (PC)), By Application (Exterior, Interior, Chassis, Powertrain & UTH), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

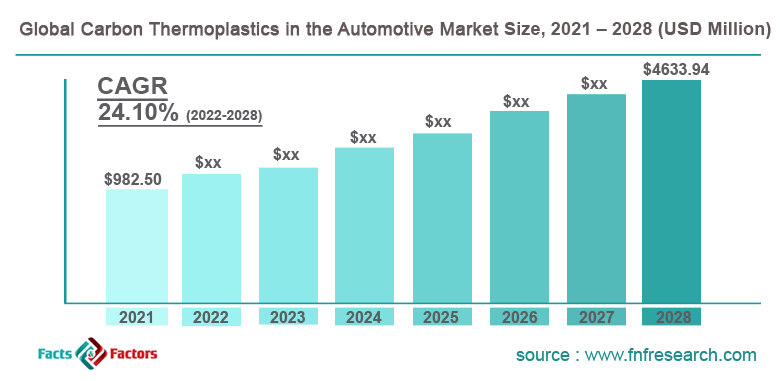

[211+ Pages Report] According to Facts and Factors, the global carbon thermoplastics in the automotive market size was worth USD 982.50 million in 2021 and is estimated to grow to USD 4633.94 million by 2028, with a compound annual growth rate (CAGR) of approximately 24.10% over the forecast period. The report analyzes the carbon thermoplastics in the automotive market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in carbon thermoplastics in the automotive market.

Market Overview

Market Overview

A composite material comprised of carbon fiber and plastic is called automotive carbon thermoplastic. The carbon fiber is blended with one or two polymers to create a special product that will be employed in producing sturdy and lightweight vehicle parts. The external and interior components of the car are designed using these thermoplastic materials. The extra benefit of automotive carbon thermoplastic is its great resistance to deformation and both acid and alkaline corrosion. Over the past few years, there has been an increase in interest in its ability to meet energy conservation and CO2 reduction demands in the automotive industry. The aerospace and automotive industries regularly use carbon fiber reinforced polymer because it may be used to create lightweight products. Adding carbon thermoplastic will improve the material's deformation and crack development resistance. Utilizing carbon thermoplastics will help increase fuel efficiency and load capacity. Additionally, it helps to reduce vibration and noise in cars. The global desire for lightweight and fuel-efficient automobiles is a major factor driving the market for carbon thermoplastics in automotive, as this material is one of the most efficient ways to reduce vehicle weight, boost fuel efficiency, and lower emissions.

Covid-19 Impact:

Covid-19 Impact:

Coronavirus has had a depressing effect on several production markets in Europe, North America, and the Asia Pacific. Because of the COVID-19 epidemic and the imposed lockdown in some countries, the automotive industrial has been one of the hardest damaged. Production activity was poor, and people did not look forward to acquiring vehicles at this time. The supply chain disruption resulted in raw material delays or non-arrival, disturbed money flows, and falling morale among manufacturing line workers, forcing them to operate at reduced or zero capabilities. As a result, demand for carbon thermoplastics in the automobile industry has decreased.

Key Insights

Key Insights

- Per the analysis shared by our research analyst, the global carbon thermoplastics in the automotive market value is expected to grow at a CAGR of 29.50 % over the forecast period.

- In terms of revenue, the global carbon thermoplastics in automotive market size was valued at around USD 982.50 million in 2021 and is projected to reach USD 4633.94 million by 2028.

- The global desire for lightweight and fuel-efficient automobiles is a major factor driving the market for carbon thermoplastics in automotive, as this material is one of the most efficient ways to reduce vehicle weight, boost fuel efficiency, and lower emissions.

- By resin type, the polypropylene (PP) category dominated the market in 2021.

- By application, the powertrain & UTH categories dominated the market in 2021.

- The Asia Pacific dominated the global carbon thermoplastics in the automotive market in 2021.

Growth Drivers

Growth Drivers

- Growing demand for light- weighted and efficient automobiles drives the market growth

China, India, and Japan are among the nations with the largest markets for the automobile industry as the ongoing expansion of the vehicle manufacturing industry in these nations. Due to carbon fiber's ability to reduce vehicle weight, vibration, and noise, automobiles are made to be more efficient. Since they may replace metal in many industries, carbon thermoplastic materials are becoming more and more valuable. The goal is to create lighter, less fuel-consuming automobiles that produce less CO2. As a result, there will be an increased demand for carbon thermoplastic in automobiles.

Restraints

Restraints

- The high price of carbon fiber may hinder the market growth

Carbon fiber reinforced components are lightweight, load-bearing, strong, and structural components that are crucial for reducing the weight of automobiles. However, one of the main challenges for this market is the high price of carbon fiber compared to other fibers (glass, natural), as small auto parts industries will suffer from purchasing the high price of carbon fiber. Additionally, difficulties are presented by automakers' worries about establishing a method for recycling or trash disposal of carbon composite parts. This may hinder the carbon thermoplastics in the automotive market.

Segmentation Analysis

Segmentation Analysis

The global carbon thermoplastics market in automotive is segregated based on resin type and application.

Based on resin type, the market is segmented into polyamide (PA), polypropylene (PP), polyphenylene sulfide (PPS), polyetherimide (PEI), and polyether ether ketone (PEEK), polycarbonate (PC). The polypropylene (PP) sector dominates the market in 2021. As a result, polypropylene is the most often used plastic in car manufacture. It is a thermoplastic polymer that can be readily molded into any shape. It is resistant to impact and has excellent chemical and heat resistance.

Based on application, the market is classified into the exterior, interior, chassis, powertrain & UTH. The powertrain & UTH category dominates the market in 2021. The small weight, excellent durability, design flexibility, and uniform surface of carbon thermoplastic composites make them ideal for use in the engine and drivetrain. As a result, there is a growing need for carbon thermoplastic composites in areas like the engine and drivetrain. During the projection period, this is anticipated to propel the powertrain & under the hood segment.

Recent Developments

Recent Developments

- February 2020: Covestro AG created a new composite technique to create thin, lightweight, high-strength, aesthetically pleasing parts for automobiles that cut fuel consumption and CO2 emissions or extend the range of electric vehicles. The technique, MaezioTM, is based on Continuous Fiber-Reinforced Thermoplastic Polymers (CFRTP).

- October 2019: The top-of-the-line certified circular polymers from the chemical recycling of mixed plastic waste, certified renewable polymers, and its new certified renewable feedstock-based polycarbonate were all on show at K 2019, together with SABIC's TRUCIRCLE initiative and solutions.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 982.50 Million |

Projected Market Size in 2028 |

USD 4633.94 Million |

CAGR Growth Rate |

24.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Celanese Corporation, Cytec Solvay, Du Pont, Gurit Holding Ag, Quickstep Holdings Limited, Saudi Basic Industries Corporation, SGL Group, Teijin Ltd, Tencate, the Dow Chemical Company, Mitsubishi Chemical Corp., Toray Industries Inc. , and Others |

Key Segment |

By Resin Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the carbon thermoplastics in the automotive market in 2021

The Asia Pacific dominated the carbon thermoplastics in the automotive market in 2021. The economies of China and India are expanding quickly, which presents many prospects for investment for different market players. The market is benefiting from the effects of globalization and westernization as well. People's increasing wealth is driving demand for vehicles with vital parts. The automotive carbon thermoplastics market is predicted to experience significant economic growth, a shift in consumer tastes, a focus on raising living standards, and increased spending on infrastructure in the automotive industry.

Competitive Landscape

Competitive Landscape

- BASF SE

- Celanese Corporation

- Cytec Solvay

- Du Pont

- Gurit Holding Ag

- Quickstep Holdings Limited

- Saudi Basic Industries Corporation

- SGL Group

- Teijin Ltd

- Tencate

- the Dow Chemical Company

- Mitsubishi Chemical Corp.

- Toray Industries Inc.

Global Carbon Thermoplastics in the Automotive Market is segmented as follows:

By Resin Type

By Resin Type

- Polyamide (PA)

- Polypropylene (PP)

- Polyphenylene Sulfide (PPS)

- Polyetherimide (PEI)

- Polyether Ether Ketone (PEEK)

- Polycarbonate (PC)

By Application

By Application

- Exterior

- Interior

- Chassis

- Powertrain & UTH

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- Celanese Corporation

- Cytec Solvay

- Du Pont

- Gurit Holding Ag

- Quickstep Holdings Limited

- Saudi Basic Industries Corporation

- SGL Group

- Teijin Ltd

- Tencate

- the Dow Chemical Company

- Mitsubishi Chemical Corp.

- Toray Industries Inc.

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors