Search Market Research Report

Data Center Colocation Market Size, Share Global Analysis Report, 2023 – 2030

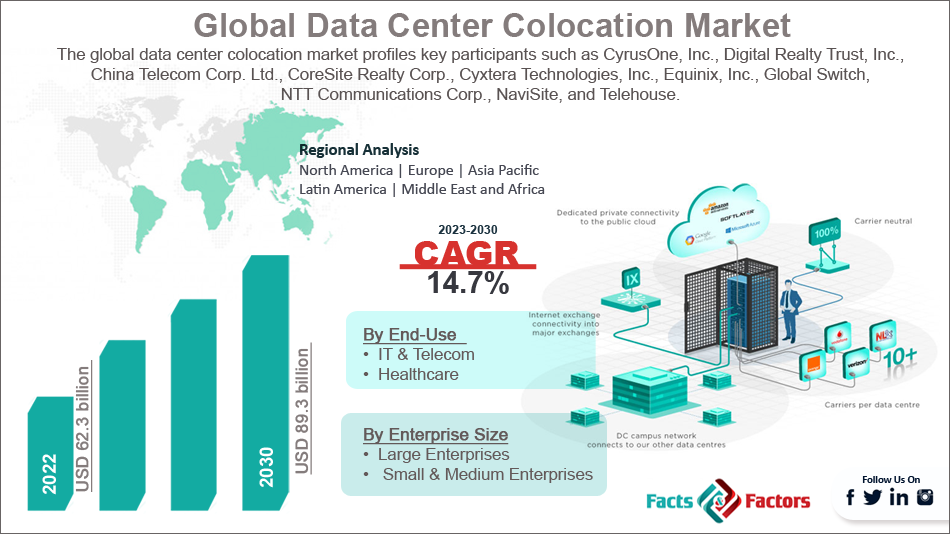

Data Center Colocation Market Size, Share, Growth Analysis Report By Colocation Type (Retail and Wholesale), By End-Use (IT & Telecom and Healthcare), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

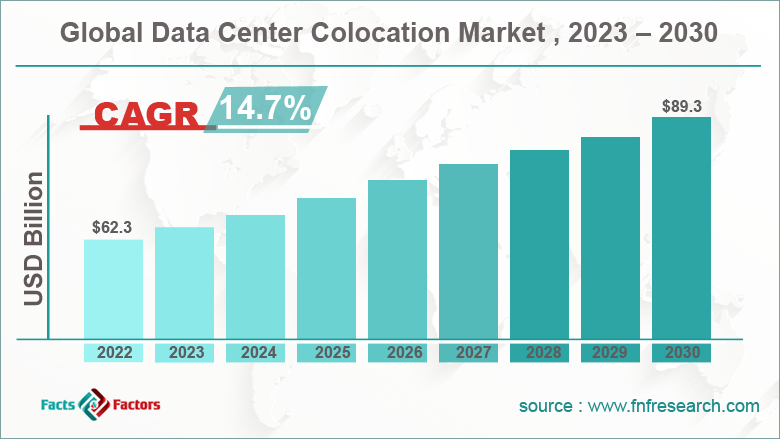

[230+ Page Report] According to the report published by Facts & Factors, the global data center colocation market size was evaluated at $62.3 billion in 2022 and is slated to hit $89.3 billion by the end of 2030 with a CAGR of nearly 14.7% between 2023 and 2030.

The data center colocation market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace. The report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the data center colocation industry report explores the investor and stakeholder space to help companies make data-driven decisions.

Market Overview

Market Overview

Data center colocation is a large data center unit that is rented to vendors for their servers. Moreover, these data center colocation services provided by the firms are structured and provide effective cooling backup, security, and bandwidth.

There is a huge demand for data center colocation as it aids businesses in data center administration along with improving risk management decisions as well as planning & operational strategies. For the record, the data center colocation includes an IP tool, a power backup unit, and a cooling unit.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global data center colocation market is projected to expand annually at the annual growth rate of around 14.7% over the forecast timespan (2023-2030)

- In terms of revenue, the global data center colocation market size was evaluated at nearly $62.3 billion in 2022 and is expected to reach $89.3 billion by 2030.

- The global data center colocation market is anticipated to record massive growth over the forecast period owing to the rise in the costs related to possessing & maintaining a data center for firms producing inconsistent volumes of data.

- Based on the colocation type, the retail segment is predicted to contribute majorly toward the global market share over the forecast timeline.

- In terms of end-user, the IT & Telecom segment is projected to dominate the global market size over 2023-2030.

- On the basis of the enterprise size, the large enterprises segment is projected to account for a major share of the global market in 2023-2030.

- Region-wise, the Asia-Pacific data center colocation market is projected to register the highest CAGR during the assessment period.

Industry Growth Factors

Industry Growth Factors

- Growing demand for OTT & video streaming activities to embellish the global market trends

Scalability of data centers, the need for reducing spending on IT infrastructure, and growing reliability to steer the growth of the global data center colocation market. The rise in the costs related to possessing & maintaining a data center for firms producing inconsistent volumes of data will steer the global market expansion. The surging use of OTT and streaming services has resulted in big data, thereby propelling global market trends.

In addition to this, the emergence of technologies such as IoT, self-driven vehicles, cloud computing, and robotics has translated into a huge need for high bandwidths & rapid data processing.

Moreover, the use of these new technologies needs a fast internet connection with reduced latency time. Furthermore, data center colocation can fulfill these needs with operators locating their data center units in the nearness of end-users. Thereby driving the global market demand.

In addition to this, the launching of the 5G network is set to expand the scope of the growth of the data center colocation market globally in the years ahead. Many governments across the globe are aiding data center colocation for setting up units and providing lands for infrastructural growth, thereby helping the market explore untapped growth potential.

Restraints

Restraints

- Rising maintenance charges and demand for cloud data centers impede the global industry surge

Huge maintenance costs and strict enforcement of government laws can put brakes on the global data center colocation industry. Surging acceptance of cloud data centers due to their reduced costs can further inhibit the expansion of the global industry.

Opportunities

Opportunities

- A surge in disaster recovery activities to open new growth avenues for the global market

An increase in structured and unstructured data along with a rise in the use of cloud computing will open new growth avenues for the data center colocation market across the globe. The rise in disaster recovery events and business continuity needs will produce new horizons of growth for the global market.

Challenges

Challenges

- Stringent laws related to improving energy efficiency put a big challenge in the growth path of the global industry

Strict government laws and security concerns can be a huge challenge in the growth path of the global data center colocation industry. For instance, government organizations are levying strict laws related to power efficiency and water utilization, thereby creating a huge challenge for the global industry surge.

Segmentation Analysis

Segmentation Analysis

The global data center colocation market is sectored into colocation type, end-use, enterprise size, and region

In terms of colocation type, the global data center colocation market is sectored into retail and wholesale segments. Furthermore, the retail segment, which contributed to the largest share of the global market in 2022, is set to hold its segmental dominance in the forecast timeframe.

The segmental growth in the coming eight years can be due to the ability of retail spaces in offering flexibility while managing small data and during times when the requirement of data center units is for a lesser timespan. In addition to this, there is a huge demand for retail colocation by various firms.

Based on end-use, the data center colocation industry across the globe is divided into IT & telecom and healthcare segments. Moreover, the IT & telecom segment, which garnered nearly 28% of the global industry share in 2022, is projected to dominate the global industry expansion even in the forecasting timespan.

The growth of the segment in the ensuing years can be due to a surge in the number of netizens across the globe. Apart from this, the continuous launching of new applications and the rise in demand for smartphones with new embedded features will steer segmental growth.

On the basis of enterprise size, the global data center colocation market is divided into large enterprises and small & medium enterprises segments. Moreover, the large enterprises segment, which accounted for a major share of over 60% of the global market in 2022, is predicted to lead the global market share in the forecasting timeline. The segmental expansion over the assessment timeframe can be due to the huge demand for data center colocation by large enterprises as the former helps in effectively handling data proficiently.

Recent Breakthroughs:

Recent Breakthroughs:

- In the first half of 2023, Web Werks and Iron Mountain jointly launched their first data center colocation referred to as HYD-1. Moreover, the new data center colocation is set up in Hyderabad in India. The move is aimed at expanding the data storage capacities of IT firms and this initiative will contribute majorly to the growth of the data center colocation industry in Asia.

- In February 2023, Onix Data Centres Ltd, a firm owning & operating data centers in Ghana, launched new data center colocation in Senegal. The strategic move will help in improving internet connectivity and boosting economic growth in West Africa.

- In the second half of 2020, Yotta Infrastructure, a reputed firm in the real-estate business in India, launched the world’s second-largest data center in Navi Mumbai in India. The move will boost the scope of growth of the data center colocation industry in India and across the globe.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 62.3 Billion |

Projected Market Size in 2030 |

USD 89.3 Billion |

CAGR Growth Rate |

14.7% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

CyrusOne Inc., Digital Realty Trust Inc., China Telecom Corp. Ltd., CoreSite Realty Corp., Cyxtera Technologies Inc., Equinix Inc., Global Switch, NTT Communications Corp., NaviSite, Telehouse., and others. |

Key Segment |

By Colocation Type, End-Use, Enterprise Size, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Insights

Regional Insights

- North America data center colocation market to accrue massive revenues over the forecast timeline

North America, which accounted lucratively towards the global data center colocation market revenue in 2022, is anticipated to continue its dominance over the analysis timeline. The regional market expansion over 2023-2030 can be due to a strong presence of key cloud solutions providers who install colocation data centers.

The thriving e-commerce industry in the U.S. has accounted majorly for the growth of the regional market. Rise in the investments in the IT infrastructure for data storage and the need for identifying consumer purchasing patterns will steer the expansion of the data center colocation market in North America.

Furthermore, the Asia-Pacific data center colocation industry, which recorded lucrative growth in 2022, is set to register the highest CAGR over the forecast timeline. The factors that are projected to measure the growth of the regional market include the presence of big IT & ITES outsourcing firms in countries such as India and the Philippines.

In addition to this, the rise in the adoption of smart systems has led to a rise in the volumes of data, thereby resulting in the generation of huge data volumes., thereby steering the growth of the industry in the sub-continent.

Competitive Space

Competitive Space

- CyrusOne Inc.

- Digital Realty Trust Inc.

- China Telecom Corp. Ltd.

- CoreSite Realty Corp.

- Cyxtera Technologies Inc.

- Equinix Inc.

- Global Switch

- NTT Communications Corp.

- NaviSite

- Telehouse.

The global data center colocation market is segmented as follows:

By Colocation Type Segment Analysis

By Colocation Type Segment Analysis

- Retail

- Wholesale

By End-Use Segment Analysis

By End-Use Segment Analysis

- IT & Telecom

- Healthcare

By Enterprise Size Segment Analysis

By Enterprise Size Segment Analysis

- Large Enterprises

- Small & Medium Enterprises

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- CyrusOne Inc.

- Digital Realty Trust Inc.

- China Telecom Corp. Ltd.

- CoreSite Realty Corp.

- Cyxtera Technologies Inc.

- Equinix Inc.

- Global Switch

- NTT Communications Corp.

- NaviSite

- Telehouse.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors