Search Market Research Report

Dietary Supplement Market Size, Share Global Analysis Report, 2024 – 2032

Dietary Supplement Market Size, Share, Growth Analysis Report By Ingredient (Vitamins, Minerals, Sports Nutrition, Herbs & Botanicals, Proteins & Amino Acids, Omega Fatty Acids, Fibers & Specialty Carbohydrates, and Others), By Form (Tablets, Capsules, Powders, Liquids, Gummies, Soft Gels, and Others), By Application (General Health, Bone & Joint Health, Cardiovascular Health, Weight Management, Energy, Diabetes, Immunity, Gastrointestinal Health, Anti-Cancer, Lung Cleanse/Detox, Sexual Health, Mental Health, Nails/Hair/Skin, Anti-Aging, Menopause, Prenatal Health, and Others), By End-user (Adults, Elderly, Pregnant Women, Children, and Others), By Distribution Channel (Offline and Online), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

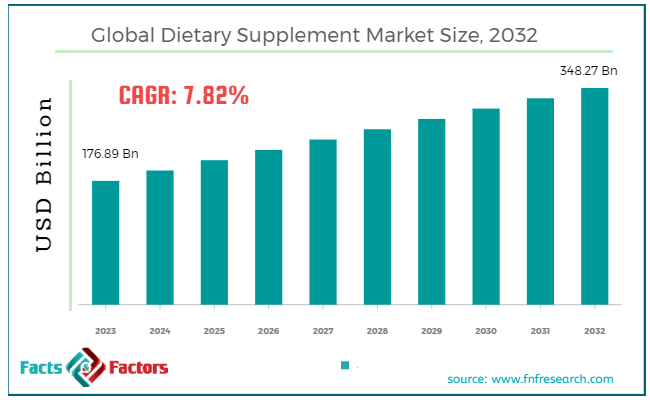

[216+ Pages Report] According to Facts & Factors, the global dietary supplement market size in terms of revenue was valued at around USD 176.89 billion in 2023 and is expected to reach a value of USD 348.27 billion by 2032, growing at a CAGR of roughly 7.82% from 2024 to 2032. The global dietary supplement market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

A dietary supplement is a product intended to supplement the diet and provide nutrients that may not be consumed in sufficient quantities from food alone. These products can include vitamins, minerals, herbs, amino acids, enzymes, and other substances. They are typically available in various forms such as tablets, capsules, powders, and liquids. Dietary supplements are widely used to ensure adequate intake of essential nutrients, support health and wellness, and address specific health concerns and deficiencies.

The dietary supplement market has been experiencing significant growth globally. This growth is driven by increasing health consciousness among consumers, aging populations, and the rising prevalence of chronic diseases, which encourage individuals to seek preventative health measures. The market is also bolstered by the growing fitness trend and the expanding interest in nutritional support for athletic performance.

Key Highlights

Key Highlights

- The dietary supplement market has registered a CAGR of 7.82% during the forecast period.

- In terms of revenue, the global dietary supplement market was estimated at roughly USD 176.89 billion in 2023 and is predicted to attain a value of USD 348.27 billion by 2032.

- The growth of the dietary supplement market is being propelled by the growing awareness of health among consumers, the aging population, and the increasing occurrence of chronic diseases.

- Based on the ingredients, the vitamin segment is growing at a high rate and is projected to dominate the global market.

- Based on the form, the tablets segment is projected to swipe the largest market share.

- Based on the application, the weight management segment is expected to dominate the global market.

- Based on the distribution channel, the offline segment is expected to dominate the global market.

- By region, North America is currently the dominating region in terms of market size and growth stability, supported by an established dietary supplement culture and extensive consumer awareness about health and wellness.

Growth Drivers:

Growth Drivers:

- Preventive Healthcare Focus: As individuals become more proactive about their health, dietary supplements gain traction as a way to prevent deficiencies and promote overall well-being. This focus on preventative measures drives market growth.

- Aging Population: A growing global aging population creates a significant demand for supplements that support healthy aging, like bone and joint health products. This demographic shift fuels market expansion.

- Growing Demand for Natural Products: Consumers are increasingly seeking natural solutions for health concerns, leading to a preference for dietary supplements over conventional medications.

- Rising Disposable Incomes: With growing disposable incomes, people are more likely to invest in their well-being, including dietary supplements.

Restraints:

Restraints:

- Regulatory Landscape: Dietary supplements face less stringent regulations compared to medications. This can raise concerns about product quality, safety, and efficacy.

- Dosage and Interaction Issues: Taking the correct dosage and understanding potential interactions with medications is crucial. Consumers may lack proper guidance, leading to potential health risks.

- Unrealistic Expectations: Dietary supplements are not a magic bullet for good health. Overreliance on supplements can distract from the importance of a balanced and nutritious diet.

Opportunities:

Opportunities:

- Technological Advancements: Emerging technologies like nutrigenomics (exploring the interaction between genes and nutrients) create possibilities for developing more targeted and personalized dietary supplements, presenting a significant growth opportunity.

- Expansion into Emerging Markets: Rising disposable incomes and growing health awareness in developing countries like those in Asia Pacific create exciting market expansion opportunities.

- E-commerce Growth: The rise of e-commerce platforms provides a convenient and accessible way for consumers to purchase supplements, potentially expanding the market reach.

- Focus on Transparency and Sustainability: Consumers are increasingly demanding transparency about ingredient sourcing and sustainable manufacturing practices. Supplement companies that prioritize these aspects can gain a competitive edge and drive market growth.

Challenges:

Challenges:

- Competition: The dietary supplement market is becoming increasingly competitive, with established brands and new entrants vying for market share. This competition can lead to price pressures and challenges in product differentiation.

- Navigating Regulatory Changes: The regulatory environment for dietary supplements can be complex and subject to change. Supplement companies need to adapt to evolving regulations to maintain compliance and market presence.

- Building Consumer Trust: Earning and maintaining consumer trust is crucial in this market. Supplement companies need to address concerns about product quality and safety through robust quality control measures and transparent communication.

Dietary Supplement Market: Segmentation Analysis

Dietary Supplement Market: Segmentation Analysis

The global dietary supplement market is segmented based on ingredient, form, application, end-user, distribution channel, and region.

By Ingredient Insights

By Ingredient Insights

Based on Ingredients, the global dietary supplement market is bifurcated into vitamins, minerals, sports nutrition, herbs & botanicals, proteins & amino acids, omega fatty acids, fibers & specialty carbohydrates, and others. Vitamins are the largest and most dominant segment in the dietary supplement market. This segment has held a market share of around 32.7% in 2023. This category includes multivitamins and single vitamins like Vitamin D, Vitamin C, and B vitamins.

The demand is driven by general health maintenance needs and the prevention of vitamin deficiencies. The minerals segment covers essential minerals such as calcium, magnesium, and iron. Minerals play crucial roles in bone health, cardiovascular health, and more. While smaller than vitamins, this segment is critical due to the specific deficiencies it addresses. Sports nutrition is the rapidly growing segment that targets athletes and fitness enthusiasts seeking supplements to enhance performance, muscle building, and recovery.

Herbs & botanicals include products like turmeric, ginger, and echinacea. This segment is rapidly growing due to increasing consumer interest in natural and organic health products. This segment is registering growth at a CAGR of 8.6% between 2024 to 2032. Herbs and botanicals are often used for their therapeutic properties and are popular in managing health concerns such as inflammation and immune health.

The protein & amino acids segment caters primarily to fitness enthusiasts and athletes looking to enhance muscle growth and recovery. This segment is expected to grow at a CAGR of 12.3% during the forecast period. Protein supplements, especially whey protein, and amino acids like BCAAs, are in high demand within this group. Omega fatty acids comprising fish oils and flaxseed oils rich in omega-3 fatty acids, this segment is recognized for its cardiovascular and cognitive health benefits.

By Form Insights

By Form Insights

Based on Form, the global dietary supplement market is divided into tablets, capsules, powders, liquids, gummies, soft gels, and others. Tablets are a traditional form of dietary supplements, valued for their convenience and dosage accuracy. This segment accounted for 34.5% of the total revenue share in 2023. They often dominate the market due to their stability and longer shelf life. Capsules are popular due to their ease of ingestion and faster absorption rates compared to tablets. They often appeal to those who avoid tablets due to difficulty swallowing or digestion issues.

Powders are common in the protein and amino acids segment; powders are versatile and popular among younger consumers who prefer to mix their supplements into beverages. Liquid supplements are ideal for those who have difficulty with solid forms and are often used for high absorption needs, such as in children and elderly populations.

By Application Insights

By Application Insights

On the basis of Application, the global dietary supplement market is categorized into general health, bone & joint health, cardiovascular health, weight management, energy, diabetes, immunity, gastrointestinal health, anti-cancer, lung cleanse/detox, sexual health, mental health, nails/hair/skin, anti-aging, menopause, prenatal health, and others. General health supplements aimed at overall wellness and health maintenance dominate this segment. Multivitamins and general supplements fall under this category and see a steady demand across various demographics. The weight management segment is expected to dominate the global market with a revenue share of around 31.4% in 2023.

With an aging population, supplements that support bone health and joint flexibility, such as calcium and glucosamine, are increasingly important. Cardiovascular health supplements like omega fatty acids that promote heart health are critical given the global rise in heart disease rates. The weight management segment includes fiber supplements, conjugated linoleic acid (CLA), and green tea, among others, which help in weight control and are gaining popularity due to the global obesity epidemic.

By End-user Insights

By End-user Insights

Based on End-users, the global dietary supplement market is divided into adults, elderly, pregnant women, children, and others. Adults are the largest consumer group for dietary supplements, driven by health, wellness, and disease prevention needs. This segment accounted for 47.3% of the total revenue share in 2023. The elderly segment is rapidly growing due to the global increase in the aging population, with a particular focus on supplements that aid in the prevention of age-related diseases.

The pregnant women segment focuses on prenatal vitamins and minerals essential for healthy pregnancy outcomes. Children segment focuses on growth and development needs, including vitamins and omega fatty acids.

By Distribution Channel Insights

By Distribution Channel Insights

Based on Distribution Channel, the global dietary supplement market is divided into offline and online. The offline segment has captured a market share of around 84.5% in 2023. The offline segment is further divided into health & beauty stores, and pharmacies & drug stores. Health & beauty stores are a traditional sales channel for dietary supplements, offering a range of specialized products and expert advice. This segment remains significant despite the growth of online sales.

Pharmacies & drug stores are a trusted source for dietary supplements, especially for those linked to specific health conditions, like mineral deficiencies or digestive health. Traditionally the most dominant channel, these outlets benefit from consumer trust and the ability to offer professional health advice.

The online segment is experiencing the fastest growth, driven by the convenience of home shopping, the availability of a wide range of products, and often competitive pricing.

Recent Developments:

Recent Developments:

- BioAdaptives Unveils Plant-Based Muscle Builder (December 2023): BioAdaptives Inc., a leader in natural supplements, launches PROTEINnMORE™, a plant-based supplement designed to support strength and muscle building. This caters to the growing demand for plant-based solutions in the fitness and wellness space. To further support this goal, BioAdaptives plans to release their AI-powered body composition app, Fit Your Outfit (FYO), in early 2024.

- Pharma Linea Introduces Sleep Support Supplement (November 2023): Pharma Linea launches Your Good Night Acute Sticks, a private-label sleep aid with clinical backing. These dissolvable sticks target acute sleep issues and aim to improve overall sleep quality.

- Kyowa Hakko Expands Postbiotic Ingredient to Mexico (September 2023): Kyowa Hakko partners with Quifaest to introduce IMMUSE, their postbiotic ingredient, to the Mexican market for the first time. This expansion signifies Kyowa Hakko's commitment to increasing the global reach of its innovative postbiotics.

- Nutritional Research Company Debuts Absorbable Supplement Line (August 2023): Nutritional Research Company (NRC) launches its Absorbable line of immune-supporting supplements. This new product line features three options: Vitamin C, Vitamin D3 (1000 IU), and Vitamin D3 (2000 IU). These offerings focus on promoting better nutrient absorption within the body.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 176.89 Billion |

Projected Market Size in 2032 |

USD 348.27 Billion |

CAGR Growth Rate |

7.82% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Abbott, American Health, Amway Corp., Archer Daniels Midland, Bayer AG, Bionova Lifesciences, Carlyle Group, DuPont de Nemours Inc., Glanbia plc, GlaxoSmithKline plc., Good Health New Zealand, Herbalife Nutrition Ltd., Nature's Bounty, Nature's Sunshine Products Inc., NBTY Inc, NOW Foods, Nu Skin Enterprises, Pfizer Inc., RBK Nutraceuticals Pty Ltd, XanGo LLC, and Others. |

Key Segment |

By Ingredient, By Form, By Application, By End-user, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Dietary Supplement Market: Regional Analysis

Dietary Supplement Market: Regional Analysis

North America, particularly the United States, is the largest and most dominant region in the dietary supplement market. The U.S. market is projected to expand at a CAGR of 6.1% over the forecast period. This region benefits from high consumer awareness about health and wellness, substantial health expenditure, and a robust regulatory environment facilitated by the FDA.

The market is characterized by high adoption rates of supplements among various demographics and a strong presence of leading industry players. The market here enjoys a solid Compound Annual Growth Rate (CAGR), driven by continuous innovation and a growing elderly population seeking preventive health measures.

Europe holds a significant share of the global dietary supplement market, driven by an increasing focus on preventive healthcare and high consumer spending power. This region is expected to grow at a CAGR of 6.8% from 2024 to 2032. Western European countries, such as Germany, the UK, and France, lead in market penetration due to their advanced healthcare infrastructure and consumer awareness.

The regulatory landscape in Europe, governed by the European Food Safety Authority (EFSA), ensures high product standards, contributing to consumer trust and market growth. Eastern European countries are experiencing faster growth rates, albeit from a smaller base, due to improving economic conditions and health awareness.

The Asia-Pacific region is the fastest-growing in the global dietary supplement market, exhibiting the highest CAGR among all regions. This region has captured a market share of around 35.4% in 2023. This growth is propelled by rising disposable incomes, increasing health consciousness, and urbanization, particularly in China and India. In 2023, China dominated the dietary supplements market in Asia, holding a market share of more than 39.6%. The region benefits from a large and diverse population with a growing middle class, which is increasingly adopting dietary supplements as part of a health-conscious lifestyle. Traditional herbal supplements are particularly popular in this region, integrating well with cultural dietary practices.

Latin America is an emerging market in the dietary supplement sector, with Brazil and Mexico leading the growth. The market is driven by increasing urbanization, rising health awareness, and economic development. Although the region faces challenges such as economic instability and varied regulatory quality, it presents substantial growth opportunities due to its young population and increasing health and wellness trends.

The Middle East and Africa (MEA) region, while still small in terms of global market share, is gradually expanding. This region is expanding at a CAGR of 11.3% from 2024 to 2032. The growth in this region is fueled by economic development, especially in Gulf Cooperation Council (GCC) countries like the UAE and Saudi Arabia, where there is a growing expatriate population and rising disposable incomes. The market's expansion is also supported by increasing awareness of health supplements and improving retail infrastructure.

Dietary Supplement Market: List of Key Players

Dietary Supplement Market: List of Key Players

Some of the main competitors dominating the global dietary supplement market include;

- Abbott

- American Health

- Amway Corp.

- Archer Daniels Midland

- Bayer AG

- Bionova Lifesciences

- Carlyle Group

- DuPont de Nemours, Inc.

- Glanbia plc

- GlaxoSmithKline plc.

- Good Health New Zealand

- Herbalife Nutrition Ltd.

- Nature's Bounty

- Nature's Sunshine Products, Inc.

- NBTY Inc

- NOW Foods

- Nu Skin Enterprises

- Pfizer Inc.

- RBK Nutraceuticals Pty Ltd

- XanGo, LLC

The global dietary supplement market is segmented as follows:

By Ingredient Segment Analysis

By Ingredient Segment Analysis

- Vitamins

- Minerals

- Sports Nutrition

- Herbs & Botanicals

- Proteins & Amino Acids

- Omega Fatty Acids

- Fibers & Specialty Carbohydrates

- Others

By Form Segment Analysis

By Form Segment Analysis

- Tablets

- Capsules

- Powders

- Liquids

- Gummies

- Soft Gels

- Others

By Application Segment Analysis

By Application Segment Analysis

- General Health

- Bone & Joint Health

- Cardiovascular Health

- Weight Management

- Energy

- Diabetes

- Immunity

- Gastrointestinal Health

- Anti-Cancer

- Lung Cleanse/Detox

- Sexual Health

- Mental Health

- Nails/Hair/Skin

- Anti-aging

- Menopause

- Prenatal Health

- Others

By End-user Segment Analysis

By End-user Segment Analysis

- Adults

- Elderly

- Pregnant Women

- Children

- Others

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Offline

- Health & Beauty Stores

- Pharmacies & Drug Stores

- Online

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Abbott

- American Health

- Amway Corp.

- Archer Daniels Midland

- Bayer AG

- Bionova Lifesciences

- Carlyle Group

- DuPont de Nemours Inc.

- Glanbia plc

- GlaxoSmithKline plc.

- Good Health New Zealand

- Herbalife Nutrition Ltd.

- Nature's Bounty

- Nature's Sunshine Products Inc.

- NBTY Inc

- NOW Foods

- Nu Skin Enterprises

- Pfizer Inc.

- RBK Nutraceuticals Pty Ltd

- XanGo LLC

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors