Search Market Research Report

RegTech Market Size, Share Global Analysis Report, 2024 – 2032

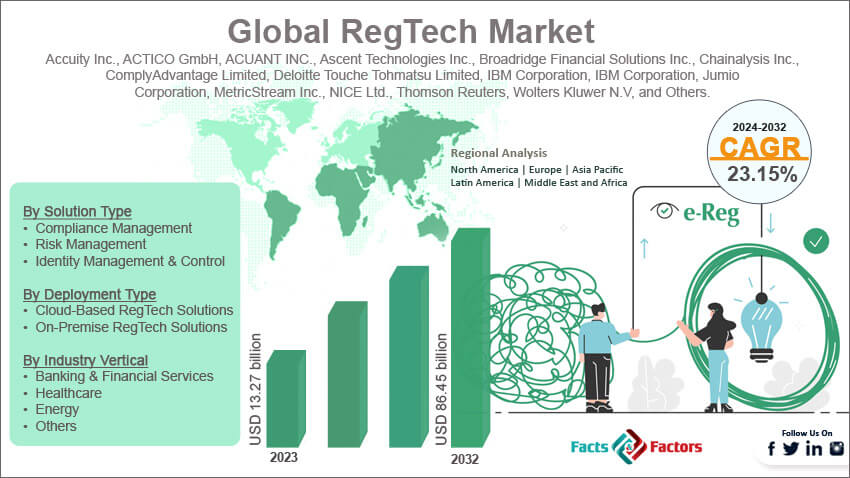

RegTech Market Size, Share, Growth Analysis Report By Solution Type (Compliance Management, Risk Management and Identity Management & Control), By Deployment Type (Cloud-Based RegTech Solutions and On-Premise RegTech Solutions), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Industry Vertical (Banking & Financial Services and Healthcare, Energy, and Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

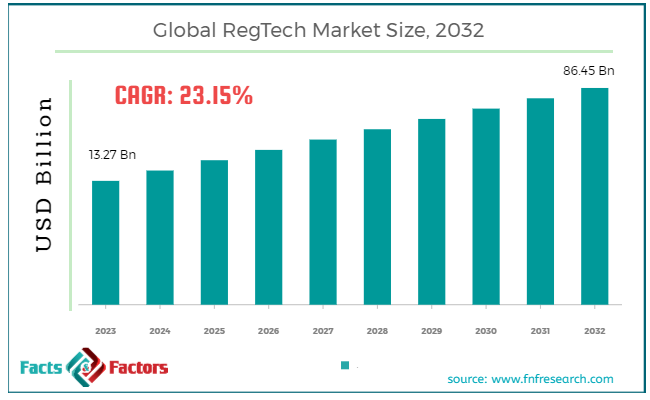

[225+ Pages Report] According to Facts & Factors, the global RegTech market size in terms of revenue was valued at around USD 13.27 billion in 2023 and is expected to reach a value of USD 86.45 billion by 2032, growing at a CAGR of roughly 23.15% from 2024 to 2032. The global RegTech market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

RegTech, short for "Regulatory Technology," refers to the use of technology, particularly information technology, to enhance regulatory processes within the financial industry. It involves the application of cloud computing technology, big data, and machine learning to help financial institutions better comply with regulations efficiently and at lower costs. RegTech solutions are designed to automate compliance tasks, reduce operational risks associated with meeting compliance and reporting obligations, improve the management of regulatory data, and offer insights into regulatory requirements.

The key benefits of RegTech include streamlined compliance, improved accuracy in data collection and analysis, and enhanced ability to respond to regulatory changes. As financial regulations become more complex and enforcement more rigorous, the demand for efficient RegTech solutions continues to grow, making it a critical component of modern financial services infrastructure.

Key Highlights

Key Highlights

- The RegTech market has registered a CAGR of 23.15% during the forecast period.

- In terms of revenue, the global RegTech market was estimated at roughly USD 13.27 billion in 2023 and is predicted to attain a value of USD 86.45 billion by 2032.

- The growth of the RegTech market is being propelled by Increasing Regulatory Complexity, Technological Advancements, Cost Reduction for Compliance and Demand for Data Management Solutions.

- Based on the Solution Type, the compliance management segment is projected to swipe the largest market share.

- Based on the Deployment Type, the Cloud-Based RegTech Solutions segment is growing at a high rate and is projected to dominate the global market due to Lower upfront costs and scalability compared to on-premise solutions.

- Based on region, North America and Europe continue to lead in terms of market size and technological adoption, the Asia-Pacific region represents a rapidly expanding frontier with significant potential for growth.

Growth Drivers:

Growth Drivers:

- Rising Regulatory Complexity: The regulatory landscape across various industries, especially finance, healthcare, and data privacy, is constantly evolving. This creates a strong demand for RegTech solutions that can help businesses navigate this complexity and ensure compliance.

- Increasing Cost of Non-Compliance: Non-compliance with regulations can result in hefty fines, reputational damage, and even operational shutdowns. RegTech solutions help businesses mitigate these risks by automating compliance tasks and improving accuracy.

- Technological Advancements: The rise of new technologies like artificial intelligence (AI) and machine learning (ML) is driving the development of more sophisticated RegTech solutions. These tools offer enhanced automation, data analysis capabilities, and risk identification.

- Growing Global Footprint: As businesses expand their operations across borders, they face a patchwork of regulations in different jurisdictions. RegTech solutions can help them comply with these varying regulations efficiently.

Restraints:

Restraints:

- High Implementation Costs: Implementing and maintaining sophisticated RegTech solutions can be expensive, especially for smaller businesses. This can be a barrier to entry for some companies.

- Data Security Concerns: RegTech solutions often involve handling sensitive customer data. Data breaches and security vulnerabilities can erode trust and damage a company's reputation.

- Integration Challenges: Integrating RegTech solutions with existing IT infrastructure can be complex and time-consuming. Businesses need to ensure compatibility and smooth data flow between systems.

- Regulatory Uncertainty: Rapidly changing regulations can create uncertainty for RegTech companies, making it difficult to develop future-proof solutions.

Opportunities:

Opportunities:

- Focus on Open Banking and PSD2: Open banking regulations like PSD2 (Payment Services Directive 2) create a need for RegTech solutions that facilitate secure data sharing and compliance for financial institutions.

- Emerging Markets with Growing Regulations: Developing economies with increasing regulatory frameworks present significant growth opportunities for RegTech solutions addressing their specific needs.

- Focus on RegTech as a Service (RaaS): The adoption of cloud-based RegTech solutions (RaaS) offers affordability and scalability, making compliance more accessible to businesses of all sizes.

Challenges:

Challenges:

- Shortage of Skilled Professionals: The RegTech sector requires professionals with expertise in both technology and regulations. A lack of skilled personnel can hinder the development and implementation of effective solutions.

- Standardization Issues: The absence of standardized regulations across different regions can create challenges for developing RegTech solutions with global applicability.

- Evolving Regulatory Landscape: Keeping pace with rapid regulatory changes requires continuous updates and adaptations for RegTech solutions to remain effective.

RegTech Market: Segmentation Analysis

RegTech Market: Segmentation Analysis

The global RegTech market is segmented based on solution type, deployment type, organization size, and industry verticals.

By Solution Type Insights:

By Solution Type Insights:

Based on Solution Type, the global RegTech market is bifurcated into compliance management, risk management and identity management & control. Compliance Management includes software solutions that help organizations comply with regulatory requirements efficiently and effectively. Tools may automate the collection of compliance data, manage documentation, and ensure that the business operations are in accordance with applicable laws and standards. This segment is expected to grow robustly as companies across the globe are increasingly burdened by the need to manage numerous and often complex regulatory requirements.

Risk Management Involves technologies that identify, assess, and mitigate risks associated with non-compliance. This segment uses predictive analytics and data modeling to foresee potential compliance risks. Identity Management & Control focuses on solutions that verify identities and enhance control mechanisms to prevent fraud. This segment is crucial given the rising incidences of cyber threats and identity theft.

By Deployment Type Insights

By Deployment Type Insights

Based on Deployment Type, the global RegTech market is categorized into Cloud-Based RegTech solutions and On-Premise RegTech solutions. Cloud-based RegTech solutions refer to RegTech solutions hosted on the cloud, offering scalability, flexibility, and cost-effectiveness. Cloud-based solutions are particularly appealing due to lower upfront costs and the ability to scale services according to the needs. The cloud-based segment is projected to exhibit the highest CAGR due to its lower barrier to entry and operational flexibility.

On-premise RegTech solutions are installed locally, on a company’s computers and servers. They often appeal to organizations that require enhanced control over their data and more customization.

By Organization Size Insights

By Organization Size Insights

Based on Organization Size, the global RegTech market is bifurcated into large enterprises, and small and medium enterprises (SMEs). Large enterprises typically have the capital and infrastructural capabilities to implement comprehensive RegTech solutions, addressing a broad spectrum of regulatory issues. Small and Medium Enterprises (SMEs) are increasingly adopting RegTech solutions to cope with growing regulatory pressures that could be overwhelming due to limited resources. While large enterprises hold a larger share, SMEs are expected to grow rapidly in adoption due to increasingly affordable cloud-based solutions that lower the entry threshold.

By Industry Vertical Insights

By Industry Vertical Insights

Based on Industry Vertical, the global RegTech market is categorized into banking & financial services and healthcare, energy, and others. Banking & Financial Services sector dominates the RegTech market due to the stringent regulatory scrutiny it faces. Solutions tailored for BFSI help in compliance with complex and varied regulations across different jurisdictions. Expected to maintain a strong growth trajectory as financial institutions continue to navigate an increasingly complex regulatory landscape. Other sectors like healthcare and energy are also embracing RegTech solutions to comply with specific regulatory demands pertinent to their operations.

Recent Developments:

Recent Developments:

- Dassault Systèmes Bolsters Financial Services Expertise (June 2023): This company acquired Innova RegTech solutions to strengthen its cloud brand, OUTSCALE. This move aims to make OUTSCALE a more reliable partner for financial institutions by providing them with automated compliance control functionalities.

- Hummingbird RegTech Launches Compliance App (April 2023): This RegTech company launched a new mobile app specifically designed for compliance professionals. The app equips users with the latest tools and resources needed to combat financial crime and stay on top of evolving regulations.

- Ascent Technologies Unveils Compliance Confidence Scorecard (March 2023): This new offering from Ascent Technologies provides businesses with a comprehensive view of their regulatory compliance status. The scorecard includes features like regulatory change monitoring, analysis, and recommendations for mapping appropriate compliance solutions and services.

- Corlytics Group Enhances Regulatory Document Management (June 2023): Corlytics Group acquired Clausematch Limited to expand its capabilities in handling regulatory documents. This acquisition allows Corlytics to offer clients intelligent solutions for creating and maintaining regulatory documents and streamlining compliance processes.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 13.27 Billion |

Projected Market Size in 2032 |

USD 86.45 Billion |

CAGR Growth Rate |

23.15% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Accuity Inc., ACTICO GmbH, ACUANT INC., Ascent Technologies Inc., Broadridge Financial Solutions Inc., Chainalysis Inc., ComplyAdvantage Limited, Deloitte Touche Tohmatsu Limited, IBM Corporation, IBM Corporation, Jumio Corporation, MetricStream Inc., NICE Ltd., Thomson Reuters, Wolters Kluwer N.V, and Others. |

Key Segment |

By Solution Type, By Deployment Type, By Organization Size, By Industry Vertical, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

RegTech Market: Regional Insights

RegTech Market: Regional Insights

North America is a dominant player in the RegTech market, largely due to its advanced financial services sector, comprehensive regulatory framework, and high adoption of new technologies. The United States, in particular, has a robust ecosystem supporting innovation in financial services technology, driven by both Silicon Valley's tech industry and Wall Street's financial experts. North America's market is expected to grow at a substantial CAGR, thanks to ongoing technological advancements and regulatory changes demanding efficient compliance solutions.

Europe also represents a significant share of the global RegTech market. The region's strict and complex regulatory requirements, especially with directives like GDPR, have driven demand for RegTech solutions. The European market benefits from a proactive regulatory approach that encourages the adoption of RegTech to ensure compliance across its diverse financial landscape. The European RegTech market is projected to expand robustly, supported by the increasing need for compliance with EU-wide regulations.

The Asia-Pacific region is the fastest-growing in the global RegTech market. This growth is fueled by rapid economic development, particularly in China, India, and Southeast Asia, coupled with a significant increase in financial service demands and evolving regulatory landscapes. Financial hubs such as Singapore and Hong Kong are leading the way in adopting RegTech solutions. Asia-Pacific's CAGR is expected to be the highest among all regions, driven by digital transformation in the financial sector and regulatory reforms.

Although currently smaller in scale, the Latin American RegTech market is gaining momentum. Countries like Brazil and Mexico are increasingly focusing on strengthening their financial regulatory frameworks, which boosts the demand for RegTech solutions. Latin America's market is expected to grow steadily as more countries in the region develop their financial and technological infrastructures.

The Middle East and Africa region is an emerging market in the RegTech space, with countries such as the United Arab Emirates and Saudi Arabia investing heavily in modernizing their financial services. The focus on diversifying economies and building digital-first financial services infrastructure is promoting the adoption of RegTech. The Middle East and Africa are projected to experience considerable growth, though from a smaller base compared to other regions.

RegTech Market: Competitive Landscape

RegTech Market: Competitive Landscape

Some of the main competitors dominating the global RegTech market include;

- Accuity Inc.

- ACTICO GmbH

- ACUANT, INC.

- Ascent Technologies, Inc.

- Broadridge Financial Solutions, Inc.

- Chainalysis Inc.

- ComplyAdvantage Limited

- Deloitte Touche Tohmatsu Limited

- IBM Corporation

- IBM Corporation

- Jumio Corporation

- MetricStream Inc.

- NICE Ltd.

- Thomson Reuters

- Wolters Kluwer N.V

The global RegTech market is segmented as follows:

By Solution Type Segment Analysis

By Solution Type Segment Analysis

- Compliance Management

- Risk Management

- Identity Management & Control

By Deployment Type Segment Analysis

By Deployment Type Segment Analysis

- Cloud-Based RegTech Solutions

- On-Premise RegTech Solutions

By Organization Size Segment Analysis

By Organization Size Segment Analysis

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry Vertical Segment Analysis

By Industry Vertical Segment Analysis

- Banking & Financial Services

- Healthcare

- Energy

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Accuity Inc.

- ACTICO GmbH

- ACUANT, INC.

- Ascent Technologies, Inc.

- Broadridge Financial Solutions, Inc.

- Chainalysis Inc.

- ComplyAdvantage Limited

- Deloitte Touche Tohmatsu Limited

- IBM Corporation

- IBM Corporation

- Jumio Corporation

- MetricStream Inc.

- NICE Ltd.

- Thomson Reuters

- Wolters Kluwer N.V

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors