Search Market Research Report

Specialty Chemicals Market Size, Share, Growth, Trends Analysis Forecast 2021-2026

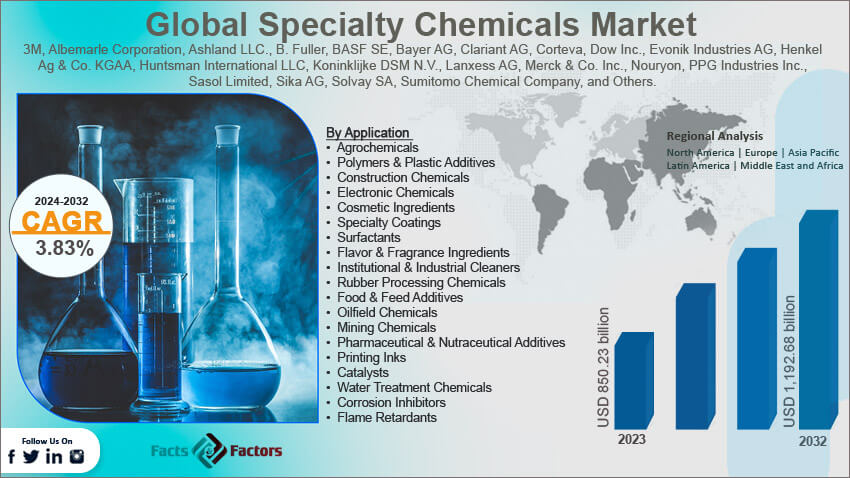

Specialty Chemicals Market By Product (Specialty Polymers, Institutional & Industrial Cleaners, Electronics Chemicals, Rubber Processing Chemicals, Flavors & Fragrances, Construction Chemicals, Food & Feed Additives, Cosmetic Chemicals, Oilfield Chemicals, Mining Chemicals, Pharmaceutical & Nutraceutical Additives, Plastic Additives, Printing Inks, Coatings, Adhesives, Sealants, And Elastomers (CASE), Catalysts, Water Treatment Chemicals, Corrosion Inhibitors, Flame Retardants, & Others), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021–2026

Industry Insights

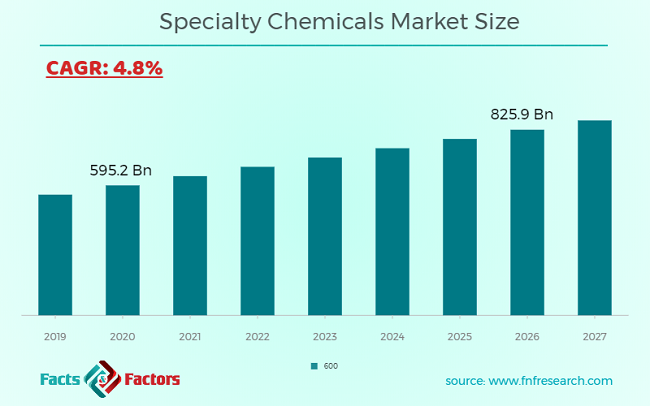

[215+ Pages Report] The latest findings and offering on the specialty chemicals market released by Facts & Factors offers a neatly titled “Global Specialty Chemicals Market”. In this report, the global specialty chemicals market exhibited USD 595.2 billion in the year 2020 and will grow at an estimated CAGR rate of 4.8% to an overall value of USD 825.9 Billion in the year 2026.

Market Overview

Market Overview

Specialty chemicals or specialties or effect chemicals are the particular brand of chemical products that have the ability to distort a wider range of effects. Some of the categories of specialty chemicals can be branded as adhesives, agrichemicals, chemical materials, colors, cosmetic additives, construction chemicals, elastomers flavors, fragrances, and paints to name a few. Such industrial sectors such as automotive, aerospace, food, cosmetics, and agricultures are extremely dependent on such products.

Industry Growth Factors

Industry Growth Factors

The primary driving factors for the significant growth of the global specialty chemicals market are rising demand for high-performance and function-specific chemicals coupled with increasing demand from the sectors of oil & gas, pulp & paper, and personal care and cosmetics to name a few. Additionally, integration of specialty chemicals in essential oils, gelatin, castor oil, and collagen coupled with rising innovation techniques in the sector is expected to increase the footprint of the global specialty chemicals market during the advent of the forecast period. Moreover, increasing R&D activities coupled with increased adoption of rechargeable and sustainable electronic components will boost the growth of the global specialty chemicals market during the advent of the forecast period.

The global specialty chemicals market is driven by rising demand from the automotive sector in terms of adhesives, lubricants, and paints coupled with increasing adoption of a healthier lifestyle to name a few. Increasing disposable income among consumers coupled with rapid industrialization measures will fuel the growth of the global specialty chemicals market during the advent of the forecast period. However, rising consumer awareness about the harmful effects of conventional chemicals on the environment coupled with increasing technicalities for production measures will hamper the growth of the global specialty chemicals market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global specialty chemicals market is segmented into product and region.

On the basis of product, the global specialty chemicals market is categorized into specialty polymers, institutional & industrial cleaners, electronics chemicals, rubber processing chemicals, flavors & fragrances, construction chemicals, food & feed additives, cosmetic chemicals, oilfield chemicals, mining chemicals, pharmaceutical & nutraceutical additives, plastic additives, printing inks, coatings, adhesives, sealants, and elastomers (CASE), catalysts, water treatment chemicals, corrosion inhibitors, flame retardants, and others. The segment pertaining to industrial and institutional cleaners segment is expected to witness the largest market share during the advent of the forecast period owing to numerous technological advancements in terms of product innovations coupled with rising demand for water-proofing compounds to name a few. The region of oilfield chemicals is expected to witness a substantial market share during the advent of the forecast period owing to the rapid expansion of refining capacity in terms of shale oil and gas drilling activities coupled with the increasing growth of oil refineries to name a few. The construction chemicals category is expected to present a lucrative opportunity during the forecast period owing to increasing growth projections in terms of erecting infrastructure coupled with rising demand for repair & renovation compounds, joint fillers, and tile fixing adhesives to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 595.2 Billion |

Projected Market Size in 2026 |

USD 825.9 Billion |

CAGR Growth Rate |

4.8% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Solvay AG, Evonik Industries AG, Clariant AG, Akzo Nobel N.V., BASF SE, Kemira Oyj, LANXESS AG, Croda International plc., and Others |

Key Segments |

Products, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the advent of the forecast period owing to rising demand from the sectors of pharmaceuticals and nutraceuticals, personal care and cosmetics, automotive, and electric and electronic coupled with growing diversification measures to name a few. Additionally, increasing industrialization coupled with improving standards of living in the region will further push the existing boundaries of the specialty chemicals market during the advent of the forecast period. Europe is expected to witness a warm market growth during the advent of the forecast period owing to the latter being a huge exporter coupled with rising oilfields to name a few. Rapid growth of the construction activities coupled with the rising number of oil and gas firms in the region will increase the footprint of the specialty chemicals market during the advent of the forecast period.

Competitive Players

Competitive Players

The key market participants for the global specialty chemicals market are

- Solvay AG

- Evonik Industries AG

- Clariant AG

- Akzo Nobel N.V.

- BASF SE

- Kemira Oyj

- LANXESS AG

- Croda International plc.

- Huntsman International LLC

- The Lubrizol Corporation

- Albemarle Corporation

- Dow Inc.

- Sumimoto Industries

- Ashland LLC

- Henkel Ag & Co KGAA.

- 3M

By Product Segment Analysis

By Product Segment Analysis

- Specialty Polymers

- Institutional & Industrial Cleaners

- Electronics Chemicals

- Rubber Processing Chemicals

- Flavors & Fragrances

- Construction Chemicals

- Food & Feed Additives

- Cosmetic Chemicals

- Oilfield Chemicals

- Mining Chemicals

- Pharmaceutical & Nutraceutical Additives

- Plastic Additives

- Printing Inks

- Coatings, Adhesives, Sealants, And Elastomers (CASE)

- Catalysts

- Water Treatment Chemicals

- Corrosion Inhibitors

- Flame Retardants

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Solvay AG

- Evonik Industries AG

- Clariant AG

- Akzo Nobel N.V.

- BASF SE

- Kemira Oyj

- LANXESS AG

- Croda International plc.

- Huntsman International LLC

- The Lubrizol Corporation

- Albemarle Corporation

- Dow Inc.

- Sumimoto Industries

- Ashland LLC

- Henkel Ag & Co KGAA.

- 3M

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors