Search Market Research Report

North America Frozen Bakery Products Market Size, Share Analysis Forecast 2020-2026

North America Frozen Bakery Products Market By Source (Wheat, Rye, Barley, Corn, and Others), By Product Type (Cakes and Pastries, Bread, Donuts & Pies, Pizza, and Others), By Distribution Channel (Convenience Stores, Supermarket/Hypermarket, Bakery Stores, Food Service & Hospitality, and Others), and By Region: Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecast 2019–2026

Industry Insights

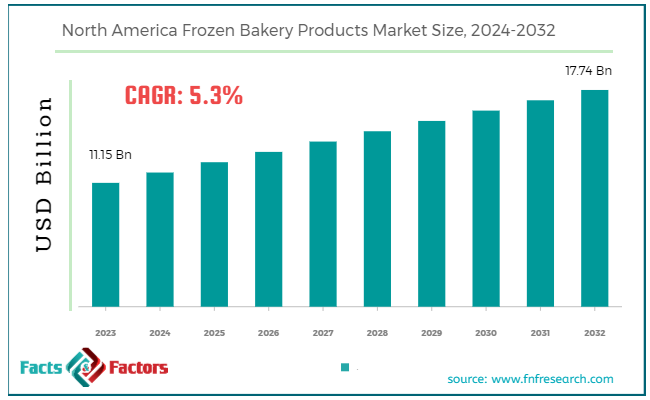

[110+ Pages Report] According to the report published by Facts Factors, the global north america frozen bakery products market size was worth around USD 9,070 million in 2019 and is predicted to grow to around USD 12,960 million by 2026 with a compound annual growth rate (CAGR) of roughly 5.2% between 2020 and 2026. The report analyzes the global north america frozen bakery products market drivers challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the north america frozen bakery products market.

This professional and specialized report study examines the technical and business perspective of the North America frozen bakery products industry. The report provides a historical analysis of the industry as well as the projected trends expected to be witnessed in the North America frozen bakery products market.

The report study analyzes the market statistics to gain an in-depth perspective of the North America frozen bakery products market. The historical insights are provided from 2016 to 2019 and projected trends are provided from 2020 to 2026. The quantitative data is provided in terms of value (USD Million) for 2016 – 2026. The qualitative data is reinforced by analyzing and providing numerous market dynamics (directly or indirectly affecting the industry) such as growth drivers, restraints, challenges, and opportunities.

Key Insights from Primary Research

Key Insights from Primary Research

- Based on the review conducted by an American university, the U.S. citizensprefer having meals while commuting due to the hectic lifestyles and busy schedules. That’s why they prefer having ready-to-eat convenience foods with prolonged shelf life, thereby propelling the demand for frozen bakery products.

- As per the primary respondents, even though the U.S. citizens are following hectic lifestyles, they are highly concerned about the nutritious quality of the consumables. Strategic developments in the frozen bakery products industry to produce nutritious food will expand the customer base and eventually bolster the regional market.

- The expansion of product portfolio with the addition of customized bakery products such as gluten-free items and bakery products with low fructose and salt content will attract a separate customer base and drive the North America frozen bakery products market.

- The “wheat” category under the source segment, as per the primary research data, holds the leading position in the regional frozen bakery products market as it is a key ingredient used in forming dough, the most common raw material in the bakery industry.

- The growing restaurant chains, particularly in the U.S., are also among the key factors pushing the demand for frozen bakery products in the market, as per the primary experts.

Key Recommendations from Analysts

Key Recommendations from Analysts

- According to the analysts, the North America frozen bakery products market generated more than USD 9,070 million in revenue in 2019 and is projected to grow at a CAGR of around 5.2% throughout the forecast period.

- Analysts have indicated that significant advancement in food processing, storage, packaging, and transportation technologies will eventually augment the demand for regional frozen bakery products.

- According to the analysts’ projection, the “bread” category under the product type is projected to capture the regional market at a faster pace as bread is the main food item in the regular meal and the demand for frozen bread in the region is propelling.

- Analysts have identified that the “supermarket/hypermarket” category under the market’s distribution channel segment captures almost one-third of the revenue share. The category is likely to bulge splendidly in the coming years owing to the growing trend for purchasing eatables at retailer stores.

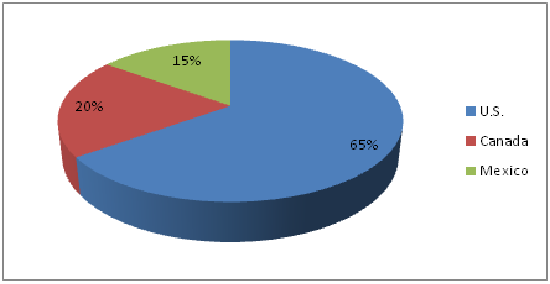

- U.S. is leading the North America frozen bakery products market owing to the rapid urbanization and the higher per capita income compared to other countries.

North America Frozen Bakery Products Market Attractiveness in 2018 – By Region

North America Frozen Bakery Products Market Attractiveness in 2018 – By Region

We have included various industry analysis models in our report and extensively demonstrated the key business strategies and competitive landscape of the North America frozen bakery products market in our study.

Our study also includes an analysis of Porter’s Five Forces framework for understanding the competitive strategies adopted by various stakeholders involved in the entire value chain of the North America frozen bakery products market. It also encompasses PESTLE analysis and SWOT analysis.

The report also offers an in-depth analysis of the market shares of each industry player and gives an outline of the market position of key players in the North America frozen bakery products market. Moreover, the study offers wide coverage of key strategic advances witnessed in the market such as new product launches, acquisitions & mergers, collaborations & joint ventures, funding & VC activities, agreements, partnerships, R&D activities, and regional expansion of key players of the North America frozen bakery products market.

The research study provides a critical assessment of the North American frozen bakery products industry by logically segmenting the market on the basis of source, product type, distribution channel, and region. Based on the past, present, and future trends, all the segments were analyzed from the bottom up, and the market sizes have been estimated from 2020 to 2026.

The rapidly altering lifestyles and the relatively higher disposable incomes in the country are the two key factors that have pushed the country to the dominating position in terms of revenue generation. Moreover, the U.S. frozen bakery products market is anticipated to grow at the fastest pace throughout the forecast period within the region.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 9,070 Million |

Projected Market Size in 2026 |

USD 12,960 Million |

CAGR Growth Rate |

5.2% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Europastry SA, Alpha Baking Co. Inc., Flower Foods Inc., ARYZTA, Grupo Bimbo S.A.B. de C.V, Associated British Foods PLC, Bridgford Foods Corporation, Lantmannen Unibake UK Ltd., Canada Bread Company Ltd., and General Mills Inc., and Others |

Key Segment |

By Source, Product, Distribution, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs.Explore purchase options |

The North American frozen bakery products market is segmented based on source, product type, distribution channel, and region. By source segmentation, the market is classified into wheat, rye, barley, corn, and others. Based on product type, the regional market is bifurcated into cakes and pastries, bread, donuts & pies, pizza, and others.

Distribution channel-wise, the market is categorized into Convenience Stores, supermarket/hypermarket, bakery stores, food service & hospitality, and others. In terms of region, the North America frozen bakery products market is segmented into U.S., Canada, and Mexico.

Some of the leading players in the global market include

Some of the leading players in the global market include

- Europastry SA,

- Alpha Baking Co. Inc.

- Flower Foods Inc.

- ARYZTA

- Grupo Bimbo S.A.B. de C.V

- Associated British Foods PLC

- Bridgford Foods Corporation

- Lantmannen Unibake UK Ltd.

- Canada Bread Company Ltd.

- General Mills Inc.

The taxonomy of the North America frozen bakery products industry by its scope and segmentation is as follows:

By Source Segmentation Analysis

By Source Segmentation Analysis

- Wheat

- Rye

- Barley

- Corn

- Others

By Product Type Segmentation Analysis

By Product Type Segmentation Analysis

- Cakes and Pastries

- Bread

- Donuts & Pies

- Pizza

- Others

By Distribution Channel Segmentation Analysis

By Distribution Channel Segmentation Analysis

- Convenience Stores

- Supermarket/Hypermarket

- Bakery Stores

- Food Service & Hospitality

- Others

By Regional Segmentation Analysis

By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Mexico

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

KEY BUSINESS POINTERS ADDRESSED & FOREMOST REASONS TO PROCURE THE REPORT:

- Statistical Analysis of the Past, Current, and Future Trends of the Industry with Validated Market Sizes Data

- Direct and Indirect Rationales Impacting the Industry

- In-depth and Micro Analysis of Viable Segments and Sub-segments

- Companies and Vendors Market Share, Competitive Landscape, and Player Positioning Analysis

- Demand Side (Consumption) and Supply Side (Production) Perspective and Analysis wherever applicable

- Key Buyers and End-Users Analysis

- Value Chain and Manufacturing Cost Structure Analysis wherever relevant

- Key Marketing Strategies as well as Key Sales Channels adopted in the market

- Investment Opportunity Analysis & Patents Analysis wherever feasible

- Technological Road Map & Technical Analysis

- Robust Research Methodology comprising dynamic mix (65%~35%) of Extensive Primary Research (primary interviews, ad-hoc surveys, questionnaires) and Protracted Secondary Research (proprietary in-house database, paid external databases, publically available validated sources)

Table of Content

Industry Major Market Players

- Europastry SA,

- Alpha Baking Co. Inc.

- Flower Foods Inc.

- ARYZTA

- Grupo Bimbo S.A.B. de C.V

- Associated British Foods PLC

- Bridgford Foods Corporation

- Lantmannen Unibake UK Ltd.

- Canada Bread Company Ltd.

- General Mills Inc.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors