Search Market Research Report

Industrial Hemp Market Size & Share, Global Industry Forecast 2022-2030

Industrial Hemp Market By Application Prospects (Paper, Personal Care, Automotive, Textiles, Food & Beverages, Animal Care, Furniture, Construction Materials, and Others), By Product Prospects (Fiber, Shivs, and Seeds) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022–2030

Industry Insights

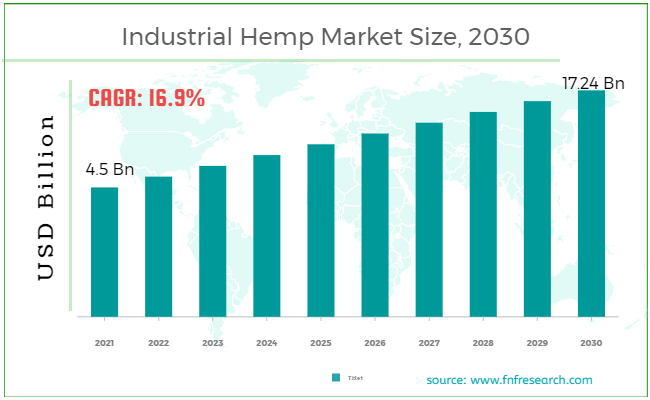

[232+ Pages Report] According to Facts and Factors, the global industrial hemp market was valued at roughly USD 4.5 billion in 2021 and is predicted to grow to about USD 17.24 billion by 2030, with a compound annual growth rate (CAGR) of approximately 16.9% over the projection period. The report analyzes the industrial hemp market’s drivers, restraints, opportunities, and challenges and the impact they have on consumption during the projection period.

Market Overview

Market Overview

Industrial hemp is a cultivar of the plant Cannabis sativa that is utilized for a range of industrial and personal purposes. Hemp fiber, hemp oil, and hemp seeds are some of its by-products. Because of their high nutritional content, antioxidant, and anti-microbial qualities, these biodegradable compounds are widely employed in a variety of industries, including personal care products, textiles, animal feed, and others. Industrial hemp, as a fast-growing plant, provides a sustainable and renewable raw material for the manufacture of a variety of products, including fuel, plastic, and paper.

Industrial hemp is a hardy, long-lasting natural fiber with low flexibility. Hemp fiber has the highest heat capacity to weight ratio of any natural fiber and provides excellent heat insulation. This cloth, like any other natural fabric, is extremely durable while also providing warmth and comfort. Furthermore, the fabric is very breathable and biodegradable, which boosts product demand. Hemp fabric is very hydrophobic, mold-resistant, insulating, and resistant to ultraviolet (UV) radiation. It delivers long-lasting products with consistent quality and softness when combined with fabrics such as linen, silk, and cotton.

Hemp seeds are mostly used in foods and dietary supplements like raw seeds, hemp milk, and hemp protein. Hemp is trypsin inhibitor-free, GMO-free, gluten-free, and contains very little residue of chemicals. Hemp protein is very nutritious, easily digestible, and contains a high concentration of amino acids, which are required by the human body to meet its protein requirements.

Hemp oil is frequently utilized in medicinal goods due to its pain-relieving and anti-inflammatory characteristics, as well as its ability for treating tumors, lower the risk of diabetes, and ease stiffness & discomfort, particularly chronic pain.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic had a tremendous influence on brick-and-mortar enterprises, compelling them to relocate to digital platforms, resulting in a significant supply and demand imbalance for hemp-based items. However, rising consumer awareness of hemp's therapeutic properties has bolstered market growth in recent times. Furthermore, expanded legalization legislation in key nations fueled the global industrial hemp market expansion throughout the epidemic.

Growth Drivers

Growth Drivers

- Functional characteristics of hemp seed & hemp oil and their expanding use in various applications are factors driving the market’s growth

Hemp's excellent nutritional value, as well as its healthy fatty acid and protein composition, is boosting demand for hemp supplements. Hemp fiber's high absorbency makes it useful for animal bedding, personal hygiene, and oil & gas clean-up uses. Furthermore, rising product demand from the paper, textile, and building materials markets due to good aesthetic and acoustic features will drive the industrial hemp market expansion. Hemp-based products are environmentally friendly, renewable, and connected with less toxic ways of production. Paper made from hemp fiber requires fewer chemicals to be processed than paper made from wood pulp. As a result, increased consumer knowledge of product benefits is expected to boost global industrial hemp market growth.

Restraints

Restraints

- A complex regulatory framework may hinder the market’s growth

Businesses that offer hemp and hemp-derived goods must follow various regulatory rules around the world. While countries around the world have varying degrees of legality for different forms of hemp, the tight regulatory requirements governing the cultivation and sale of industrial hemp across many states within the same country may be difficult for producers and consumers to comply with. Furthermore, the legislation governing hemp possessing tetrahydrocannabinol (THC) and cannabidiol (CBD) varies greatly, adding to the complexity associated with the commodity's trading.

Opportunities

Opportunities

- Industrial hemp is being used to develop new products that have the potential to provide considerable growth opportunities

As hemp farming becomes more legal, corporations and research institutions are being compelled to create innovative products with industrial hemp. One such application is biofuel, which is predicted to have huge potential to grow in the coming years. With rising oil prices (diesel and gasoline), as well as increased concerns about global warming, biofuels are gaining appeal. Hemp seed extracts are being used to make hemp biodiesel, which may be used in any diesel vehicle. Additionally, hemp can be used to produce ethanol, which is currently being produced from food crops such as wheat and corn. This would result in greater food production efficiency.

Challenges

Challenges

- Lack of processing facilities, as well as planting and harvesting equipment, is a significant challenge

Following the legalization of industrial hemp, for example, in the United States, the country's industrial hemp business has grown fast, as it is one of the largest users of hemp-derived products. However, there has been a dearth of suitable harvesting and planting equipment. Due to the fragility of air seeders used for crop planting, they must be used with low air volume in the case of hemp speed.

Furthermore, industry analysts have claimed that the US lacks commercial-scale processing facilities, which is one of the greatest impediments to the expansion of the country's industrial hemp market.

Segmentation Analysis

Segmentation Analysis

The global industrial hemp market is segregated on the basis of application prospects, product prospects, and region.

By application prospects, the market is divided into paper, personal care, automotive, textiles, food & beverages, animal care, furniture, construction materials, and others. Personal care products have the highest market share and are predicted to increase at a rapid CAGR over the forecast period.

By product prospects, the market is divided into fiber, shivs, and seeds. The fiber segment is expected to increase at the fastest CAGR during the forecast period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 4.5 Billion |

Projected Market Size in 2030 |

USD 17.24 Billion |

CAGR Growth Rate |

16.9% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

HempMedsBrasil, Hemp, Inc., Valley Bio Ltd., HempFlax B.V., American Cannabis Company, Plains Industrial Hemp Processing Ltd., Boring Hemp Company, Ecofiber Industries Operations, Marijuana Company of America, Inc., Terra Tech Corp., CBD Biotechnology Co., American Hemp, Botanical Genetics, LLC, Industrial Hemp Manufacturing, LLC, and Parkland Industrial Hemp Growers Cooperative Ltd. |

Key Segment |

By Application Prospects, By Product Prospects, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia Pacific region is expected to be fastest-growing market during the forecast period

Asia Pacific region leads the industrial hemp industry, contributing to more than 33% of global sales. India, China, Japan, Australia, Korea, Thailand, and New Zealand are all heavily involved in the use and production of industrial hemp and its byproducts, including seeds, fiber, oil, and hurds. Growing global sales, as well as technological and innovation improvements, are allowing harvesting simpler for planters and thus changing the face of hemp production in the region. The regional industrial hemp market is prone to be affected by the growing demand for hemp-based food and supplements in developing nations with an aging population over the forecast period.

North America is one of the largest consumers in the global industrial hemp market due to the existence of multiple application areas. Furthermore, rising consumer spending power, a rising elderly group, and heightened concerns about skin disorders & UV protection are projected to fuel demand for hemp oil in the personal care industry in the region. In Europe, the product is mostly employed in the form of fibers in construction materials, automotive parts, fabrics, and textiles. The hemp seed market, on the other hand, is expected to be driven by the growing market for hemp oil in the personal care, food & supplements, and cosmetics markets throughout the projected period.

Recent Developments

Recent Developments

- October 2020: Diamonds is a new CBD product from Hemp Inc. that is produced from golden-hued high CBD and gives the same results as 92 percent and 98.7 percent pure CBD.

- May 2019: Atalo Holdings (US) and GenCanna have formed a strategic alliance to construct a fully integrated hemp production and handling facility in Kentucky, US.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the global industrial hemp market are :

- HempMedsBrasil

- Hemp Inc.

- Valley Bio Ltd.

- HempFlax B.V.

- Marijuana Company of America Inc.

- American Cannabis Company

- Plains Industrial Hemp Processing Ltd.

- Boring Hemp Company

- Ecofiber Industries Operations

- Terra Tech Corp.

- CBD Biotechnology Co.

- American Hemp

- Botanical Genetics LLC

- Industrial Hemp Manufacturing

- Parkland Industrial Hemp Growers Cooperative Ltd.

The global industrial hemp market is segmented as follows:

By Application Prospects

By Application Prospects

- Paper

- Personal Care

- Automotive

- Textiles

- Food & Beverages

- Animal Care

- Furniture

- Construction Materials

- Others

By Product Prospects

By Product Prospects

- Fiber

- Shivs

- Seeds

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Southeast Asia

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- HempMedsBrasil

- Hemp Inc.

- Valley Bio Ltd.

- HempFlax B.V.

- Marijuana Company of America Inc.

- American Cannabis Company

- Plains Industrial Hemp Processing Ltd.

- Boring Hemp Company

- Ecofiber Industries Operations

- Terra Tech Corp.

- CBD Biotechnology Co.

- American Hemp

- Botanical Genetics LLC

- Industrial Hemp Manufacturing

- Parkland Industrial Hemp Growers Cooperative Ltd.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors