Search Market Research Report

Blood Plasma Fractionation Market Size, Share Global Analysis Report, 2022 – 2028

Blood Plasma Fractionation Market Size, Share, Growth Analysis Report By Product (Albumin, Immunoglobulin, Coagulation Factors, Protease Inhibitors, Others), By Application (Immunology & Neurology, Hematology, Critical Care, Pulmonology, & Others), By End-User (Hospitals & Clinics, Research Laboratories, & Academic Institutes), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

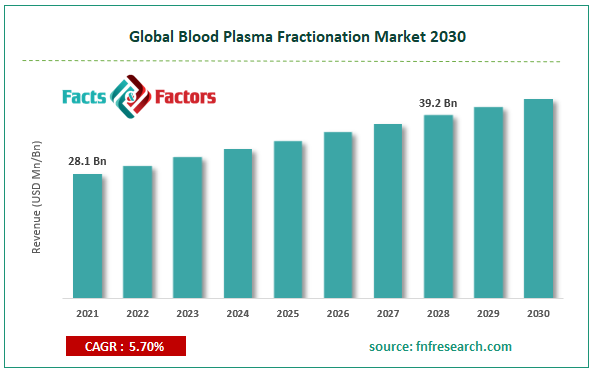

[218+ Pages Report] According to Facts and Factors, the Global Blood Plasma Fractionation Market size was worth USD 28.1 billion in 2021 and is estimated to grow to USD 39.2 billion by 2028, with a compound annual growth rate (CAGR) of approximately 5.70% over the forecast period. The report analyzes the Blood Plasma Fractionation market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Blood Plasma Fractionation market.

Market Overview

Market Overview

Plasma is a blood component that is created from whole blood through a process called plasmapheresis. It has many therapeutic and medical uses. A source of many different proteins in human plasma. But only a small subset of these proteins can be used to make therapeutic plasma products. The fractionation procedure is the method used to separate, extract, and purify these proteins from plasma. With variables like the increase in respiratory illnesses worldwide, an aging population with blood-related illnesses, and rising immunoglobulin consumption, the market for global Blood Plasma Fractionation is expanding.

The global Blood Plasma Fractionation market has also boomed as a result of increased investment in R&D. A significant driver of the market's expansion is the rise in rare disorders that call for plasma therapy or plasma derivatives. The market for Blood Plasma Fractionation is being held back by the government's strict controls on plasma therapy. An obstacle to the market's expansion is the lack of plasma proteins.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 outbreak has compelled researchers to test plasma treatment on those who have been afflicted. As there was no particular medication or vaccine for the sickness during the early stages of the pandemic, the patients were given blood plasma to help them recover. The use of plasma therapy to treat COVID-19 has not yet received FDA approval in the United States. Nevertheless, the plasma fractionation business will have profitable growth prospects as a result of the encouraging outcomes of plasma therapy in the treatment and management of the disease.

Key Insights

Key Insights

- Blood Plasma Fractionation Market share value at a CAGR of 5.70% over the forecast period.

- With variables like the increase in respiratory illnesses worldwide, an ageing population with blood-related illnesses, and rising immunoglobulin consumption, the market for global Blood Plasma Fractionation is expanding.

- By application, the immunology and neurology segment will dominate the market in 2021.

- By product, the immunoglobulin segment will dominate the market in 2021.

- North America will dominate the Global Blood Plasma Fractionation Market in 2021.

Growth Drivers

Growth Drivers

- Increasing adoption of immunoglobulin is likely to pave the way for global market growth

Immunoglobulin is becoming more widely used for the treatment, diagnosis, and management of metabolic illnesses globally, which is one of the most important and significant aspects influencing the market's expansion. To understand the effectiveness and treatment nature of immunoglobulin to treat complicated diseases like Alzheimer's and other autoimmune disorders, there has been ongoing study and development. Immunoglobulin is widely used, which will increase its dominance and boost market prospects.

Restraints

Restraints

- Stringent regulatory policies may hamper the global market growth

Blood Plasma Fractionation products are strictly regulated by regulatory agencies because they are made from whole blood. The market's expansion may be constrained by strict restrictions regarding the manufacturing facility, the source of the whole blood, and the isolation procedure, among other things. Such strict regulations could affect how quickly a product is developed and manufactured. The development of vaccinations to stop the COVID-19's spread may also have an impact on these products' sales in the years to come.

Opportunities

Opportunities

- The establishment of GLP-compliant facilities to bring up several growth opportunities

Key market participants' increased focus on constructing advanced blood Plasma Fractionation plants is probably going to fuel the industry's expansion. These facilities are crucial for conducting the process in a clean, microorganism-free environment. In addition, such facilities will be vital in preserving the supply-demand cycle for plasma derivatives globally in light of the 2019–2020 global pandemic. As a result, the market's expansion has increased.

Segmentation Analysis

Segmentation Analysis

The global Blood Plasma Fractionation market is segregated on the basis of product, application, end-user, and region.

By product, the market is divided into Albumin, Immunoglobulin, Coagulation Factors, Protease Inhibitors, and Others. Among these, the immunoglobulin segment will dominate the market in 2021. The greatest portion of the market was attributable to the increased usage of immunoglobulins for a variety of causes, such as primary or chronic immune deficiency, rising demand for them to improve disease treatment, and their advantages in boosting diagnosis rates.

By end-user, the market is classified into Hospitals & Clinics, Research Laboratories, & Academic Institutes. The hospitals & clinics segment will dominate the market in 2021. In type 2 diabetes, a considerable amount of insulin is not utilized properly. Some of the key factors influencing the growth of this market include the increasing need for medicines for immunodeficiency disorders, the rising number of hospitals and healthcare expenditures, and hospitals and clinics' disproportionately high use of plasma-derived products.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 28.1 Billion |

Projected Market Size in 2028 |

USD 39.2 Billion |

CAGR Growth Rate |

5.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

CSL (Australia), Grifols, S.A. (Spain), Shire (U.S.), Octapharma AG (Switzerland), (China), KabaFusion, Kedrion S.P.A (Italy), Japan Blood Products Organization (Japan), Emergent BioSolutions (U.S.), LFB (France), Biotest AG (Germany), Sanquin (Netherlands), and Others |

Key Segment |

By Product, Application, End-user, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In January 2022, an international investment business called Permira declared that it would buy Kedrion and combine it with BPL.

- In August 2021, for greater patient convenience, CSL (Australia) received FDA approval for the novel BERINERT [C1 Esterase inhibitor, Human (Intravenous)] Administration Kit.

Regional Landscape

Regional Landscape

- Rising preventative therapy use is likely to help North America dominate the global market

North America dominates the Global Blood Plasma Fractionation Market in 2021attributed to the rising preventative therapy use among diagnosed patients as well as the rising use of immunoglobulins in neurological and autoimmune illnesses. The large number of patients with haemophilia who have registered further fuels the expansion of this sector. The market for Blood Plasma Fractionation in North America will be driven by the increasing adoption of coagulation factors due to the rising number of hemophilic patients.

Over the forecast period, Asia Pacific regional market is expected to be the fastest-growing region in the Blood Plasma Fractionation market in 2021. The main driver of the market's expansion is the existence of governmental authorities that control and oversee plasma collection, fractionation, and sales. Due to the rising demand for plasma fractionation and growing concern for human health, China is the market leader in the world for Blood Plasma Fractionation. Increased cases of diseases like haemophilia, primary & secondary immunological deficiencies, and severe fever with thrombocytopenia syndrome (SFTS), among others, all contribute to the market's expansion.

Competitive Landscape

Competitive Landscape

Key players within the global blood plasma fractionation market include

- CSL (Australia)

- Grifols

- S.A. (Spain)

- Shire (U.S.)

- Octapharma AG (Switzerland)

- (China)

- KabaFusion

- Kedrion S.P.A (Italy)

- Japan Blood Products Organization (Japan)

- Emergent BioSolutions (U.S.)

- LFB (France)

- Biotest AG (Germany)

- Sanquin (Netherlands)

- Intas Pharmaceuticals Ltd. (India)

- Bharat Serum Vaccines Limited (India)

- China Biologic Products Holdings Inc. (China)

- G.C. Pharma (Korea)

- Bio Products Ltd. (U.K.)

- Shanghai Raas Blood Products Co. Ltd. (China)

- S.K. Plasma (Korea)

- Sichuan YuandaShuyang Pharmaceutical Co. Ltd. (U.S.)

- Centurion Pharma (Istanbul)

- ADMA Biologics Inc. (U.S.)

- Fusion Healthcare (India)

- Hemarus Therapeutics Limited (India)

- PlasmaGenBioSciences Pvt. Ltd. (India)

- Virchow Biotech Private Limited (India)

The Global Blood Plasma Fractionation Market is segmented as follows:

By Product

By Product

- Albumin

- Immunoglobulin

- Coagulation Factors

- Protease Inhibitors

- Others

By Application

By Application

- Immunology & Neurology

- Hematology

- Critical Care

- Pulmonology

- Others

By End-user

By End-user

- Hospitals & Clinics

- Research Laboratories

- Academic Institutes

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- CSL (Australia)

- Grifols

- S.A. (Spain)

- Shire (U.S.)

- Octapharma AG (Switzerland)

- (China)

- KabaFusion

- Kedrion S.P.A (Italy)

- Japan Blood Products Organization (Japan)

- Emergent BioSolutions (U.S.)

- LFB (France)

- Biotest AG (Germany)

- Sanquin (Netherlands)

- Intas Pharmaceuticals Ltd. (India)

- Bharat Serum Vaccines Limited (India)

- China Biologic Products Holdings Inc. (China)

- G.C. Pharma (Korea)

- Bio Products Ltd. (U.K.)

- Shanghai Raas Blood Products Co. Ltd. (China)

- S.K. Plasma (Korea)

- Sichuan YuandaShuyang Pharmaceutical Co. Ltd. (U.S.)

- Centurion Pharma (Istanbul)

- ADMA Biologics Inc. (U.S.)

- Fusion Healthcare (India)

- Hemarus Therapeutics Limited (India)

- PlasmaGenBioSciences Pvt. Ltd. (India)

- Virchow Biotech Private Limited (India)

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors