Search Market Research Report

Wax Market Size, Share Global Analysis Report, 2022 – 2028

Wax Market Size, Share, Growth Analysis Report By Product Type Outlook (Mineral Wax, Synthetic Wax, Natural Wax), By Application Outlook (Candles, Packaging, Plastics & Rubber, Pharmaceuticals, Cosmetics & Toiletries, Fire Logs, Adhesives, Others), and By Region - Global Industry Insights, Comparative Analysis, Trends, Statistical Research, Market Intelligence, and Forecast 2022 – 2028

Industry Insights

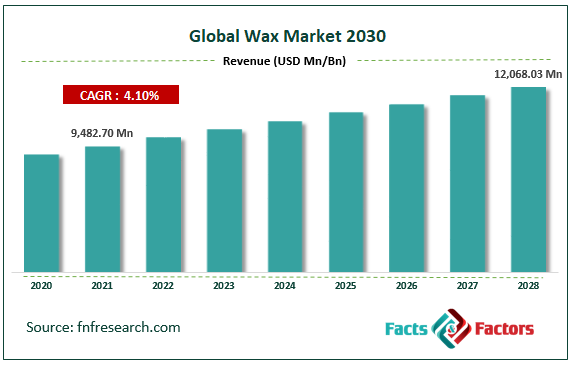

[203+ Pages Report] According to Facts and Factors, the global wax market size was valued at USD 9,482.70 million in 2021 and is predicted to increase at a CAGR of 4.10 % to USD 12,068.03 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

Market Overview

Market Overview

At room temperature, wax is a type of organic substance that is flexible and hydrophobic. Lipids and higher alkanes that are water insoluble but soluble in non-polar organic solvents are included. The increase in demand for wax from the candle and packaging sectors is a major driver driving market expansion. The expansion of the wax market is fueled by the demand for home decor items such as colored and scented candles. Candles have evolved from a commodity that provides light to a luxury item. Candles are now commonly utilized as ornamental items and make excellent gifts. The use and demand for bio-based waxes is another industrial trend. Consumers are concerned about the potential negative health impacts of chemical items, which is driving this demand. As a result, there is a change in the wax market toward organic or green goods.

People in developed countries have altered their preferences from synthetic to green or bio-based items as their health and wellbeing concerns have grown. As a result of these developments, a number of cosmetics and personal care product producers have begun to develop bio-based products. As a result, bio-based waxes like carnauba wax, beeswax, and candelilla wax, among others, are replacing synthetic and paraffin wax in the production of cosmetic and personal care products. Customers are captivated by advances in candle products such as product shape, style, color, and scent. Changing consumer behavior, as well as the growing popularity of candles-based craft materials, as well as related décor and interior design, has transformed the conventional candle industry into a sophisticated, forward-thinking industry.

Impact of COVID - 19

Impact of COVID - 19

Due to the prolonged lockdown in major countries, the outbreak of COVID-19 resulted in the partial or complete shutdown of non-essential goods production facilities. This resulted in the closure or suspension of production activities in most industrial units around the world. The COVID-19 epidemic halted output in a variety of industries, including packaging, cosmetics, chemicals, and candle manufacturing. The delivery of raw materials to these businesses was disrupted due to supply chain disruptions. As a result, demand for wax from businesses that rely on wax for production has decreased. Furthermore, the global demand for waxes was lowered as demand for cosmetics, candles, and consumer products declined.

The complete research study looks at both the qualitative and quantitative aspects of the Wax market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global Wax market is segregated based on Product, Application, and Region.

Based on product, Mineral wax dominated the market and accounted for the majority of the revenue. This is due to the increasing use of goods in cosmetic formulations and the increased demand for cosmetics in developing and emerging nations. Mineral waxes are completely free of esters and alcohol, unlike beeswax and plant-based waxes. Fractional distillation is used to extract these products from coal, petroleum, lignite, and shale oil. Microcrystalline, paraffin, petrolatum, and ceresin are a few of the most well-known mineral waxes. Paraffin wax is one of the most regularly extracted waxes as a by-product from the oil industry, ensuring consistent supply and ease of production.

Based on Application, the candles application segment dominated the market. This can be attributed to the increased popularity of aromatherapy via scented candles. Candles have evolved into a necessary household item. Birthday, taper, utilitarian, teal light container, and novelty candles are all available in a number of sizes, shapes, and product lines. These are used for a variety of things, including aromatherapy for relaxation and stress relief, as well as home decor. The market is distinguished by the wide range of candles available and the convenience with which they can be purchased through a variety of distribution methods. Candle demand has been boosted by an expanding number of distribution outlets, such as décor and mass retail stores, as well as e-commerce platforms.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 9,482.70 Million |

Projected Market Size in 2028 |

USD 12,068.03 Million |

CAGR Growth Rate |

4.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Sinopec Corp, China National Petroleum Corporation, HollyFrontier Corporation, BP P.L.C, Nippon Seiro Co., Ltd., Baker Hughes Company, Exxon Mobil Corporation, Sasol Limited, The International Group, Inc., Evonik Industries AG, BASF SE, Dow, and Others |

Key Segment |

By Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

In 2021, Asia Pacific dominated the wax market, accounting for the most revenue share. Rising living standards and increased industrialization, particularly in China and India, are credited with the expansion. Low labor, raw material, and operating costs are also expected to drive market expansion. The increased use of cosmetic items such as creams, lotions, sunscreens, and makeup among Japan's, India's, Indonesia's, Korea's, and China's young is likely to drive market expansion. From 2021 through 2029, emerging economies such as Indonesia and Malaysia, as well as other Southeast Asian countries, are expected to rise steadily. Because of the region's rapidly increasing packaging industry, demand for printing ink is expected to surge.

List of Key Players in the Global Wax Market:

List of Key Players in the Global Wax Market:

- Sinopec Corp

- China National Petroleum Corporation

- HollyFrontier Corporation;

- BP P.L.C

- Nippon Seiro Co., Ltd.

- Baker Hughes Company

- Exxon Mobil Corporation

- Sasol Limited

- The International Group, Inc.

- Evonik Industries AG

- BASF SE

- Dow

- Honeywell International Inc.

- Royal Dutch Shell P.L.C

- Mitsui Chemicals, Inc.

The Global Wax Market is segmented as follows:

By Product Type Outlook

By Product Type Outlook

- Mineral wax

- Synthetic Wax

- Natural Wax

By Application Outlook

By Application Outlook

- Candles

- Packaging

- Plastics & Rubber

- Pharmaceuticals

- Cosmetics & Toiletries

- Fire Logs

- Adhesives

- Others

By Regional Outlook

By Regional Outlook

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Sinopec Corp

- China National Petroleum Corporation

- HollyFrontier Corporation;

- BP P.L.C

- Nippon Seiro Co. Ltd.

- Baker Hughes Company

- Exxon Mobil Corporation

- Sasol Limited

- The International Group Inc.

- Evonik Industries AG

- BASF SE

- Dow

- Honeywell International Inc.

- Royal Dutch Shell P.L.C

- Mitsui Chemicals Inc.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors