Search Market Research Report

Telehealth for Women's Reproductive and Sexual Health Market Size, Share Global Analysis Report, 2022 – 2028

Telehealth for Women's Reproductive and Sexual Health Market Size, Share, Growth Analysis Report By Age Group (Adolescent, Adult, and Geriatric), By Offering (Consulting Services, Diagnostic/Testing Services, and Drug Delivery), By Application (Birth Control, STD Prevention, Menopause, PMS, Postpartum Depression, Pelvic Pain, Urinary Tract Infection (UTI), Incontinence, Endometriosis, Vulvodynia, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

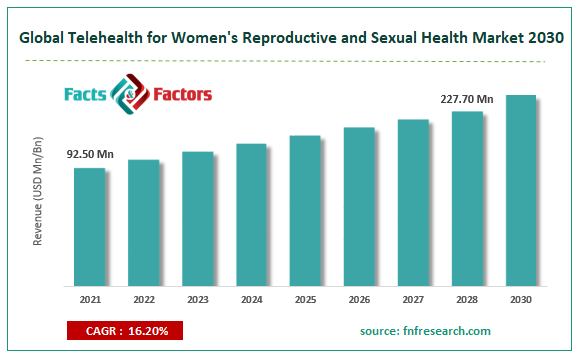

[221+ Pages Report] According to Facts and Factors, the global telehealth for women's reproductive and sexual health market size was worth USD 92.50 million in 2021 and is estimated to grow to USD 227.71 million by 2028, with a compound annual growth rate (CAGR) of approximately 16.20% over the forecast period. The report analyzes the Telehealth for women reproductive and sexual health market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in Telehealth for the women's reproductive and sexual health market.

Market Overview

Market Overview

Telemedicine is defined by the World Health Organization (WHO) as the delivery of medical services by medical professionals while leveraging technology to share data for disease diagnosis, treatment, and prevention. The use of telemedicine in reproductive health care has shown potential in providing creative solutions to unmet health needs, particularly in regions with few health care professionals, even though it has not yet been widely implemented throughout the United States. Leading medical organizations support telemedicine to improve access for rural women and strengthen reproductive health services. Basic communication methods such as phone calls, texts, emails, faxes, and online patient health portals can be a part of telemedicine. These technologies let patients schedule appointments, read appointment summaries, examine lab results, and engage with their doctors.

Due to unequal access to technology, many settings find it challenging or impossible to integrate innovative digital health care delivery options. Telehealth is a more affordable option than traditional treatment. Virtual healthcare services are becoming more popular as smartphone use and dependence rise. Due to its many benefits, telemedicine has long been hailed as a way to improve access to healthcare, particularly in rural areas with a shortage of clinicians. Adoption of smartphones, acceptance of preventative healthcare, supportive legislation, and increased funding are all factors promoting market expansion and awareness to address the lowered availability of clinic-based services during the pandemic while keeping an eye on the obstacles to digital health solutions.

COVID-19 Impact:

COVID-19 Impact:

More women are now in danger financially due to the coronavirus pandemic. In particular, women of color are more likely than men to have lost their jobs due to the coronavirus pandemic. They might have lost their employment-based health insurance as a result. Receiving contraception and other SRH services is becoming more difficult due to social exclusion on both a physical and psychological level. Women were postponing parenthood or having fewer kids. Women's access to SRH services and their financial ability to access them has been restricted during the pandemic. Affects women of color more than white women once more.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, Telehealth for women's reproductive and sexual health market value is to grow at a CAGR of16.20% over the forecast period.

- In terms of revenue, the telehealth for women's reproductive and sexual health market size was valued at around USD 92.50million in 2021 and is projected to reach USD 227.71million by 2028.

- Affordability, availability of smartphones, and lack of accessible health services across the globe are the major factors driving the market's growth.

- By Age Group, the Adult category dominated the market in 2021.

- By Offering, the consulting services category dominated the market in 2021.

- North America dominated the Telehealth for women's reproductive and sexual health market in 2021.

Growth Drivers

Growth Drivers

- Increased prevalence among women to drive the market growth

Anemia, osteoporosis, breast cancer, and menopause are some of the most prevalent illnesses that women worldwide are being diagnosed with regularly. These conditions are widespread and could be life-threatening for the sufferer. Due to the rising prevalence of these disorders, it is necessary to give these patients efficient procurements. There is an increasing need for drugs to address these diseases.

Restraints

Restraints

- Some feminine healthcare products have unfavorable side effects, which are expected to hamper market growth.

Even though women are more likely than men to have life-threatening illnesses, several obstacles prevent the growth of the women's healthcare industry. Some medications' detrimental effects on women's health are one such factor. For instance, taking contraceptive pills may result in spotting or bleeding between periods, sore breasts, nausea, headaches, and other unfavorable side effects. These side effects may cause individuals great suffering in addition to pain.

Opportunities

Opportunities

- An increase in investment projects by significant market players to enhance opportunities in the market

One of the most visible trends in the market for women's health devices is the deployment of many investment initiatives. It is projected to significantly impact the market's growth over the forecast period. There are many benefits to the rapid speed of investment projects. One advantage of these activities is the expanded availability of more straightforward and affordable solutions, promoting broader adoption of these medical devices.

Segmentation Analysis

Segmentation Analysis

The Telehealth for women reproductive and Sexual Health market is segregated based on age group and offers,

By age group, the market is divided into adolescents, adults, and geriatrics. Adults dominate in this particular segment. They are most well-versed with the services and utilize them to the fullest. More telehealth providers are focusing on the business area of women's reproductive and sexual health, with working women as their primary target market.

By offering, the market is divided into consulting services, diagnostic/testing services, and drug delivery. In this segment, in 2021, consulting services held a dominant share, but drug delivery is also gaining traction. In comparison to reproductive health services generally, only a tiny percentage of SRH services including contraception, medication abortion, STI care, maternal health, and sexual assault services were provided via Telehealth before the pandemic, which may have been due in part to a lack of access to these services since this data predates the COVID-19 pandemic.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 92.50 Million |

Projected Market Size in 2028 |

USD 227.71 Million |

CAGR Growth Rate |

16.20% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

American Well, HeyDoctor, LLC, Maven Clinic Co, ICEBREAKER HEALTH INC. (Lemonaid), NURX Inc., Pandia Health, Inc., PILL CLUB, and Others |

Key Segment |

By Age Group, Offering, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- Ovia Health, the only digital family health platform with clinical support, and Nurx have partnered. Due to this collaboration between the two businesses, a new birth control tracking tool will be added to the Ovia Fertility mobile app. To help women stay on top of their preferred method of birth control, the new capability enables users to track the combination pill, the minipill, the extended cycle pill, and the intrauterine device.

- Nurx partnered with American multinational technology company Amazon. To encourage medication adherence and prevent unintended pregnancies, the two businesses would jointly launch the Nurx Birth Control and Sexual Health Knowledge Skill for Alexa after their partnership.

Regional Landscape

Regional Landscape

- North America led the market due to the technology boom.

In 2021, North America accounted for the most significant revenue share globally, which dominated the global market for women's digital health. This results from enhanced access to the most cutting-edge technology, widespread availability of modern technological infrastructure, expanded access to diagnostic and therapeutic options, and higher disposable incomes. Additionally, as technology improves in countries like the US, Canada, and Mexico, more people are adopting the newest technologies to address fundamental and widespread healthcare problems centered explicitly on women.

Over the forecast period, Asia Pacific regional market is expected to grow significantly. Lack of payment policies and the tendency for service providers to receive lower compensation levels than those for in-person service providers are the main obstacles to Telehealth in developing nations.

Competitive Landscape

Competitive Landscape

Key players within the Global Telehealth for Women's Reproductive and Sexual Health market include

- American Well

- HeyDoctor LLC

- Maven Clinic Co

- ICEBREAKER HEALTH INC. (Lemonaid)

- NURX Inc.

- Pandia Health Inc.

- PILL CLUB

Global Telehealth for women's reproductive and Sexual Health market is segmented as follows:

By Age Group

By Age Group

- Adolescent

- Adult

- Geriatric

By Offering

By Offering

- Consulting Services

- Diagnostic/Testing Services

- Drug Delivery

By Application

By Application

- Birth Control

- STD Prevention

- Menopause

- PMS

- Postpartum Depression

- Pelvic Pain

- Urinary Tract Infection (UTI)

- Incontinence

- Endometriosis

- Vulvodynia

- Others

By Region

By Region

-

North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- American Well

- HeyDoctor LLC

- Maven Clinic Co

- ICEBREAKER HEALTH INC. (Lemonaid)

- NURX Inc.

- Pandia Health Inc.

- PILL CLUB

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors