Search Market Research Report

Wearable Injectors Market Size, Share Global Analysis Report, 2022 – 2028

Wearable Injectors Market Size, Share, Growth Analysis Report By Type (On-Body Injector, Off-Body Injector), By Technology (Spring Based, Motor Based, Rotary Pump, Expanding Battery, Other Technology), By Therapy (Immuno-Oncology, Diabetes, Cardiovascular Disease, Other Disease), By End User (Hospitals and Clinics, Home Healthcare Setting), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

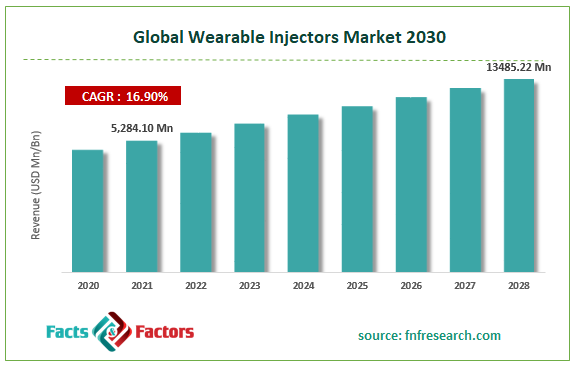

[223+ Pages Report] According to the report published by Facts & Factors, the global wearable injectors market size was worth around USD 5,284.10 million in 2021 and is estimated to grow to about USD 13,485.22 million by 2028, with a compound annual growth rate (CAGR) of approximately 16.90% over the forecast period. The report analyzes the wearable injectors market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the wearable injectors market.

Market Overview

Market Overview

Condensed drug delivery devices developed for longer-term, one-step medication administration are wearable injectors, sometimes known as patch pumps. They are medical devices that attach to the body and automatically release the patient's prescribed doses at the right moment. Wearable injectors, single-use devices readily worn on the body, are used to administer the medication subcutaneously over a pre-programmed period of seconds or hours. They inject large amounts of sticky medications more quickly and safely through the body's subcutaneous tissues. After injecting the entire amount, they are taken out of the body and disposed of correctly. The idea of "patient centricity" and a stronger emphasis on human factors in drug delivery design have made these devices conceivable. An increase in the prevalence of chronic diseases like diabetes, cardiovascular disease, cancer, and others; a rise in the use of biologics like monoclonal antibodies for treating diseases; and an increase in research and development (R&D) activities for wearable injector devices like Bluetooth connectivity with smartphones and digital displays are the main factors propelling the global wearable injectors market growth.

COVID-19 Impact:

COVID-19 Impact:

Patients, especially those with chronic conditions, are being recommended to self-administrate medication at home due to the possibility of exposure to COVID-19. Healthcare providers also preserve resources for acute care or COVID-19-infected patients free of charge. The need for wearable injectors and other remote care equipment has increased. Due to this, the market for wearable injectors is anticipated to expand gradually and optimistically during this period, despite the COVID-19 epidemic.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global wearable injectors market value will grow at a CAGR of 16.90% over the forecast period.

- In terms of revenue, the global wearable injectors market size was valued at around USD 5284.10 million in 2021 and is projected to reach USD 13,485.22 million by 2028.

- An increase in the prevalence of chronic diseases like diabetes, cardiovascular disease, cancer, and others; a rise in the use of biologics like monoclonal antibodies for treating diseases; and an increase in research and development (R&D) activities for wearable injector devices like Bluetooth connectivity with smartphones and digital displays are the main factors propelling the market growth.

- By type, the on-body injector category dominated the market in 2021.

- By technology, the spring-driven category dominated the market in 2021.

- North America dominated the wearable injectors market in 2021.

Growth Drivers

Growth Drivers

- A growing number of biologics in the drug development pipeline drives the market growth

Biologics are typically administered through an intravenous infusion at medical facilities. Over the past ten years, self-administration in the home has become more and more common. With Libertas, a BD product, various biologic drugs are now administered in research, providing the company a footing in the CRO industry. Patients will switch to less expensive options, creating a demand for wearable injectors. Additionally, wearable injectors provide benefits including simple administration, diminished discomfort, and reduced hassle from syringes, which propels the global wearable injectors market expansion.

Restraints

Restraints

- Patient non-compliance with prescribed pharmaceutical therapy may hinder the market growth

The high cost of wearable injectors is expected to hinder the market growth. Due to the high cost, the consumers in developing and underdeveloped countries’ sales of wearable injectors are less as compared to developed countries which impacts the global wearable injectors market during the forecast period.

Opportunity

Opportunity

- An increase in public-private financing for targeted research presents market opportunities

For the market players, the projection period will see an increase in public-private financing for targeted research initiatives, rising demand for minimally invasive operations, rising youth sports engagement, and rising product novelty and development due to global technological breakthroughs. The market's growth rate will also be accelerated by expanding internet penetration, rising arthroscopic surgery use, rising aged and obese populations worldwide, and rising per capita health care spending.

Segmentation Analysis

Segmentation Analysis

The wearable injector market is segmented into type, technology, therapy, end user, and region.

Based on type, the market is divided into on-body and off-body. The on-body segment dominated the market in 2021 due to a rise in demand due to how pleasant these patches are to wear (stomach). They are also practical for usage at home and are water resistant. The advantage of injectors is that they can be worn on the body. The off-body wearable injector market is anticipated to grow fastest since these devices remove hazards such as painful device removal, skin-adhesive fitting problems, and skin sensitivity or irritation. Future market expansion in this sector is anticipated to be fueled by increasing investments in improving off-body injectors.

Based on technology, the market is categorized as motor driven, spring driven, expanding battery, rotary pump and other technology. The spring-driven segment dominated the market in 2021 since it is user-friendly and allows patients to accurately administer the medication subcutaneously by pressing one or more buttons on the device. According to research, the wearable spring-based Subcuject injector accurately administers a 3 mL, 1 cP viscous dosage in 4 minutes. Given that these products are more user-friendly than alternatives, the rotary pump wearable injectors market is anticipated to expand faster over the forecast period.

Based on therapy, the market is divided into diabetes, immuno-oncology, cardiovascular disease, and other diseases. The diabetes segment dominated the market in 2021. This market sector is expanding due to the increased prevalence of diabetes worldwide and the expanding availability of wearable injectors for treating these diseases.

Based on end-user, the market is divided into hospitals & clinics and home care settings. The home care settings segment dominated the market in 2021. The market is expanding due to increased demand for home healthcare services, the need for sophisticated medication delivery systems that require little technical knowledge, and a decline in the number of hospitals stays for patients. The home care market is also anticipated to be driven by the low cost of wearable injectors and the growing desire to reduce healthcare costs.

Recent Developments

Recent Developments

- April 2021: The first and only infusion set, the Medtronic Extended infusion set, which may be worn for up to 7 days, was introduced by Medtronic plc. The tubing used to deliver insulin from the pump to the body is known as an infusion set.

- February 2020: BD declared that the 50 patients in its human clinical trial for its BD Libertas Wearable Injector had completed the study.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5,284.10 Million |

Projected Market Size in 2028 |

USD 13,485.22 Million |

CAGR Growth Rate |

16.90% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Ypsomed, Amgen, Subcuject, Enable Injections, Medtronic Plc, Insulet Corporation, United Therapeutics Corp., CeQur SA, Sensile Medical, ATS Automation, West Pharmaceutical Services Inc., Tandem Diabetes Care, Valeritas, Sonceboz, Noble, Elcam Drug Delivery Device, Bespak, Stevanato Group, Sorrel Medical, Weibel CDS AG, Neuma. |

Key Segment |

By Type, Technology, Therapy, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the wearable injectors market in 2021

Due to the rising prevalence of chronic illnesses and disorders linked to lifestyle, North America dominated the global wearable injectors market in 2021. Additionally, it is projected that expenditures in building healthcare infrastructure and rising medical costs will boost the growth of the global wearable injectors market. According to the CDC, about 37 million Americans have diabetes, and 90 to 95 % have type 2. The market is also predicted to expand due to prominent market participants such as Becton, Johnson & Johnson Services, Inc., Unilife Corporation, Dickinson and Company, Steady Med Therapeutics, Inc., Amgen, Inc., and Enable Injections having a local presence in the United States. The demand for the wearable injector market is driven by the discovery of numerous novel medications that can successfully cure chronic conditions. Additionally, the growing acceptance of tailored pharmaceuticals may have a favorable effect on the market in the years to come.

Competitive Landscape

Competitive Landscape

- Ypsomed

- Amgen

- Subcuject

- Enable Injections

- Medtronic Plc

- Insulet Corporation

- United Therapeutics Corp.

- CeQur SA

- Sensile Medical

- ATS Automation

- West Pharmaceutical Services Inc.

- Tandem Diabetes Care

- Valeritas

- Sonceboz

- Noble

- Elcam Drug Delivery Device

- Bespak

- Stevanato Group

- Sorrel Medical

- Weibel CDS AG

- Neuma.

Global Wearable Injectors Market is segmented as follows:

By Type

By Type

- On-body Injector

- Off-body Injector

By Technology

By Technology

- Spring Based

- Motor Based

- Rotary pump

- Expanding battery

- Other technology

By Therapy

By Therapy

- Immuno-oncology

- Diabetes

- Cardiovascular disease

- Other diseases

By End User

By End User

- Hospitals and clinics

- Home healthcare settings

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Ypsomed

- Amgen

- Subcuject

- Enable Injections

- Medtronic Plc

- Insulet Corporation

- United Therapeutics Corp.

- CeQur SA

- Sensile Medical

- ATS Automation

- West Pharmaceutical Services Inc.

- Tandem Diabetes Care

- Valeritas

- Sonceboz

- Noble

- Elcam Drug Delivery Device

- Bespak

- Stevanato Group

- Sorrel Medical

- Weibel CDS AG

- Neuma.

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors