Search Market Research Report

Renewable Energy Certificate Market Size, Share & Demand Analysis Forecast 2022-2030

Renewable Energy Certificate Market Size, Share, Growth Analysis Report By End-User (Voluntary and Compliance), By Energy Type (Wind Power, Solar Power, Gas Power, and Hydroelectric Power), By Capacity (More than 5,000 kWh, 1,100 kWh to 5,000 kWh, and 0 to 1,000 kWh), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2030

Industry Insights

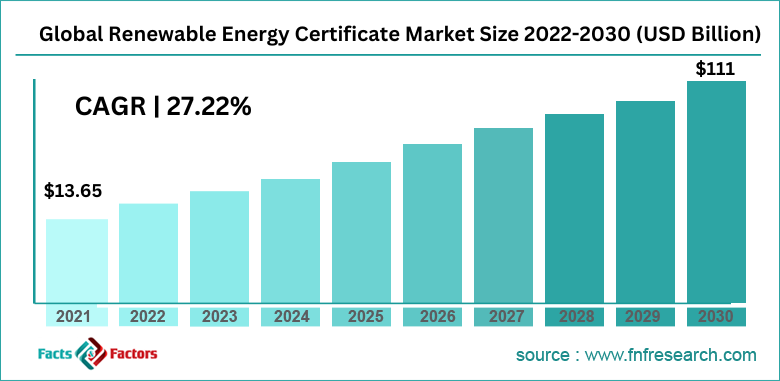

[221+ Pages Report] According to the report published by Facts and Factors, the global renewable energy certificate market size was worth around USD 13.65 billion in 2021 and is predicted to grow to around USD 111 billion by 2030 with a compound annual growth rate (CAGR) of roughly 27.22% between 2022 and 2030. The report analyzes the global renewable energy certificate market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the renewable energy certificate market.

Market Overview

Market Overview

Renewable energy certificates (RECs) are instruments or energy commodities that can be used in the commercial market. RECs also goes by the name of Renewable Energy Credits, Renewable Electricity Certificates, Tradable Renewable Certificates (TRCs), or Green Tags. They are tradable and non-tangible certifications that verify the bearer’s ownership of one megawatt per hour (MWh) of electricity which has been generated from an renewable source. It is currently considered one of the most innovative ways to market the adoption of renewable energy as the holder of a REC can trade off the instrument in the commercial market for profit.

In this process, once the power generated from renewable sources has been fed into the grid, the person or entity operating the source receives the REC instrument which can be considered a commodity and be sold in an open market for instance, they can be bought by a company that has a high carbon footprint.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global renewable energy certificate market is estimated to grow annually at a CAGR of around 27.22% over the forecast period (2022-2030)

- In terms of revenue, the global renewable energy certificate market size was valued at around USD 13.65 billion in 2021 and is projected to reach USD 111 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing emphasis on the adoption of renewable energy

- Based on capacity segmentation, more than 5,000 KWH was predicted to show maximum market share in the year 2021

- Based on end-user segmentation, compliance was the leading user in 2021

- On the basis of region, North America was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Growing emphasis on the adoption of renewable energy to propel market demand

The global renewable energy certificate market is expected to be driven by the growing emphasis on the adoption of renewable energy in residential and commercial units. The energy that has origins or is collected from renewable sources like wind, sunlight, or any other source that can automatically or naturally replenish and can be measured on the human timescale, is known as renewable energy. Renewable sources are considered more sustainable sources of energy and RECs are an excellent way of marketing renewable energy since they can technically be considered as an incentive given to the entity that adopts renewable energy. RECs are tradable instruments and the price solely depends on the demand. The holder of REC can choose to withhold the instrument until they can get the desired price which means that these commodities are like investments.

Restraints

Restraints

- Reports claiming the effectiveness of the certificate to restrict market expansion

There have been growing official reports on how the corporate sector is buying inexpensive RECs as a means of trading off its carbon footprint instead of investing in renewable energy resources. Since the companies do not have to set up windmills or solar power generators, they can continue to operate as before without actually switching to renewable energy. This trend leads to the net effect being zero since no real-time measures are being undertaken by businesses to lower their carbon footprint. The inefficiency of the certificates could impact the renewable energy certificate industry growth.

Opportunities

Opportunities

- Growing revamping activities surrounding RECs to provide growth opportunities

Countries that run REC programs have realized the various loopholes in these tradable instruments. They have been working consistently to improve the certain drawbacks that exist in the global renewable energy certificate market. Such proactive initiatives are expected to create higher growth opportunities during the forecast period. For instance, the Central Electricity Regulatory Commission of India made certain amendments related to RECs, in 2021, which included providing perpetual validity to REC once they are sold and establishing a monitoring system to ascertain non-hoarding of RECs amongst various other changes.

Challenges

Challenges

- Less voluntary uptake of RECs to pose a major challenge to market growth

Multiple reports have showcased that most of the renewable energy certificates sold are from compliance-related buyers. There have been only limited sales generated from voluntary takers of RECs. It is the main challenge that lies in the expansion of the renewable energy certificate industry which is induced by factors like lack of knowledge and poor reinforcement measures that need to be handled more efficiently.

Segmentation Analysis

Segmentation Analysis

The global renewable energy certificate market is segmented based on end-user, energy type, capacity, and region

Based on the end-user, the global market is divided into voluntary and compliance.

- In 2021, the global market was led by the compliance segment due to the various initiatives undertaken by government bodies to ensure the promotion of renewable energy and allow seamless compliance with renewable purchase obligations (RPO)

- As per reports, currently, there are very limited voluntary buyers of RECs which can be attributed to multiple factors

- Onligates units like open-access consumers and discoms are the major buyers of RECs. A recent Intellecap report in India showed that nearly 60% of the country’s RECs were bought by discoms

Based on energy type, the global market is segmented into wind power, solar power, gas power, and hydroelectric power.

Based on capacity, the global market is divided into more than 5,000 kWh, 1,100 kWh to 5,000 kWh, and 0 to 1,000 kWh

- The highest segment was the more than 5,000 kWh segment in 2021 driven by the rapid and increasing investments in the development of wind and solar farms due to the growing demand for renewable energy

- The world is expected to shift toward cleaner sources of energy due to depleting fossil fuel levels along with increasing global warming

- Market players can expect a higher push from regional governments toward more effective and higher-capacity RECs

- In 2021, India sold more than INR 9000 crore of the renewable energy certificate

Recent Developments:

Recent Developments:

- In December 2022, the high court of Delhi, India’s capital city announced the suspension of trading renewable energy certificates for the next 6 weeks. This announcement applies to all RECs that were sold before 31st October 2022. The move was influenced due to a petition submitted by the Indian Wind Power Association Northern Region Council which challenged the new 2022 regulations laid down by the Central Electricity Regulatory Commission

- In October 2022, the International Renewable Energy Agency (IRENA) with the support of its partners claimed the necessity of establishing a closer international collaboration to aid green hydrogen production. The announcement was aimed at strengthening the initiatives under the G7 Hydrogen Action Pact which was announced in the same year

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 13.65 Billion |

Projected Market Size in 2030 |

USD 111 Billion |

CAGR Growth Rate |

27.22% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

The Environmental Tracking Network of North America, Western Area Power Administration, U.S. Environmental Protection Agency and Defense Logistics Agency Energy, Green-e Energy, Central Electricity Regulatory Commission., and others. |

Key Segment |

By End-User, Energy Type, Capacity, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead with the highest market share

The global renewable energy certificate market is projected to be led by North America during the forecast period with the United States leading the regional revenue since it has been a pioneer in the global market and has worked consistently toward deploying RECs for promoting renewable energy in the country. The US has two main markets which are divided into voluntary and compliance markets.

The former represents the segment of the population that voluntarily wishes to buy REC whereas the latter is influenced by the policies existing in almost 29 states of the US along with Puerto Rico and the District of Columbia. These policies necessitate that companies providing electricity supply some part of the total electricity percentage that has been generated using renewable sources until a specified year. For instance, the requirement in New York was 24% by 2013. Growth in Asia-Pacific is anticipated to be led by India and Malaysia which have been at the forefront of adopting RECs in the regional electric sector.

Competitive Analysis

Competitive Analysis

- The Environmental Tracking Network of North America

- Western Area Power Administration

- U.S. Environmental Protection Agency and Defense Logistics Agency Energy

- Green-e Energy

- Central Electricity Regulatory Commission

The global renewable energy certificate market is segmented as follows:

By End-User Segment Analysis

By End-User Segment Analysis

- Voluntary

- Compliance

By Energy Type Segment Analysis

By Energy Type Segment Analysis

- Wind Power

- Solar Power

- Gas Power

- Hydroelectric Power

By Capacity Segment Analysis

By Capacity Segment Analysis

- More than 5,000 kWh

- 1,100 kWh to 5,000 kWh

- 0 to 1,000 kWh

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- The Environmental Tracking Network of North America

- Western Area Power Administration

- U.S. Environmental Protection Agency and Defense Logistics Agency Energy

- Green-e Energy

- Central Electricity Regulatory Commission

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors