Search Market Research Report

Precious Metal Market Size, Share Global Analysis Report, 2021 – 2026

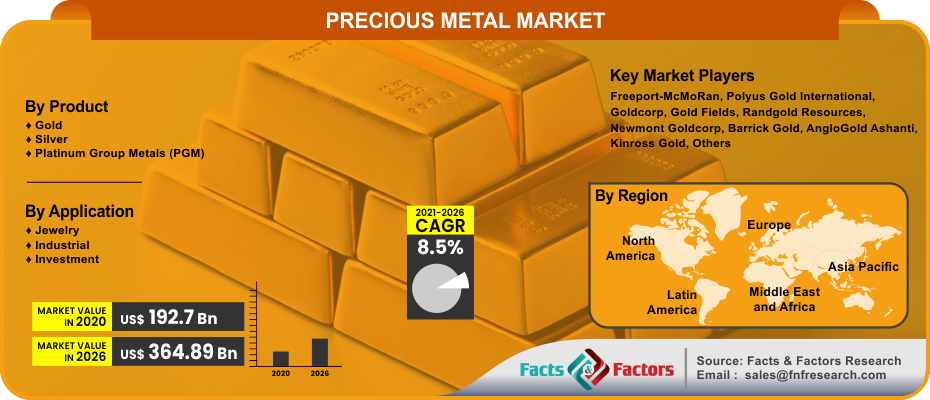

Precious Metal Market By Product (Gold, Silver, & Platinum Group Metals (PGM)), By Application (Jewelry, Industrial, & Investment), And By Regions - Global & Regional Industry Perspective, Comprehensive Analysis, and Forecast 2021 – 2026

Industry Insights

[197+ Pages Report] The latest finding surrounding the “Global Precious Metal Market” recently published by Facts & Factors offers a neatly packaged and comprehensive read. In this report, the global precious metal market will reach a projected value of USD 364.89 Billion by 2026 with a growth rate of 8.5% CAGR from an initial value of USD 192.7 Billion in the year 2020.

Market Overview

Market Overview

Precious metals are the rare and naturally concurring metallic chemical elements of higher economic value and are often less reactive than most elements of the noble class. These metals often have a higher luster and shine. Precious metals have an interesting history and were often traded as currency and are now regarded as investment points in today’s day and age. Additionally, gold, silver, platinum, and palladium have a currency code of ISO 4217.

Industry Growth Factors

Industry Growth Factors

The contributing factors that are responsible for the significant growth of the global precious metal market is the rising demand for the products in the jewelry based applications coupled with gold being used as a commodity in various religious beliefs in India and China to name a few. Additionally, the rising marriages in the subcontinent of India and China coupled with increased production of precious metals such as gold and platinum will increase the footprint of the global precious metal market during the advent of the forecast period. Moreover, properties such as higher ductility and machinability within precious metals will boost the growth of the global precious metal market during the advent of the forecast period to a considerable growth.

The global precious metal market will be driven by exchange of precious metals in stock markets coupled with increasing disposable income among consumers to name a few. Recycling of metals and rising consumer waste pertaining to home electronics is expected to give rise to a huge scrap of palladium. However, the advent of COVID-19, rising costs related to extractive measures and rising unemployment measures will hamper the growth of the global precious metal market during the advent of the forecast period.

Segmentation Analysis

Segmentation Analysis

The global precious metal market is segmented into product, application, and region.

On the basis of product, the global precious metal market is divided into gold, silver, and platinum group metals (PGM). The silver segment is expected to witness the largest market share during the advent of the forecast period owing to increased usage among the industrial and jewelry sector coupled with a much lower cost when compared to its counterparts to name a few. The segment pertaining to gold is expected to witness the fastest growing CAGR during the advent of the forecast period owing to higher trading prices coupled with increased production across a global purview to name a few. Based on application, the global precious metal market is classified into jewelry, industrial, and investment. The industrial segment is expected to witness the largest market share during the advent of the forecast period owing to increased usage among electrical and electronics sector coupled with rise in silver commodities across a wider applicable scale. The segment pertaining to jewelry is expected to occupy a substantial market share during the advent of the forecast period owing to steady consumption patterns coupled with increasing wedding sector amongst emerging economies to name a few.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 192.7 Billion |

Projected Market Size in 2026 |

USD 364.89 Billion |

CAGR Growth Rate |

8.5% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Freeport-McMoRan, Polyus Gold International, Goldcorp, Gold Fields, Randgold Resources, Newmont Goldcorp, Barrick Gold, AngloGold Ashanti, Kinross Gold, Newcrest Mining, First Quantum Minerals, North American Palladium Ltd, Harmony Gold Mining Limited, and GlencoreXstrata, and Others |

Key Segments |

Product, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

Asia-Pacific is expected to witness the largest market share during the advent of the forecast period owing to rising demand from emerging economies such as India, China, Japan, and Malaysia coupled with the region being the home to strong manufacturing sectors to name a few. Additionally, factors such as India being the home to a strong consumer base pertaining to gold coupled with rising penetration of international players will increase the footprint of the precious metal market during the advent of the forecast period. Rising FDIs by foreign players in the region coupled with strong and favorable initiatives aimed at improving extraction and exploration of precious metals will further boost the growth of the precious metal market during the advent of the forecast period. North America will witness the fastest growing CAGR during the advent of the forecast duration owing to easy availability of silver based resources coupled with a stronger manufacturing base in the central region of United States to name a few.

Competitive Players

Competitive Players

The key market participants for the global precious metal market are

- Freeport-McMoRan

- Polyus Gold International

- Goldcorp

- Gold Fields

- Randgold Resources

- Newmont Goldcorp

- Barrick Gold

- AngloGold Ashanti

- Kinross Gold

- Newcrest Mining

- First Quantum Minerals

- North American Palladium Ltd

- Harmony Gold Mining Limited

- GlencoreXstrata

By Product Segment Analysis

By Product Segment Analysis

- Gold

- Silver

- Platinum Group Metals (PGM)

By Application Segment Analysis

By Application Segment Analysis

- Jewelry

- Industrial

- Investment

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Industry Major Market Players

- Freeport-McMoRan

- Polyus Gold International

- Goldcorp

- Gold Fields

- Randgold Resources

- Newmont Goldcorp

- Barrick Gold

- AngloGold Ashanti

- Kinross Gold

- Newcrest Mining

- First Quantum Minerals

- North American Palladium Ltd

- Harmony Gold Mining Limited

- GlencoreXstrata

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors