Search Market Research Report

Insurance Business Process Outsourcing Market Size, Share Global Analysis Report, 2022 – 2028

Insurance Business Process Outsourcing Market Size, Share, Growth Analysis Report By Deployment Type (On-Premise, & Cloud), By Organization Size (Large Enterprise, Small And Medium Enterprises), By Outsourcing Type (Call Center Service, Data Processing Service, Outsourcing Service, Underwriting Service, And Accounting Service), By Project Types (Life and Annuity policy Services, Property and Casualty Policy Services/Claim Services, and Pension Services), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

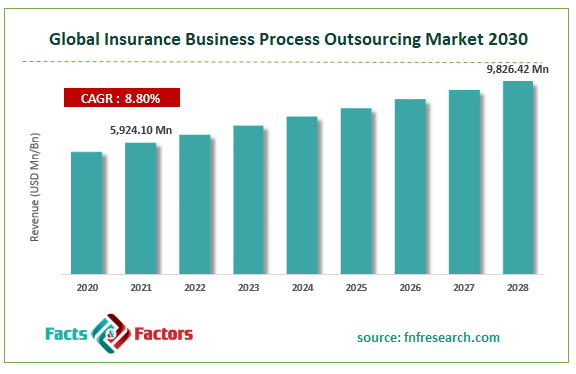

[233+ Pages Report] According to Facts and Factors, the global insurance business process outsourcing market size was worth USD 5,924.10 million in 2021 and is estimated to grow to USD 9826.42 million by 2028, with a compound annual growth rate (CAGR) of approximately 8.80% over the forecast period. The report analyzes the insurance business process outsourcing market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the insurance business process outsourcing market.

Insurance Business Process Outsourcing Market- Overview

Insurance Business Process Outsourcing Market- Overview

Insurance business process outsourcing is the process by which some companies outsource some of their back-office tasks such as bookkeeping, data entry, accounting, commerce support services, digital marketing services and billing services of the service provider’s third party; a defined service level completes the task. Insurance business process outsourcing is considered a valuable option for those companies that find it difficult to hire experienced staff and manage in-house departments. Insurance institutes must successfully manage their core business functions to achieve their targets. Many insurance firms have found that business process outsourcing helps companies be better equipped with the necessary infrastructure, modern insurance technology, and talented experts. An increase in demand for cost-effective operations and the need for business processes among organizations is expected to boost the insurance business process outsourcing market during the forecast period. Business process outsourcing is increased flexibility to meet changing business and commercial conditions.

Covid-19 Impact:

Covid-19 Impact:

The covid-19 virus has spread worldwide, and an increase in cases of covid -19 across the globe is resulting in an economic slowdown. Developed countries are affected by this pandemic. Most of the manufacturing or production of goods is suspended globally. Most countries have adversely impacted businesses due to partial or full lockdown. This, in turn, is projected to indirectly hinder the global insurance business process outsourcing market in the next few years. Lack of industrial activities is expected to result in low cash flows, further impacting the funding of projects. The post-covid-19 pandemic world looks unclear.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global insurance business process outsourcing market value is expected to grow at a CAGR of 8.80 percent over the forecast period.

- In terms of revenue, the global insurance business process outsourcing market size was valued at around USD 5,924.10 million in 2021 and is projected to reach USD 9,826.42 million by 2028.

- The release of new products or services, financing commodity or resource prices legislation, regulation and product diversification, and competitors.

- By deployment type, the cloud segment dominated the market in 2021.

- By types of outsourcing, the outsourcing service segment dominated the market in 2021.

- Europe dominated the global insurance business process outsourcing market in 2021.

Drivers

Drivers

- An increase in demand to manage stringent regulatory compliances

Insurance business process outsourcing an increasing demand for cost-effective operations, and the need for business processes among organizations is expected to boost the insurance business process outsourcing market during the forecast period. Furthermore, an increased demand to manage stringent regulatory compliances effectively is a major factor projected to boost the market in the forecast period. In addition, the rising adoption of cloud-based services growing the demand for insurance business process outsourcing to manage the cloud data is expected to support the market expansion during the forecast period.

Restraints

Restraints

- Privacy and data security concerns are expected to hamper the market growth

The data security and privacy concern are expected to hamper the market growth during the forecast period due to the high deployment of cloud-based services, which increases the threats of cyber-attacks and privacy concerns. Furthermore, the increasing incidents of cyber-attacks in the companies are anticipated to hamper the market growth during the forecast period.

Opportunity

Opportunity

- The use of insurance business process outsourcing in various applications offers opportunities

Insurance business process outsourcing offers numerous services such as call center, finance, accounting business process outsourcing services and digital marketing services for increasing demand for business process outsourcing. Thus, the use of insurance business process outsourcing in various applications is expected to offer lucrative opportunities for the market players during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global insurance business process outsourcing market has been segmented into deployment type, organization size, project types, and outsourcing type.

Based on organization size, insurance business process outsourcing is classified into large enterprises and small and medium enterprises. The large enterprise segment dominated the market in 2021 as it included more than 250 employees, increasing the insurance services.

Based on outsourcing type, insurance business process outsourcing is classified into call center service, data processing service, outsourcing service, underwriting service and accounting service. Among these, the outsourcing services segment dominated the market during the forecast period due to the expansion of the telecommunication and e-commerce industry, raising the demand for outsourcing services.

Based on deployment type, insurance business process outsourcing is classified into on-premise and cloud. The cloud segment dominated the market in 2021 and is expected to continue its dominance in the forecast period as it has a high capacity of storage and provides high bandwidth of internet connectivity, increasing the demand for cloud deployment services.

Recent Developments

Recent Developments

- In August 2021, PhonePay announced that it had received preliminary approval from IRDAI to act as a broker for life and general insurance products. As a result, the company can offer insurance advice to its 300+ million users.

- In November 2021, the Competition Commission of India (CCI) approved HDFC Life Insurance’s acquisition of 100% shareholding in Exide Life Insurance.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 5,924.10 Million |

Projected Market Size in 2028 |

USD 9826.42 Million |

CAGR Growth Rate |

8.80% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Accenture, Capita, Cognizant, EXL, Genpact, HCL Technologies Limited, Infosys Limited, Insuserve-1, Sutherland, WNS (Holdings) Ltd., Wipro Limited, and Others |

Key Segment |

By Deployment Type, Organization Size, Outsourcing Type,Project Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Insurance Business Outsourcing Market: Regional Landscape

Insurance Business Outsourcing Market: Regional Landscape

- The Europe region occurred the largest market

The Europe region dominates the market in revenue generation. Europe dominates the insurance business process outsourcing market due to increasing the demand for cost-effective operations need for business process outsourcing. Moreover, the rapid adoption of advanced technologies and government initiatives to encourage business outsourcing also help drive the region's market growth. Therefore, these factors are expected to support the market expansion in the European region.

Competitive Landscape

Competitive Landscape

Key players within global Insurance Business Process Outsourcing market include

- Accenture

- Capita

- Cognizant

- EXL

- Genpact

- HCL Technologies Limited

- Infosys Limited

- Insuserve-1

- Sutherland

- WNS (Holdings) Ltd.

- Wipro Limited

Insurance Business Process Outsourcing is segmented as follows:

By Deployment Type

By Deployment Type

- On-Premise

- Cloud

By Organization Size

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Types of Outsourcing

By Types of Outsourcing

- Call Center Services

- Data Processing Services

- Outsourcing Services

- Underwriting Services

- Accounting Services

By Project Types

By Project Types

- Life and Annuity policy Services,

- Property and Casualty Policy Services/Claim Services

- Pension Services

By Regional Segment Analysis

By Regional Segment Analysis

-

North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Accenture

- Capita

- Cognizant

- EXL

- Genpact

- HCL Technologies Limited

- Infosys Limited

- Insuserve-1

- Sutherland

- WNS (Holdings) Ltd.

- Wipro Limited

Frequently Asked Questions

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors