Search Market Research Report

Digital Pathology Market Size, Growth, Global Trends, Forecast 2022-2028

Digital Pathology Market by Product (Scanners, Software, Communication Systems, and Storage Systems), By Type (Human Pathology, Veterinary Pathology), By Application (Drug Discovery, Disease Diagnosis, Training & Education, and Tele-consultation), By End User (Hospitals, Pharmaceutical & Biotechnology Companies, Diagnostic Labs, and Academic & Research Institutes): Global Industry Perspective, Comprehensive Analysis, and Forecast 2022 – 2028

Industry Insights

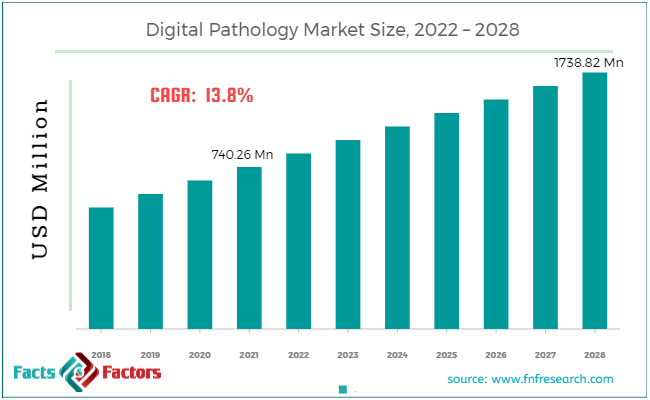

[215+ Pages Report] According to the report published by Facts and Factors, the global Digital Pathology market was valued at approximately USD 740.26 million in 2021, and is expected to generate revenue of around USD 1738.82 million by end of 2028, growing at a CAGR of around 13.8% between 2022 and 2028. The rising number of pathologists, the benefits of digital pathology, and its rapid adoption in the healthcare industry are expected to boost market demand over the forecast period.

Market Overview

Market Overview

Digital pathology is a diagnosis carried out by the use of various computer technologies. Digitized specimen slide generates information that is managed by advanced computation and through virtual microscopy. Advancement in genetic science, medical science as well as computer technology together hand in hand has developed the subfield of pathology called digital pathology. During disease diagnosis, digitization of pathology is performed at hospitals, diagnostic centers. It offers a high-resolution sample scanning, analysis of computer images, and online storage of digital slides which enables pathologists to examine slides without forensic evidence

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic is expected to have a beneficial impact on the worldwide digital pathology industry. The FDA's Center for Devices and Radiological Health issued an enforcement policy for remote digital pathology devices aimed at pathologists, clinical laboratories, and drug administration personnel. As a result of the growth in chronic disease cases, the use of digital pathology systems for diagnosis has risen, which is expected to boost the digital pathology market over the forecast period (2022-2028).

As a result, new developments by leading competitors and an increased number of product approvals drive market growth. However, the high cost of digital pathology equipment is projected to stymie market expansion during the projected timeframe.

Industry Growth Factors

Industry Growth Factors

One of the important driving factors for the digital pathology market is an enhancement in lab efficiency. An improvement in lab efficiency is critical for the correct and swift diagnosis of the disease and improved access to medical reports via apps and websites. Moreover, increasing penetration of medical insurance in the population is driving the demand for pathological services, and to provide swift and efficient services, investments in digital pathology infrastructure have increased significantly. The rising prevalence of chronic diseases has further increased the requirement for digital pathology. As per the WHO survey, the total number of chronic respiratory disease cases increased by 39.5% between 1990 to 2017. At COVID-19, a Digital Pathology Enforcement Policy for Pathologists, clinical laboratories, healthcare centers, and drug management staff was issued by the US FDA's Centre for Devices and Radiological Health.

Drivers

Drivers

- Growing digital pathology usage for lab performance

Digital pathology improves lab efficiency by lowering costs, speeding up response times, and giving subject-matter expertise. Patients and doctors rely on lab data for diagnosis, thus tests must be conducted fast and precisely. Moreover, pathologists save money and time by accessing digitized slides via web services. The COVID-19 pandemic has prompted lockdowns and social restrictions. These constraints have spurred demand for digital pathology technologies, which allow pathologists to assess medical outcomes distant from initial diagnosis.

Restraints

Restraints

- Digitized pathology systems are extremely expensive

A standard digital pathology system contains a slide scanner, image server, and software. A digital pathology scanner costs between $110,000 and $130,000 in Asia-Pacific. Big hospitals with huge capital expenditures can afford these technologies, whereas pathologists and academic institutes with small budgets or no IT assistance cannot. Healthcare professionals in poor countries like India, Brazil, and Mexico cannot afford such high-tech equipment. Also, trained personnel are necessary to efficiently handle and maintain digital pathology systems. It is believed that the expensive cost of these systems, coupled with a lack of experienced individuals to handle digital pathology equipment, will limit their use.

Opportunities

Opportunities

- Private pathology practices to get affordable scanners

The high cost of digital pathology technology, like scanners, restricts industry expansion. Thus, the introduction of cheap scanners should benefit participants in the digital pathology industry. Small firms can't afford pricey digital pathology systems. The availability of low-cost scanners and small players' willingness to digitize pathology processes may inspire pathologists with restricted finances to use them.

Challenges

Challenges

- Lack of skilled pathologists

Pathologists perform vital laboratory tests for illness diagnosis. However, there is a lack of pathologists globally, particularly in Africa and Asia-Pacific. A Springer study (2020) found that Switzerland had 35,355 residents per pathologist, while Canada and the US have 20,658 and 25,325, respectively. In Germany, one pathologist per 47,989 people. Digital pathology helps clinicians safely share data with pathologists across geographical borders. Moreover, modern technologies like AI and machine learning assist pathologists to diagnose diseases faster and more effectively. Due to the acute lack of pathologists, digital pathology is likely to be increasingly used for remote pathological consultation and services.

Segmentation Analysis

Segmentation Analysis

The global digital pathology market is segmented on the basis of product, type, application, and end-user. On the basis of Product, the global digital pathology market is segmented into scanners, software, communication systems, and storage systems. In 2020, the scanners segment was expected to account for the majority of the market share. The software segment, on the other hand, is predicted to grow at the fastest rate between 2021 and 2028. The scanner aids in the production of rapid, dependable, and high-resolution photographs of cell nuclei. It also assists pathologists, histologists, and other medical experts in scanning slides and uploading them to a network for remote access and collaboration between experts.

On the basis of type, the global market is categorized into human pathology, veterinary pathology. By application segment, the global digital pathology market is divided into drug discovery, disease diagnosis, training & education, and teleconsultation. In 2020, the drug discovery category was expected to account for the biggest percentage of the market overall. During the year 2021–2028, the same segment, on the other hand, is predicted to post the greatest CAGR. One of the primary drivers of growth in the drug discovery segment is the core advantage that digital pathology offers pharmaceutical research, which is the application of image analysis algorithms for decreasing the number of subject interpretations, growing awareness of neurological disorders, and the availability of advanced EEG products.

By end-user, the market is classified into hospitals, pharmaceutical & biotechnology companies, diagnostic labs, and academic & research institutes. Pharmaceutical and biotechnology companies are expected to dominate the industry in 2020. By 2028, the same category is predicted to be the market's largest shareholder. Pharmaceutical and biotechnology companies are digitizing their work. Companies are continually searching for new chemicals and biomarkers. In addition, digital pathology facilitates data interchange between pharmaceutical corporations and R&D labs. Due to the causes listed above, the market for pharma and biotech firms is expected to rise in the future years.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 740.26 Million |

Projected Market Size in 2028 |

USD 1738.82 Million |

CAGR Growth Rate |

13.8% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Koninklijke Philips N.V., Hamamatsu Photonics, Leica Biosystems, Visiopharm A/S, Corista, Indica Labs, OptraSCAN, Glencoe Software, Inspirata Inc., Mikroscan Technologies, Proscia Inc., Kanteron Systems, Roche, Apollo Enterprise Imaging, Sectra AB, and Huron Digital Pathology among others. |

Key Segment |

By Product, By Type, By Application, By End User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

Asia-Pacific is expected to record the highest rate of growth over the next few years due to a rise in awareness of digital pathology systems. The presence of a large patient base with chronic & infectious diseases and an increase in expenditure in healthcare infrastructure will support the market growth during the forecast timeline. Moreover, the ever-changing life science sector is predicted to offer lucrative market expansion opportunities in developing economies such as China, India, and Malaysia. North America accounted for the major market share among the others, and it has been expected to maintain this trend in the near future, owing to the huge adoption of digital pathology systems.

Recent Developments

Recent Developments

- September 2021: In a joint venture, Visiopharm (Denmark) and Agilent Technologies, Inc. (US) will commercialize Visiopharm's CE-IVD-certified AI-driven Precision Pathology software alongside Agilent's automated pathology staining solutions.

- August 2021: In a signed agreement, Sectra AB (Sweden) and the University Medical Center Utrecht (Netherlands) agreed that UMC will use Sectra's pathology module to facilitate productive interdisciplinary conversations between pathologists and radiologists at the hospital.

- April 2021: For nations throughout North America and Europe, Leica Biosystems and Paige.AI, Inc. (US) have teamed up to bring Paige's artificial intelligence-powered research tools for tumor detection, grading, and quantification to the Leica Biosystems digital pathology platform.

Competitive Landscape

Competitive Landscape

A large selection of diagnostic products is available from manufacturers, who are concentrating on product development. Furthermore, leading players in the digital pathology market are concentrating on expanding their global and regional footprint through acquisitions and international expansion on an international scale.

Major players in the market are :

- Koninklijke Philips N.V.

- Hamamatsu Photonics

- Leica Biosystems

- Visiopharm A/S

- Corista

- Indica Labs

- OptraSCAN

- Glencoe Software

- Inspirata Inc.

- Mikroscan Technologies

- Proscia Inc.

- Kanteron Systems

- Roche

- Apollo Enterprise Imaging

- Sectra AB

- Huron Digital Pathology

The Global Digital Pathology Market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Scanners

- Software

- Communication Systems

- Storage Systems

By Type Segment Analysis

By Type Segment Analysis

- Human Pathology

- Veterinary Pathology

By Application Segment Analysis

By Application Segment Analysis

- Drug Discovery

- Disease Diagnosis

- Training & Education

- Tele-consultation

By End-User Segment Analysis

By End-User Segment Analysis

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Diagnostic Labs

- Academic & Research Institutes

Regional Segment Analysis

Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Industry Major Market Players

- Koninklijke Philips N.V.

- Hamamatsu Photonics

- Leica Biosystems

- Visiopharm A/S

- Corista

- Indica Labs

- OptraSCAN

- Glencoe Software

- Inspirata Inc.

- Mikroscan Technologies

- Proscia Inc.

- Kanteron Systems

- Roche

- Apollo Enterprise Imaging

- Sectra AB

- Huron Digital Pathology

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors