Search Market Research Report

Abdominal Surgical Robot Market Size, Share Global Analysis Report, 2022 – 2028

Abdominal Surgical Robot Market Size, Share, Growth Analysis Report By Product Type (Remote Control and Voice Control), By Application (Gynecology, Urology, General Surgery, and Others), By End-User (Hospitals, Research Centres, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

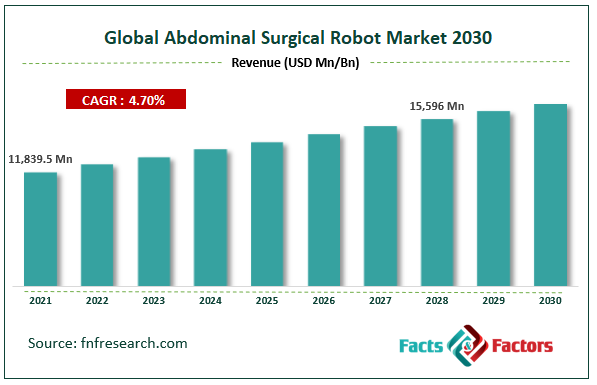

[227+ Pages Report] According to Facts and Factors, the global Abdominal Surgical Robot Market size was worth USD 11,839.5 million in 2021 and is estimated to grow to USD 15,596 million by 2028, with a compound annual growth rate (CAGR) of approximately 4.7% over the forecast period. The report analyzes the Abdominal Surgical Robot Market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the Abdominal Surgical Robot Market.

Market Overview

Market Overview

An apparatus that aids doctors in abdominal surgeries are an abdominal surgical robot. "Abdominal surgery" refers to operations like gastrectomy, colectomy, and hernia repair. The machine has a robotic arm and a control panel as its two primary components. The surgeon operates the robotic arm fitted with surgical tools while seated at a console. The primary factors impacting market expansion include the growing inclination for minimally invasive procedures and the increasing need for high-precision surgical operations. In addition, the benefits of an abdominal surgical robot, such as less pain and suffering, quick healing, less blood loss, and a brief hospital stay, all contribute to the market's expansion.

The global market for abdominal surgical robots is anticipated to grow over the forecast years as the U.S. Food and Drug Administration (FDA) continues to approve robotic and surgical navigation systems for use in complicated spinal procedures. Additionally, surgeons worldwide are actively using technical developments in surgical robot equipment supplemented with artificial intelligence to reduce the death rate linked to chronic conditions. However, the primary factor impeding the growth of the global market is the high cost of the robotic surgical technique.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 epidemic has had a disastrous effect on the population and economy of the entire world. Healthcare systems are under a lot of stress due to the pandemic. Healthcare institutions and providers have been directed to halt performing elective surgical operations and medical evaluations during this time to reduce the risk of transmission and save money for COVID-19 patients. The epidemic has caused a temporary worldwide restriction on elective procedures, which has caused cancellations of elective procedures worldwide and harmed the abdominal surgery robotics market.

Key Insights

Key Insights

- North America held the most significant revenue share of 45.1% in 2021 and dominated the market for AI-based surgical robots.

- In terms of application, gynecology is anticipated to have the largest market share.

- The expanding requirement for automation in the healthcare sector and the changing trend toward sophisticated robotic surgery are the main drivers driving the market size for abdominal surgical robots.

- The market for abdominal surgical robots will experience slow growth due to the increase in fatalities and injuries from robotic surgery.

- By end-user, the "hospital" group held the largest market share with a share of almost 71.22% in 2021.

Growth Drivers

Growth Drivers

The advantages of these treatments, such as smaller incisions, fewer cuts, decreased scarring, reduced discomfort, increased safety, quicker recovery times, and significant cost savings, are driving up demand for minimally invasive surgeries (MIS) globally. These benefits are enhanced by robotic minimally invasive surgery, improving accuracy, repeatability, control, and efficiency. Additionally, abdominal robotic surgery offers extremely sophisticated visualization tools that give doctors a better perspective of the operating room and use H.D. cameras to show minute structures. Robots can help surgeons access difficult-to-reach locations because they have higher agility and more dexterity than the human hand. They can also rotate 360 degrees. The market for abdominal surgical robots is anticipated to develop over the next few years due to these benefits of surgical robots and the rising desire for better, speedier healthcare services.

Restraints

Restraints

Robotically assisted operations are more expensive than minimally invasive ones. For example, the CyberKnife robotic system costs about USD 4 million per unit, whereas the da Vinci system, one of the most popular robotic systems, costs between USD 1.5 million and USD 2.5 million. In addition, the cost of a robot's annual maintenance, which is close to USD 125,000, adds to the already expensive cost of robotic surgery. The typical cost of a robotic surgical operation ranges from USD 3,000 to USD 6,000. Thus, it is anticipated that the market for medical robots will develop slowly due to the increasing cost of procedures brought on by the usage of robotic systems. Similar financial cuts have been made to hospitals in various European nations in recent years, and more are anticipated in the years to come. Budget cuts have forced hospitals to implement cost-containment strategies in many areas of operation. Staff reductions, delays in facility upgrades, and freezes on capital equipment purchases, including pricey robotic systems, are all effects of cost-cutting.

Opportunities

Opportunities

Ambulatory surgery centers (ASCs) are independent medical clinics focusing on outpatient surgical, diagnostic, and preventive procedures. The cost-effectiveness of ASCs benefits governments, third-party payers, and patients equally. According to a Healthcare BlueBook and HealthSmart study, ASCs provide a less expensive site of care than hospital outpatient departments (a provider of health plans for self-funded employers), reducing the cost of outpatient surgery by USD 38 billion annually. As a result, ASCs, particularly in the U.S., purchase advanced robotics to handle complex situations. As a result, the market for abdominal surgical robots is highly lucrative due to the expanding number of ASCs offering robotic-assisted specialized surgeries.

Segmentation Analysis

Segmentation Analysis

The global Abdominal Surgical Robot Market is segregated based on Product Type, Application, End-User, and Region.

By Application, the market is divided into general Surgery, Gynecology, Urology, and Others. Gynecology is predicted to account for the highest part of the market. It held a market share of 42.9 percent in 2021. With the speed and ease of robotic-assisted surgery, patients often schedule gynecologic treatments. The market is expanding due to rising minimally invasive surgery adoption and developments in surgical technology. Gynecological problems like irregular vaginal bleeding, uterine fibroids (U.F.), cervical cancer, ovarian cysts, endometriosis, and other related disorders are becoming more common, which is fueling the market's expansion. Gynecology is expected to experience tremendous growth potential due to the quick development of technology, increased government measures to support sophisticated healthcare facilities and services, and increased medical insurance coverage.

By End-User, the market is divided into Hospitals, Research Centres, and Others. With almost 71.22 percent of the market in 2021, the "hospital" segment had the highest end-user share. The market expansion in this sector was driven by the rising number of surgical operations and inpatient visits. With their capacity to enhance surgical outcomes, hospitals have been using abdominal surgical robots more frequently lately. Laparoscopic surgery is one sort of minimally invasive surgery that can be done with the aid of a robot.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 11,839.5 Million |

Projected Market Size in 2028 |

USD 15,596 Million |

CAGR Growth Rate |

4.7% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

CMR Surgical Ltd, AdEchoTech, Accuray Incorporated, Corindus Inc., AVRA Medical Robotics Inc.Corporation, Medrobotics Corporation, Intuitive Surgical, Titan Medical Inc., Revo, Virtual Incision, TransEnterix Surgical Inc., and Others |

Key Segment |

By Product, Application, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In November 2020, Johnson & Johnson Services Inc. released information on their surgical robotic platform, which it claims would provide unequaled flexibility and control compared to the rest of the market. According to the business, the new Ottava system features six arms that will be integrated into the operating table, giving surgeons additional control and flexibility. In addition, the available space in the operating room is expanded and enhanced workflow to facilitate patient access. The platform also incorporates a zero-footprint design.

Regional Landscape

Regional Landscape

North America is anticipated to be the most dominating area for the surgical robots market due to technological improvements in the United States and Canada. With significant companies, expanding chances for start-ups to enter the market, and ongoing innovations in the field of artificial intelligence and robotics for healthcare, the region held the most significant revenue share. The market is expanding due to the rising demand for minimally invasive and robot-assisted surgeries. Key industry players are also concentrating on creating precise and efficient surgical robots to hasten North America's market expansion. The market for abdominal surgical robots is expected to grow in the region over the next few years as more healthcare infrastructure is built and adopted, supported by advanced technology.

The abdominal surgical robots market in the Asia-Pacific region is predicted to grow significantly due to the increased incidence of prostate cancer in China and India. During the projected period, the market expansion is anticipated to be fuelled by the introduction of technologically improved equipment for surgical operations and interventional treatments in the regional market, along with a rise in the number of patients choosing robotic surgery. The increase is also predicted to be boosted by significant players in the Asia Pacific area boosting their investments. In addition, the category has grown due to the quickly evolving surgical robotics technology and the rising patient population in developing nations like China and India.

Competitive Landscape

Competitive Landscape

Key players within the global Abdominal Surgical Robot market include

- CMR Surgical Ltd

- AdEchoTech

- Accuray Incorporated

- Corindus Inc.

- AVRA Medical Robotics Inc.Corporation

- Medrobotics Corporation

- Intuitive Surgical

- Titan Medical Inc.

- Revo

- Virtual Incision

- TransEnterix Surgical Inc..

The global Abdominal Surgical Robot Market is segmented as follows:

By Product

By Product

- Remote Control

- Voice Control

By Application

By Application

- General Surgery

- Gynaecology

- Urology

- Others

By End-User

By End-User

- Hospitals

- Research Centres

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- CMR Surgical Ltd

- AdEchoTech

- Accuray Incorporated

- Corindus Inc.

- AVRA Medical Robotics Inc.Corporation

- Medrobotics Corporation

- Intuitive Surgical

- Titan Medical Inc.

- Revo

- Virtual Incision

- TransEnterix Surgical Inc..

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors