Search Market Research Report

Sales Tax Software Market Size, Share, Trends Analysis Forecast 2022-2028

Sales Tax Software Market Size, Share, Growth Analysis Report By Solution (Consumer Use Tax Management, Tax Filings, Others), By Deployment Mode (Cloud, On-Premise), By Industry Vertical (BFSI, Transportation, Retail, Telecom & IT, Healthcare, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

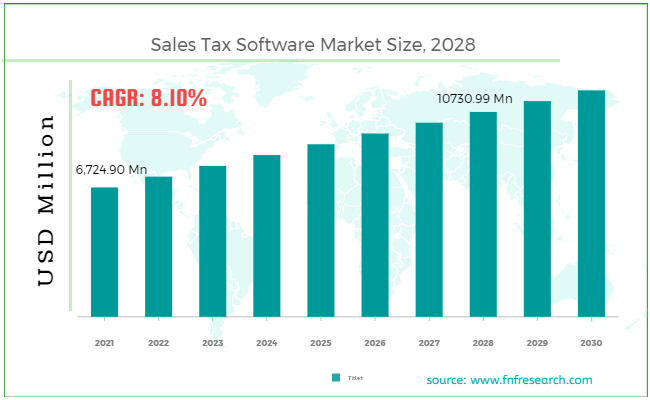

[234+ Pages Report] According to Facts and Factors, the global sales tax software market size was worth around USD 6,724.90 million in 2021 and is estimated to grow to about USD 10,730.99 million by 2028, with a compound annual growth rate (CAGR) of approximately 8.10% over the forecast period. The report analyzes the sales tax software market drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the sales tax software market.

Market Overview

Market Overview

Sales tax filing is automated by sales tax software provided by reputable banking and IT firms. Providing consuming organizations with access to specialized software assists them in managing their finances and reduces the possibility of human error while filing sales tax. This software provides a better operational solution than accounting professionals since it consistently updates the rules supplied by the appropriate authorities. One of the main benefits for the sales tax software industry and its providers is the extensive use of the internet and cloud computing. This technological accessibility has led to the employment of specialized software solutions and cutting-edge technologies made accessible via the internet and cloud-based deployment model, which has assisted enterprises in structuring their operations more successfully. As a result of complex regulations and compliances, increasing transaction volumes, and other considerations, the market for sales tax software is growing. The extensive internet and cloud computing usage, which has resulted in higher adoption of these services, is a significant driver boosting the market's growth.

COVID-19 Impact:

COVID-19 Impact:

The government's increased adoption of new tax laws has led to tremendous growth in the tax management industry in 2021. Additionally, lifting government restrictions & curfews in most countries, the restart of travel & tourism around the world, and the prudent use of funds to boost local economies would help the tax management industry thrive. The market for sales tax management software has grown significantly over the past few years due to governments in the great majority of nations imposing lockdowns and halting international travel to curb the virus's spread.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global sales tax software market value will grow at a CAGR of 8.10% over the forecast period.

- In terms of revenue, the global sales tax software market size was valued at around USD 6,724.90 million in 2021 and is projected to reach USD 10,730.99 million by 2028.

- The extensive internet and cloud computing usage, which has resulted in higher adoption of these services, is a significant driver boosting the market's growth.

- By solution, the tax filings category dominated the market in 2021.

- By industry vertical, the retail category dominated the market in 2021.

- North America dominated the global sales tax software market in 2021.

Growth Drivers

Growth Drivers

- Implementation of automation and digitalization across various organizations drives the market growth

The global digitization revolution presents enormous opportunities for businesses to adapt their current processes and business models to increase efficiency and revenue. Digital transformation or digitalization of organizations refers to incorporating digital technology into various organizational initiatives, business processes, and business models. Any industry's digital transformation is primarily driven by end-to-end business process optimization, operational effectiveness, cost containment, and a decrease in human error. Businesses have greatly profited from the paradigm shift away from manual, antiquated procedures and toward automated, modern ones. Increased productivity, cost savings, and income opportunities are some advantages that are anticipated to increase the use of sales tax software, thereby boosting the growth of the global sales tax software market.

Restraints

Restraints

- The rise in the absence of quality infrastructure needed for efficient operations may hinder the market growth

The main factors limiting the global sales tax software market growth, among others, are the rise in the absence of quality infrastructure needed for efficient operations of these services, the increase in the demand for knowledgeable professionals to provide efficient workflow of services & maintain the operational cycle, and the increase in concerns regarding the security of confidential data of an enterprise with the deployment of these services over the cloud.

Segmentation Analysis

Segmentation Analysis

The global sales tax software market has been segmented into solution, deployment mode, industry vertical, and region.

Based on the solution, the market is segmented into consumer use tax management, tax filings, and others. The tax filings segment dominated the market in 2021. Sales tax software is widely used in the tax filing section of the economy due to constantly changing tax legislation and government regulations and reducing human mistakes.

Based on deployment mode, the market is segmented into cloud and on-premise. The cloud segment dominated the market in 2021. The development of the cloud-based sector is fueled by the cloud's potential to offer cutting-edge data storage and accessibility methods anytime and anywhere.

Based on industry vertical, the market is segmented into BFSI, transportation, retail, telecom & IT, and healthcare. The retail segment dominated the market in 2021. Complicating the tax filing process and necessitating a streamlined tax filing service is the development of international cross-border trade and online retail, which is linked with modern trends like e-commerce.

Recent Developments

Recent Developments

- June 2021: Stripe's leader in digital payments introduced new software to make it easier for businesses to calculate sales taxes. Businesses will find it easier to compute and collect sales taxes thanks to this new tool.

- April 2021: Davo Technologies, which automates sales taxes for small businesses, has completed a deal to be acquired by Avalara. When sales taxes are needed to be filed and paid to state and local tax authorities, Davo's software automatically links to the point of sale systems to extract the amounts owed, daily put aside sales tax money, store the funds, and file and pay sales taxes on their behalf.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6,724.90 Million |

Projected Market Size in 2028 |

USD 10,730.99 Million |

CAGR Growth Rate |

8.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

AVALARA, APEX ANALYTIX, CCH INCORPORATED, EDOC SOLUTIONS, VERTEX INC, RYAN LLC, SALES TAX DATALINK, LEXISNEXIS, SAGA INTACT INC, ZOHO CORPORATION, and Others |

Key Segment |

By Solution, Deployment Type, Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the sales tax software market in 2021

In 2021, North America dominated the global sales tax software market. The process of filing taxes in this region has become more difficult due to the rise in transaction levels and associated amounts. The rising need for sales tax software from various industries, including transportation, IT & communications, retail, and healthcare, is another factor fueling North America's growth. The adoption of a cloud-based solution accelerates market growth due to the expanding digital revolution worldwide. The governments of developing nations like the US and Canada are taking several steps to encourage the use of digital services by businesses and consumers.

Competitive Landscape

Competitive Landscape

- AVALARA

- APEX ANALYTIX

- CCH INCORPORATED

- EDOC SOLUTIONS

- VERTEX INC

- RYAN LLC

- SALES TAX DATALINK

- LEXISNEXIS

- SAGA INTACT INC

- ZOHO CORPORATION

Global Sales Tax Software Market is segmented as follows:

By Solution

By Solution

- Consumer Use Tax Management

- Tax Filings

- Others

By Deployment Type

By Deployment Type

- Cloud

- On-Premise

By Industry Vertical

By Industry Vertical

- BFSI

- Transportation

- Retail

- Telecom & IT

- Healthcare

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- AVALARA

- APEX ANALYTIX

- CCH INCORPORATED

- EDOC SOLUTIONS

- VERTEX INC

- RYAN LLC

- SALES TAX DATALINK

- LEXISNEXIS

- SAGA INTACT INC

- ZOHO CORPORATION

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors