Search Market Research Report

Plasmid Market Size, Share Global Analysis Report, 2022 – 2028

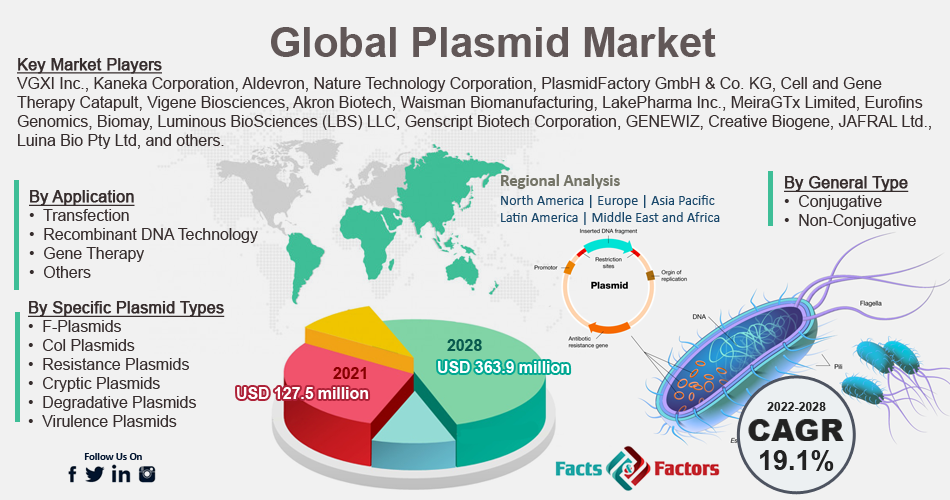

Plasmid Market Size, Share, Growth Analysis Report By General Type (Conjugative, Non-Conjugative), By Specific Plasmid Types (F-Plasmids, Col Plasmids, Resistance Plasmids, Cryptic Plasmids, Degradative Plasmids, Virulence Plasmids), By Application (Transfection, Recombinant DNA Technology, Gene Therapy, Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

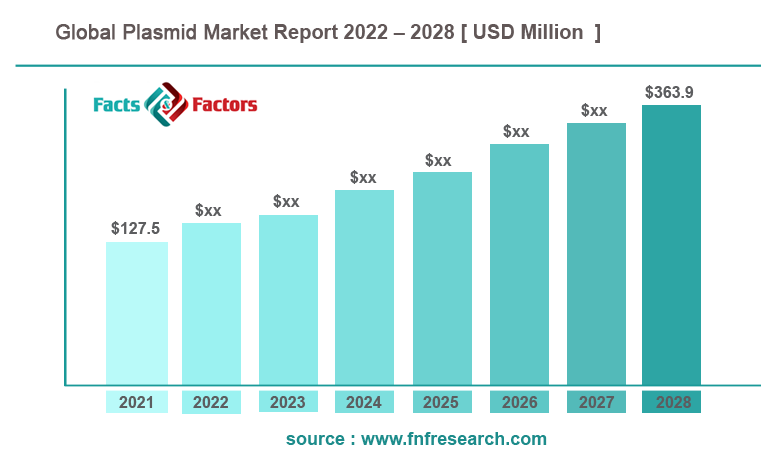

[212+ Pages Report] According to Facts and Factors, the global plasmid market size was worth around USD 127.5 million in 2021 and is estimated to grow to about USD 363.9 million by 2028, with a compound annual growth rate (CAGR) of approximately 19.1% over the forecast period. The report analyzes the plasmid market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the plasmid market.

Market Overview

Market Overview

A plasmid is a collection of DNA components from various cells and tissues. The plasmid is important in modern medicine. A plasmid can be utilized directly as a medicinal agent, like those in gene therapy and vaccine antigen production, and indirectly for various research purposes. It is a self-replicating microbial circular, smaller, and extrachromosomal DNA replication utilized in recombinant DNA technology and genetic engineering. Plasmid comes in various forms, including high-quality plasmid DNA, GMP-grade plasmid DNA, and non-GMP grade plasmid DNA. The high-quality plasmid is used in the GMP-compliant manufacture of antibodies, recombinant viruses, and RNA. Genetically engineered medicines have emerged as an attractive treatment option for various diseases, including genetic defects and certain viral diseases. A rising number of individuals seeking gene therapy is a primary factor driving plasmid market growth. The benefits of utilizing viral vectors include a minimal risk of chromosomal integration, resilience due to process validations, limited infection to a broad spectrum of cells, and ease of culture production, all of which drive their adoption and market expansion. The global plasmid market is growing due to an increase in financing for R&D activities related to gene therapy, cancer incidence, viral infection, and genetic abnormalities, and an increase in awareness about gene therapy. However, the high cost of therapies, the risk of mutagenesis, and other barriers to gene therapy limit the expansion of the plasmid market.

COVID-19 Impact:

COVID-19 Impact:

Since numerous viral vectors, recombinant proteins, live attenuated viruses, and nucleic acid-based vaccines are now being developed to treat the diseases, the COVID-19 pandemic is anticipated to create growth prospects for the plasmid market in the future. The viral vector used in viral vector vaccines is a recombinant virus with genes for the viral antigen(s) cloned using recombinant DNA techniques. This virus is frequently attenuated to lessen its pathogenicity. There are two types of vector vaccines: replicating and non-replicating. One dose may be adequate for protection with these vector-based vaccinations, which is a big benefit. Additionally, businesses in the market for manufacturing viral vectors are expanding their production facilities.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global plasmid market value is expected to grow at a CAGR of 19.1% over the forecast period.

- In terms of revenue, the global plasmid market size was valued at around USD 127.5 million in 2021 and is estimated to grow to about USD 363.9 million by 2028.

- A rising number of individuals seeking gene therapy is a primary factor driving plasmid market growth.

- By general type, the conjugative segment dominated the market in 2021.

- By application, the gene therapy segment dominated the market in 2021.

- North America dominated the global plasmid market in 2021.

Growth Drivers

Growth Drivers

- The growing incorporation of plasmid drives the market growth

The global plasmid market growth is fueled by the expanding use of plasmids in creating vaccinations. Developing vaccines for influenza, HIV, malaria, infections, and Ebola frequently uses plasmids. Because DNA vaccinations are so successful, they are administered more frequently, encouraging people to use plasmids. The market is expanding due to the rising incidence of the target ailment & disease and the efficiency of viral vectors in the delivery of gene therapy. In addition, it is anticipated that the future will provide new opportunities for industry participants due to the rising demand for synthetic genes and the unexplored expanding market potential.

Restraints

Restraints

- The high cost of gene therapies may hinder the market growth

The high cost of gene therapies and potential insertional mutagenesis are anticipated to restrain the growth of the global plasmid market. It is expensive and time-consuming to establish manufacturing procedures for innovative biotherapeutics. Since production scale-up is a significant obstacle to the commercialization of plasmid DNA, it is a complicated procedure. Therefore, the manufacture of the plasmid is facing more and more difficulties, limiting market expansion.

Opportunities

Opportunities

- Growing investments and developments provide growth opportunities

Increasing investments and developments in the biopharmaceutical sector to create innovative manufacturing technologies boost plasmid commercial production output. This might significantly profit the market over the forecast period.

Challenges

Challenges

- The lack of suitable infrastructure may hinder the market growth

The proper operation of research and development in plasmid production is challenged by a lack of suitable infrastructure and financial constraints. This may limit the expansion of the plasmid market over the forecast period.

Segmentation Analysis

Segmentation Analysis

The global plasmid market is segregated based on general type, specific plasmid types, application, and region.

By general type, the market is divided into conjugative and non-conjugative. Among these, the conjugative segment dominated the market in 2021. Conjugative plasmids are extrachromosomal DNA components that can transmit horizontally and are present in various naturally occurring, isolated bacteria. Plasmids may carry genes that are advantageous to their bacterial host, but they may also have a negative impact on fitness. It is superior to other gene transfer methods because it causes less damage to the target's cellular envelope and can transmit significant amounts of genetic information.

By specific plasmid types, the market is segmented into F-plasmids, col plasmids, resistance plasmids, cryptic plasmids, degradative plasmids, and virulence plasmids. The col plasmids dominated the market in 2021. Col plasmids contain genes that code for bacteriocins, proteins that kill other bacteria. Degradative plasmids allow the digestion of uncommon compounds such as toluene and salicylic acid. Virulence plasmids that transform the bacteria into a pathogen.

By application, the market is classified into transfection, recombinant DNA technology, gene therapy, and others. The gene therapy segment dominated the market in 2021. Due to the growing usage of gene therapy to treat several viral and genetic illnesses, it is anticipated that gene therapy will continue to be the market's dominating application during the next five years. Additionally, it is frequently utilized to identify patient issues, which raises the need for treatment. The expansion of the gene therapy market is anticipated to be fueled by rising public awareness of the practice and technological developments in the plasmid synthesis process. Rich product pipelines and increased business producing vector-based products for gene treatments are other factors contributing to the segment's growth.

Recent Developments

Recent Developments

- May 2021: The Next Generation 4D-Nucleofector Cell Transfection Platform from Lonza boasted enhanced usability and performance that has been demonstrated. Modular architecture offers unparalleled size and throughput flexibility while delivering a performance that has been tested.

- June 2020: Aldevron and Ziopharm Oncology partnered strategically to help produce plasmid DNA for T-cell treatment of solid malignancies.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 127.5 Million |

Projected Market Size in 2028 |

USD 363.9 Million |

CAGR Growth Rate |

19.1% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

VGXI Inc., Kaneka Corporation, Aldevron, Nature Technology Corporation, PlasmidFactory GmbH & Co. KG, Cell and Gene Therapy Catapult, Vigene Biosciences, Akron Biotech, Waisman Biomanufacturing, LakePharma Inc., MeiraGTx Limited, Eurofins Genomics, Biomay, Luminous BioSciences (LBS) LLC, Genscript Biotech Corporation, GENEWIZ, Creative Biogene, JAFRAL Ltd., Luina Bio Pty Ltd, Cepham Life Sciences, Lonza, Greenpak Biotech Ltd, Delphi Genetics, Biomiga, Genopis Inc., Altogen Biosystems, Puresyn Inc., GeneImmune Biotechnology Corp., Synbio Technologies, Geneone Life Science, Ajinomoto Bio-Pharma Services., and others. |

Key Segment |

By General Type, Specific Plasmid Types, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America dominated the global plasmid market in 2021

North America dominated the global plasmid market in 2021 because of the region's strong adoption of plasmid-based goods, increased incidence of cancer & monogenic illnesses, extensive product pipeline, and technological improvements. Another factor that has contributed to this region's big share of the market is the existence of a large number of institutions working in advanced therapy research and development. Investments made by federal agencies to expand the region's cell therapy research base are expected to boost the growth of the North American plasmid market.

Competitive Landscape

Competitive Landscape

- VGXI Inc.

- Kaneka Corporation

- Aldevron

- Nature Technology Corporation

- PlasmidFactory GmbH & Co. KG

- Cell and Gene Therapy Catapult

- Vigene Biosciences

- Akron Biotech

- Waisman Biomanufacturing

- LakePharma Inc.

- MeiraGTx Limited

- Eurofins Genomics

- Biomay

- Luminous BioSciences (LBS) LLC

- Genscript Biotech Corporation

- GENEWIZ

- Creative Biogene

- JAFRAL Ltd.

- Luina Bio Pty Ltd

- Cepham Life Sciences

- Lonza

- Greenpak Biotech Ltd

- Delphi Genetics

- Biomiga

- Genopis Inc.

- Altogen Biosystems

- Puresyn Inc.

- GeneImmune Biotechnology Corp.

- Synbio Technologies

- Geneone Life Science

- Ajinomoto Bio-Pharma Services

Global plasmid market is segmented as follows:

By General Type

By General Type

- Conjugative

- Non-Conjugative

By Specific Plasmid Types

By Specific Plasmid Types

- F-Plasmids

- Col Plasmids

- Resistance Plasmids

- Cryptic Plasmids

- Degradative Plasmids

- Virulence Plasmids

By Application

By Application

- Transfection

- Recombinant DNA Technology

- Gene Therapy

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- VGXI Inc.

- Kaneka Corporation

- Aldevron

- Nature Technology Corporation

- PlasmidFactory GmbH & Co. KG

- Cell and Gene Therapy Catapult

- Vigene Biosciences

- Akron Biotech

- Waisman Biomanufacturing

- LakePharma Inc.

- MeiraGTx Limited

- Eurofins Genomics

- Biomay

- Luminous BioSciences (LBS) LLC

- Genscript Biotech Corporation

- GENEWIZ

- Creative Biogene

- JAFRAL Ltd.

- Luina Bio Pty Ltd

- Cepham Life Sciences

- Lonza

- Greenpak Biotech Ltd

- Delphi Genetics

- Biomiga

- Genopis Inc.

- Altogen Biosystems

- Puresyn Inc.

- GeneImmune Biotechnology Corp.

- Synbio Technologies

- Geneone Life Science

- Ajinomoto Bio-Pharma Services

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors