Search Market Research Report

Contract Research Organization (CRO) Market Size & Share, Trends Analysis Forecast 2028

Contract Research Organization (CRO) Market By Service Type (Early Phase Development Services, Clinical Research Services, Laboratory Services, Regulatory Consulting Services), By Therapeutic Area (Oncology, Clinical Pharmacology, Cardiology, Infectious Disease, Neurology, Gastroenterology & Hepatology, Ophthalmology, Others), By End-use (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Academic Institutes), By Application, By Technology, By Function, and By Region - Global Industry Insights, Growth, Size, Share, Comparative Analysis, Trends and Forecast 2022 – 2028

Industry Insights

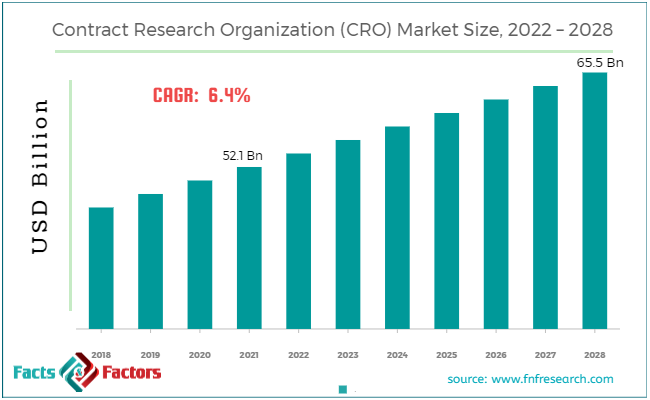

[219+ Pages Report] According to Facts and Factors, the global contract research organization (CRO) market was valued at USD 52.1 billion in 2021 and is predicted to increase at a CAGR of 6.4% to USD 65.5 billion by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

Market Overview

Market Overview

The contract research firm offers services that are based on research. It provides contract services to medical, government, pharmaceutical, biotechnical, and other industries. Data management, regulatory, clinical operation, submission, and quality assurance are some of the services provided by the industry. The advancement of technology is increasing market demand. Clinical and non-clinical research is the two sectors where contract research services are needed the most. The pharmaceutical and biotech businesses are allocating funds for research and development. These industries' research results in market innovation and medicine development. These industries will benefit greatly from this significant investment in research. Pharmaceutical companies' investments are a major driver of the CRO market.

The need to build contacts and agreements grows when new items are introduced, resulting in tremendous growth opportunities. In the medication business, there are a lot of patents that are about to expire. The contract service market has additional development prospects as a result of these reasons. There are a few obstacles to the CRO market's overall expansion. The challenge of maintaining market demand is a market constraint. There aren't enough professionals on the market to handle demand from various industries. The market faces a variety of obstacles due to a lack of qualified personnel. It is a research institute that must compete against scientists and experts. Incompetence can result from a lack of professionalism. In addition, analytics testing is lacking in the industry. As a result, the use of contract research firms has an impact.

Impact of COVID – 19

Impact of COVID – 19

With the World Health Organization (WHO) calling the COVID-19 outbreak a pandemic, a number of prominent pharmaceutical and biopharmaceutical businesses have ramped up R&D and production efforts to create and sell SARS-CoV-2 viral diagnostic kits, vaccines, and treatments. Many pharmaceutical and biotechnology businesses have partnered with CROs through long-term agreements, partnerships, and collaborations all over the world to speed up the R&D process. COVID-19 study has also attracted the attention of contract research organizations (CROs). There have been a number of new service launches as well as agreements, partnerships, and collaborations with other pharmaceutical firms and academic institutes for the research and development of COVID-19 vaccines, therapeutics, and diagnostics. Expansion of manufacturing facilities has also been funded. As a result, the COVID-19 epidemic has functioned as a stimulus for outsourcing drug development procedures, benefiting every part of the pharmaceutical contract research sector.

The complete research study looks at both the qualitative and quantitative aspects of the contract research organization (CRO) market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply-side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global contract research organization (CRO) market is segregated based on service type, therapeutic area, and end-use.

Early phase development services, clinical research services, laboratory services, and regulatory consulting services are the four service types that make up the contract research organization market. The clinical research services category is likely to grow at a healthy rate over the forecast period. Phase I, Phase II, Phase III, and Phase IV are the four phases of clinical research services. The rise of the segment can be attributed to the increased prevalence of chronic diseases and the demand for effective medications and diagnostics products.

The therapeutic areas in which the contract research organization market is segmented include oncology, clinical pharmacology, cardiology, infectious disease, neurology, gastroenterology & hepatology, ophthalmology, and others. By 2029, the oncology market is expected to grow at a rapid pace. Because cancer is becoming more common, sponsors are concentrating their efforts on developing new medicines and medical technology to help with cancer management. As a result, there has been a rise in the number of clinical trials and drug discoveries for cancer treatment. Rising cancer rates are projected to stimulate segmental expansion as a result of the aforementioned considerations.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 52.1 Billion |

Projected Market Size in 2028 |

USD 65.5 Billion |

CAGR Growth Rate |

6.4% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Charles River Laboratories, Clinipace Inc., CMIC HOLDING Co., Ltd, EPS International Co., Ltd (EPS Group), ICON plc, IQVIA, Laboratory Corporation of American Holding (Covance Inc), Medpace, Inc, PAREXEL International Corporation, Pharmaceutical Product Development, LLC, Worldwide Clinical Trials, WuXi AppTec, and Others |

Key Segment |

By Service Type, Therapeutic Area, End-use, Application, End-Use Industry, Technology, Function, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

Over the projected period, the market for contract research organizations in North America is expected to grow significantly. The significant concentration of pharmaceutical and biotechnology firms in the region is responsible for the strong market growth. In addition, the pharmaceutical and biotechnology companies' growing focus on outsourcing clinical trials for the treatment of various diseases is expected to boost the market growth in North America.

Another region with well-established large pharmacies in Europe. The need for contract research is increased due to the significant investment. In addition, the region has a high number of professionals who can do substantial research. With improvements in the pharmaceutical business, Asia Pacific is seeing moderate demand. High demand and money will be generated by these three primary regions.

Competitive Landscape

Competitive Landscape

List of Key Players in the Global Contract Research Organization (CRO) Market:

- Charles River Laboratories

- Clinipace Inc.

- CMIC HOLDING Co., Ltd

- EPS International Co., Ltd (EPS Group)

- ICON plc

- IQVIA

- Laboratory Corporation of American Holding (Covance Inc)

- Medpace, Inc

- PAREXEL International Corporation

- Pharmaceutical Product Development, LLC (a part of Thermo Fisher Scientific, Inc.)

- Worldwide Clinical Trials

- WuXi AppTec

The global contract research organization (CRO) market is segmented as follows:

By Service Type Segment Analysis

By Service Type Segment Analysis

- Early Phase Development Services

- Clinical Research Services

- Laboratory Services

- Regulatory Consulting Services

By Therapeutic Area Segment Analysis

By Therapeutic Area Segment Analysis

- Oncology

- Clinical Pharmacology

- Cardiology

- Infectious Disease

- Neurology

- Gastroenterology & Hepatology

- Ophthalmology

- Others

By End-use Segment Analysis

By End-use Segment Analysis

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Academic Institutes

By Application Segment Analysis

By Application Segment Analysis

- Glazing

- Flooring & Joining

- Sanitary & Kitchen

- Others

By End-Use Industry Segment Analysis

By End-Use Industry Segment Analysis

- Residential

- Industrial

- Commercial

By Technology Segment Analysis

By Technology Segment Analysis

- Water-Based

- Solvent-Based

- Reactive

- Others

By Function Segment Analysis

By Function Segment Analysis

- Bonding

- Protection

- Insulation

- Soundproofing

- Cable Management

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Charles River Laboratories,

- Clinipace Inc.

- CMIC HOLDING Co. Ltd.

- EPS International Co. Ltd (EPS Group)

- ICON plc

- IQVIA

- Laboratory Corporation of American Holding (Covance Inc)

- Medpace Inc.

- PAREXEL International Corporation

- Pharmaceutical Product Development LLC (a part of Thermo Fisher Scientific Inc.)

- Worldwide Clinical Trials.

Frequently Asked Questions

Q.3. What are the key factors driving the global contract research organization (CRO) market growth?

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors