Search Market Research Report

Butadiene Market Size, Share Global Analysis Report, 2022 – 2028

Butadiene Market Size, Share, Growth Analysis Report By Production Process (C4 Hydrocarbon Extraction, N-Butane Dehydrogenation, From Ethanol, From Butenes), By Product (Styrene-Butadiene Rubber, Styrene Butadiene Latex, Butadiene Rubber, Acrylonitrile Butadiene Rubber, Nitrile Butadiene Rubber, Hexamethylenediamine), By End-User (Building & Construction, Healthcare, Automobile Industries, Consumer Products Industries), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

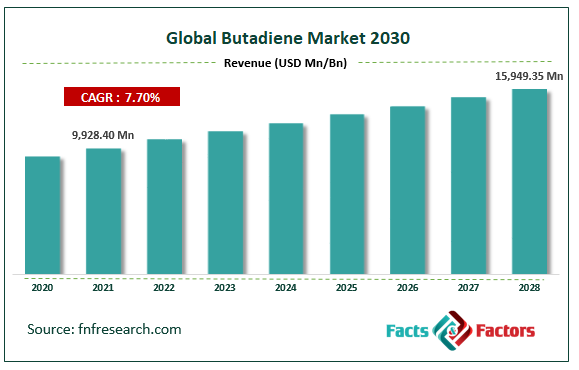

[212+ Pages Report] According to the report published by Facts Factors, the global butadiene market size was worth USD 9,928.40 million in 2021 and is estimated to grow to USD 15949.35 million by 2028, with a compound annual growth rate (CAGR) of approximately 7.70 percent over the forecast period. The report analyzes the butadiene market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the butadiene market.

Market Overview

Market Overview

Butadiene, also known as 1,3-butadiene, is a highly reactive gas having a moderate aromatic or gasoline-like odor at ambient temperature and pressure. It is a byproduct of ethylene & propylene synthesis and is largely utilized as a monomer in creating synthetic rubbers and plastics. If used sparingly, it can be employed as a chemical intermediary. The resulting rubbers or plastics are used in automobiles, building materials, appliance parts, computers & telecommunications equipment, protective apparel, packaging, and household items. Butadiene-based polymers have enhanced functionality, performance, and safety while being less expensive. The global market is driven by several factors, including the expansion of manufacturing industries such as automobiles & consumer durables, rising population awareness of the importance of green building construction, the development of eco-friendly methods of polymer emulsion production, and the rising demand for water-based solvents and coatings.

Covid-19 Impact:

Covid-19 Impact:

COVID-19 has a negative impact on the butadiene market because end-user sectors' demand was insufficient. The current pandemic scenario has temporarily halted the development of new buildings and car manufacturing facilities. As a result, the global butadiene market was impacted by the demand for styrene-butadiene and polybutadiene rubber, used in tires, concrete additives, building crack fillers, and other applications. The spread of COVID-19 in 2020 reduced economic and social activities and altered the industrial and transportation environments. The epidemic has impacted the world economy, collapsing tire production, trade, and sales of vehicles and other equipment. Butadiene demand has increased due to the use of protective gloves manufactured of nitrile rubber under the current conditions.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global butadiene market value is expected to grow at a CAGR of 7.70% over the forecast period.

- In terms of revenue, the global butadiene market size was valued at around USD 9,928.40 million in 2021 and is projected to reach USD 15,494.35 million by 2028.

- The global market is driven by several factors, including the expansion of manufacturing industries such as automobiles and consumer durables and rising population awareness of the importance of green building construction.

- By production process, the n-butane dehydrogenation category dominated the market in 2021.

- By product, the acrylonitrile butadiene rubber category dominated the market in 2021.

- Asia-Pacific dominated the global butadiene market in 2021.

Growth Drivers

Growth Drivers

- Growing demand for styrene-butadiene rubber drives the market growth

The growing demand for styrene-butadiene rubber (SBR), used to make tires and other synthetic rubber goods, is a key element driving the butadiene industry. The softness and erratic pricing of natural rubber, the enhanced qualities of synthetic rubber, and the geographical limitations of rubber plantations all contribute to the expansion of the global market. Additionally, the growing demand for green tires made from butadiene monomers derived from bio-based materials combined with the growing use of butadiene in commercial and household applications is opening up more attractive business prospects for the players in the global butadiene market.

Restraints

Restraints

- Carcinogenic characteristics of butadiene may hamper the market growth

The global butadiene market may be constrained by considerations like butadiene's carcinogenic characteristics and many acute & chronic effects brought on by its emissions. The butadiene industry expansion is also anticipated to be hindered by the escalating environmental worries. Variable raw material prices and a strict regulatory environment further impede the market's growth. The recent decline in the automobile sector is anticipated to provide a significant obstacle to expanding the butadiene market.

Segmentation Analysis

Segmentation Analysis

The global butadiene market is segregated based on the production process, product, end-user, and region.

Based on the production process, the market is segmented into C4 hydrocarbon extraction, n-butane dehydrogenation, from ethanol, and from butenes. The n-butane segment dominated the market in 2021 due to its high volatility and low water solubility.

Based on product, the market is classified into styrene-butadiene rubber, styrene-butadiene latex, butadiene rubber, acrylonitrile butadiene rubber, nitrile butadiene rubber, and hexamethylenediamine. In 2021, styrene-butadiene rubber dominated the market. These rubber polymers' physical and chemical properties give tires performance-improving components, such as rolling resistance, wearable, and traction. In industrial settings, SBR rubber often replaces natural rubber without intermediate steps. Only a few of its advantages include superior abrasion resistance, crack endurance, and aging characteristics.

Based on end-user, the market is segmented into building & construction, healthcare, automobile, and consumer products. The automobile segment dominated the butadiene market in 2021 due to an increase in automobiles. The automotive industry's strong influence impacts the butadiene market on the need for synthetic rubbers.

Recent Development:

Recent Development:

- April 2021: A joint venture between Sinopec and SK Global Chemical, a division of SK Innovation, is intended to start operating commercially in the second half of 2021 after developing new petrochemical facilities.

- January 2020: After carrying out extensive repairs on the facility, CPC Corporation allegedly resumed operations at one of its naphtha crackers in Taiwan, which has the potential to produce 193,000 tons/year of propylene and 380 tons/year of ethylene, a major feedstock for butadiene.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 9,928.40 Million |

Projected Market Size in 2028 |

USD 15,949.35 Million |

CAGR Growth Rate |

7.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Reliance Industries Limited, Braskem, ExxonMobil Chemical Company, Royal Dutch Shell Plc., TPC Group Inc., Sinopec, LyondellBasell Industries N.V., Jiutai Energy Inner Mongolia Co. Ltd., Lanxess, and others. |

Key Segment |

By Production Process, Product, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia-Pacific dominated the Butadiene market in 2021.

In 2021, the Asia Pacific dominated the global butadiene market due to the area's quick industrialization and the rising need for butadiene for rubber & automotive applications. China is the largest butadiene consumer and the market with the greatest growth in the region, followed by India and other South-East Asian nations. China Association of Automobile Manufacturers (CAAM) reports that as of April 2019, sales and production of commercial cars reached 5,01,000 and 4,68,000 units, respectively, and saw considerable increases of 91% and 73.8% from March. For the stakeholders in the butadiene market, this opens up attractive potential.

Competitive Landscape

Competitive Landscape

- BASF SE

- Reliance Industries Limited

- Braskem

- ExxonMobil Chemical Company

- Royal Dutch Shell Plc.

- TPC Group Inc.

- Sinopec

- LyondellBasell Industries N.V.

- Jiutai Energy Inner Mongolia Co. Ltd.

- Lanxess

Global Butadiene Market is segmented as follows:

By Production Process

By Production Process

- C4 hydrocarbon extraction

- N-butane dehydrogenation

- From ethanol

- From butenes

By Product

By Product

- Styrene-Butadiene Rubber

- Styrene Butadiene Latex

- Butadiene Rubber

- Acrylonitrile Butadiene Rubber

- Nitrile Butadiene Rubber

- Hexamethylenediamine

By End-User

By End-User

- Building and Construction

- Healthcare

- Automobile Industries

- Consumer Products Industries

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- Reliance Industries Limited

- Braskem

- ExxonMobil Chemical Company

- Royal Dutch Shell Plc.

- TPC Group Inc.

- Sinopec

- LyondellBasell Industries N.V.

- Jiutai Energy Inner Mongolia Co. Ltd.

- Lanxess

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors