Search Market Research Report

Bitcoin Market Size, Share Global Analysis Report, 2022 – 2028

Bitcoin Market Size, Share, Growth Analysis Report By Wallet Type (Software Wallets, Hardware, Online Wallets, Paper Wallets), By Application (International Transactions, Private Transactions, Payments & Buying), By End User (Large, Small, and Medium Enterprises), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

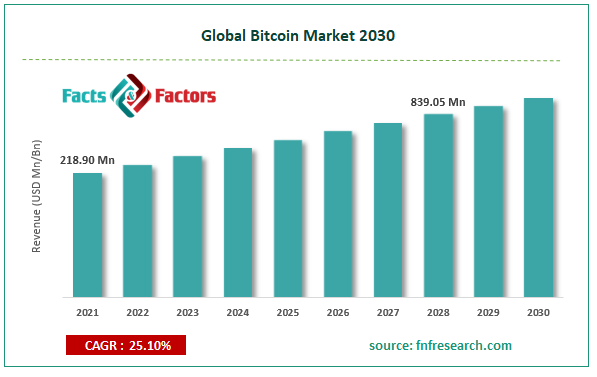

[203+ Pages Report] According to Facts and Factors, the global bitcoin market size was worth USD 218.90 million in 2021 and is estimated to grow to USD 839.05 million by 2028, with a compound annual growth rate (CAGR) of approximately 25.10% over the forecast period. The report analyzes the bitcoin market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the bitcoin market.

Market Overview

Market Overview

Bitcoin was the first decentralized electronic currency. There have been thousands more that have entered the market. Today, people prefer virtual currencies to conventional models since they allow quicker payments with no interchange fees, giving transparency and resistance to inflation. Bitcoin exchange is another name for bitcoin. Blockchain is a decentralized technology that tracks and manages transactions across numerous computers.

Additionally, it is a peer-to-peer system that enables users to make and receive money from anywhere in the world and does not rely on banks to authenticate the transactions. The transparency in bitcoin transactions made possible by crypto-ledger technology is a key advantage of bitcoin over conventional currency and digital payment systems. The creation of powerful computer technology and high-speed internet infrastructure has led to the emergence of super bitcoin mining rigs. The main driver of bitcoin coin demand is uncertainty concerning financial institutions and government action in the financial industry. The primary driving force behind the bitcoin industry is the improved clarity of information about the many types of bitcoins that are now accessible on the market. Among young people, using bitcoin wallets on internet platforms has emerged as a new trend. The number of users is likely to increase, adding credibility to the digital currency exchange facilities and improving the prognosis for the bitcoin market.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic has harmed the bitcoin market because the stability of digital currencies has significantly decreased. In contrast, the discrepancies have substantially increased, and bitcoin has become more turbulent. As a result, demand for digital currencies during a global health crisis is expected to decline. During the epidemic, even banks began making their initial investments in bitcoin exchange companies. To support B2B bitcoin payments, banks started developing their own (blockchain-based) platforms.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global bitcoin market value will grow at a CAGR of 25.10% over the forecast period.

- In terms of revenue, the global bitcoin market size was valued at around USD 218.90 million in 2021 and is projected to reach USD 839.05 million by 2028.

- One of the main factors driving market expansion is low cost, ownership, quicker, and safer operations.

- By wallet type, the hardware category dominated the market in 2021.

- By application, the payment category dominated the market in 2021.

- The Asia Pacific dominated the global bitcoin market in 2021.

Drivers

Drivers

- Increasing Demand for Payment System Visibility to drive the market

Enhanced data accessibility and independence across payments in banks, financial services, insurance, and other business sectors are projected to contribute to the bitcoin market's promising expansion in the upcoming years. The usage of bitcoin in the banking sector offers several advantages, including sending and receiving payments transparently and securely storing customer information. This has fueled the growth of the global bitcoin market.

Restraints

Restraints

- Lack of awareness of financial literacy may hinder the market growth.

However, the bitcoin ledger is only useful in wealthy civilizations due to the general lack of financial literacy and knowledge of numerous digital technologies among the general populace. Many industrialized and developing economies have begun considering employing digital ledger technology for financial operations. It prevents the global market from attracting new participants, which invariably prevents the market from reaching its full potential.

Opportunity

Opportunity

- Distributed ledger systems to present market opportunities

Distributed ledger systems enable it to use a randomized payment model for a virtual currency system by doing away with the need for a centralized intermediary management system. Financial transactions can be tracked thanks to distributed headline technology. Creating digital money enables virtual tracking and exchange of any value. Bitcoin provides a strong platform for information sharing. Blockchain is a distributed ledger technology that boosts real-time security for the digital economy. Such factors might impact the bitcoin market in the upcoming years, generating profitable potential pockets in the market.

Segmentation Analysis

Segmentation Analysis

The global bitcoin market has been segmented into wallet-type, end users and applications.

Based on the wallet type, the bitcoin market is divided into software wallets, hardware, online wallets, and paper wallets. The hardware segment showed significant growth in the market in 2021. The bitcoin hardware market has been divided into GPUs, CPUs, FPGAs, and ASICs according to the type of processor used. Hash codes are generated as part of the validation procedure to encrypt the transactions. The mining company needs extremely effective and efficient hardware to produce a hash code. In other words, miners must produce as many hash codes as possible to obtain new blocks and solve them. Mining pays out for the miners. There are many different sizes and types of mining rigs.

Based on application, the global bitcoin market is segmented into international transactions, private transactions, payments and buying. The payments segment is anticipated to have the highest share in this market in 2021. Bitcoin payments have several advantages, such as enhanced security, insurance from fraud, a decentralized system, minimal costs, fees for consumer protection, and quick international transfers. These variables contribute to boosting crypto-currency acceptance rates.

Based on end-user, the market is divided into large, small, and medium enterprises. The large enterprise was the fastest growing segment in the market in 2021. Large enterprises are discovering that significant clients and vendors want to engage using crypto. A growing number of businesses globally use bitcoin and other digital assets for various investment, operational, and transactional purposes.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 218.90 Million |

Projected Market Size in 2028 |

USD 839.05 Million |

CAGR Growth Rate |

25.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Airbitz, ANX, Avalon Life S.A., BitGo, BitPay, BitPesa, Bitstamp Ltd., BITWAGE INC., Bitwala, Blockstream Inc., Circle Internet Financial Limited, Coinbase, Coinify ApS, Ethereum Foundation, nChain Group, Nvidia Corporation, R3 Consortium (Ripple), Uphold Inc., Xapo Inc, and Others |

Key Segment |

By Wallet type, Application, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- March 2021, Morgan Stanley, an American investment bank, started to offer access to bitcoin funds to its wealth management clients. This enabled the company to improve its offerings. A significant amount of funds being raised by various venture capital firms in the market are expected to offer lucrative growth opportunities.

- October 2021, Coin Switch Kuber (crypto exchange platform) raised over USD 260 million through investors such as Andreessen Horowitz & Coinbase Ventures. Additionally, the growing number of developments by the key market player is anticipated to boost the bitcoin industry's growth.

Regional Landscape

Regional Landscape

- The Asia Pacific dominated the bitcoin market in 2021

Asia Pacific region held a significant share in the global bitcoin market in 2021. The rise in bitcoin exchanges around Asia has helped the bitcoin market mature and experience some competitive spirit. Chinese banks are hiring bitcoin specialists as the government is pushing the adoption of the bitcoin technology to promote openness and fight fraud in the country's financial sector. These elements fuel the regional bitcoin market's expansion.

The number of internet-based currency conversion facilities has significantly increased due to South and Southeast Asia's developing data transfer network and digital awareness. Given the cheap electricity costs, the pleasant climate, the presence of significant mining firms, and the availability of venture capital funding, it is projected that the Chinese market will be the largest in this region.

Competitive Landscape

Competitive Landscape

- Airbitz

- ANX

- Avalon Life S.A.

- BitGo

- BitPay

- BitPesa

- Bitstamp Ltd.

- BITWAGE INC.

- Bitwala

- Blockstream Inc.

- Circle Internet Financial Limited

- Coinbase

- Coinify ApS

- Ethereum Foundation

- nChain Group

- Nvidia Corporation

- R3 Consortium (Ripple)

- Uphold Inc.

- Xapo Inc.

Global Bitcoin Market is segmented as follows:

By Wallet type

By Wallet type

- Software Wallets

- Hardware

- Online Wallets

- Paper Wallets

By Application

By Application

- International Transactions

- Private Transactions

- Payments,

By End User

By End User

- Individual

- Large Enterprises

- Small & Medium Enterprises

- System & Software

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Airbitz

- ANX

- Avalon Life S.A.

- BitGo

- BitPay

- BitPesa

- Bitstamp Ltd.

- BITWAGE INC.

- Bitwala

- Blockstream Inc.

- Circle Internet Financial Limited

- Coinbase

- Coinify ApS

- Ethereum Foundation

- nChain Group

- Nvidia Corporation

- R3 Consortium (Ripple)

- Uphold Inc.

- Xapo Inc.

Frequently Asked Questions

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors